The Undeniable Industrial Boom Happening in Kansas City

Learn why Kansas City is at the center of a pivotal moment in our country’s industrial resurgence. Watch the video to see how you can invest in this opportunity.

Our Track Record by the Numbers

$250M+

Investor Capital Managed

850+

Investors Served

$600M+

Assets Under Management

11+

Years Track Record

$65M+

Investor Distributions Since Inception

From Ben Fraser

Chief Investment Officer, Aspen Funds

Dear Kansas City Investor,

Hey, Ben Fraser here—Chief Investment Officer and Managing Principal at Aspen Funds.

To understand why this industrial land investment could be one of the most profitable opportunities of the next decade, let me take you back to the beginning of our story…

The Origin of Aspen Funds – Investing with a Macro-Driven Approach

In 2008, when the financial crisis shook the global economy, my co-founder, Jim, was an award-winning developer in California. Almost overnight, everything changed.

- 8.8 million jobs lost

- Unemployment spiked to 10%

- 8 million home foreclosures

- The S&P 500 plunged 38.5% in 2008 alone

- $7.4 trillion in wealth evaporated

He lost almost everything he had built. And he wasn’t alone—investors everywhere took massive losses, whether they were in stocks or real estate.

But as the dust settled, a pattern emerged.

Jim realized that the lender always won.

No matter how volatile the markets were, those who understood economic cycles and structured their investments accordingly were the ones who thrived.

That realization led to the founding of Aspen Funds over a decade ago—built on a simple but powerful philosophy:

👉 Follow macroeconomic trends and invest where the smart money is going.

This approach has guided us through multiple market cycles, helping us identify high-potential opportunities before they become mainstream.

And today, one of the biggest macro-trends unfolding is the industrial boom happening right now in Kansas City.

The Undeniable Industrial Boom Happening in Kansas City

For years, global supply chains relied on overseas manufacturing, but today, the landscape is shifting rapidly. The return of U.S. manufacturing is not just a trend—it’s a fundamental economic transformation.

- Manufacturing is returning to America.

- Supply chains are being restructured for resilience.

- Industrial real estate demand is surging like never before.

This shift is driven by the most protectionist foreign policy America has seen in decades, championed by policies that prioritize domestic production. Tariffs on our closest allies and economic incentives for reshoring are making it abundantly clear: America is reclaiming its role as a global manufacturing powerhouse. Critical supply chains are being rebuilt within our borders, and U.S. industrial capacity is set to expand dramatically.

At the epicenter of this shift? Kansas City.

Why Kansas City’s Location is Modern-Day Gold

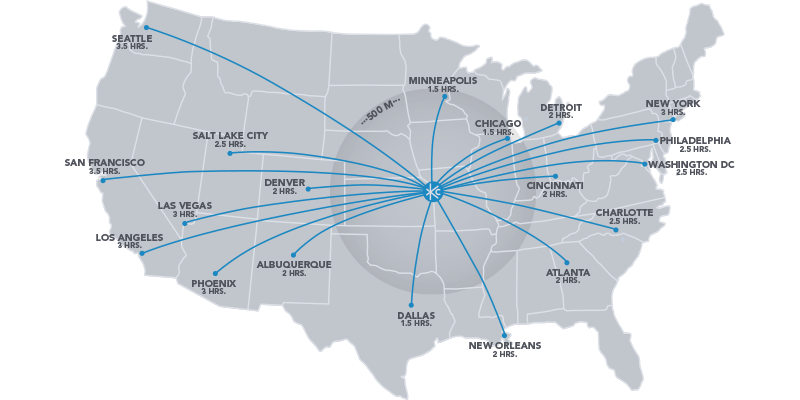

Kansas City sits in the absolute heart of America. Look at the map—smack dab in the middle of the country. It’s no accident that so many of the nation’s most crucial transportation routes intersect here. For decades, this prime location was overlooked as companies chased cheap labor overseas. But now? That decision is reversing at an astonishing pace.

Imagine a manufacturer in California trying to get products to the East Coast. The cost of shipping, the time delays, the reliance on overloaded ports—it’s an operational nightmare. But Kansas City? It offers direct access to every major region in the country in a fraction of the time and at a fraction of the cost. That’s why major corporations are setting up shop here, securing land before the rest of the market catches on.

Kansas City isn’t just well-placed—it’s an infrastructure powerhouse. It boasts one of the most extensive rail networks in the country, directly connecting to both coasts. The highway system is among the best for logistics, allowing freight to move quickly and efficiently. And let’s not forget the growing workforce. With manufacturing returning, companies need skilled labor, and Kansas City has a deep talent pool ready to meet the demand.

For years, this land was undervalued. No one was paying attention because the industrial sector wasn’t expanding. But now, with supply chains shifting back to the U.S., that land—once overlooked—is becoming modern-day gold. The companies that secure it now will be the ones reaping the rewards in the years to come. Investors who recognize this trend early have a chance to get in before the rush.

Kansas City isn’t just growing—it’s transforming into a major industrial powerhouse. The best part? Most investors don’t even realize what’s happening.

Why Industrial Land is a Hidden Gem for Wealth Building

Most investors focus on stocks, bonds, or rental properties. But industrial land investing has long been a wealth-building secret of institutions and ultra-high-net-worth individuals.

Here’s why:

🔹 Scarcity Creates Value – Unlike stocks, companies can’t simply “create” more land. Industrial land is the modern-day equivalent of gold—an irreplaceable asset in high demand.

🔹 No Tenants, No Management Headaches – Unlike rental properties, industrial land ownership doesn’t come with the hassles of property management or dealing with tenants.

🔹 Institutional Demand is Driving Prices Up – Private equity firms, hedge funds, and corporations are pouring billions into industrial real estate. This wave of institutional capital is just getting started.

🔹 Early Entry = Maximum Upside – The biggest gains in real estate come from getting in before the market fully prices in the opportunity. Right now, Kansas City industrial land is undervalued compared to its future potential.

This is the same early-stage pattern we’ve seen in other high-growth real estate markets before major price appreciation kicks in.

The Aspen Industrial Land Fund Opportunity

At Aspen Funds, we specialize in macro-driven alternative investments—capitalizing on long-term trends before they become obvious. With deep local knowledge, strong broker relationships, and a boots-on-the-ground approach, we have positioned ourselves to take full advantage of the industrial boom in Kansas City.

Through the Aspen Industrial Land Fund, we are acquiring prime industrial land in Kansas City’s fastest-growing logistics corridors—targeting the best locations with the highest potential for future development. One such area is the Golden Triangle Corridor, located south of I-435 and east of Highway 35. This corridor is one of the most in-demand areas for future manufacturing and logistics facilities, with major companies already securing positions here.

Our strategy is simple but powerful: we acquire undervalued raw land before development interest drives up prices. Investors in the fund gain access to prime industrial sites before the entitlement and permitting process adds significant value. This unique approach allows investors to capture upside in two ways—through natural appreciation as demand for industrial land surges, and through forced appreciation created by Aspen Funds as we entitle, permit, and potentially prepare the land for development.

This exclusive investment opportunity allows accredited investors to:

✅ Own a stake in high-value industrial land before major development occurs

✅ Benefit from a passive investment with massive upside potential

✅ Invest alongside experienced institutional investors with deep market knowledge

✅ Gain access to a deal that isn’t available on the public market

This is a strategic land acquisition in the path of explosive industrial growth, backed by the same market insights and trend analysis that have made Aspen Funds a leader in alternative investing. By partnering with Aspen Industrial, investors gain a unique opportunity to be at the forefront of America’s industrial resurgence—before the rest of the market catches on.

If you believe in the undeniable industrial boom happening in Kansas City, there’s no better time to take action.

Securing Your Place in Kansas City's Industrial Growth

The window of opportunity in Kansas City’s industrial land market is narrowing. As more companies recognize the region’s logistical advantages, the pace of acquisitions is accelerating. What was once an overlooked part of the country is now a critical hub for manufacturing and distribution, and the most strategic land positions are being secured at a rapid rate.

This isn’t speculation—it’s already happening. Institutional capital is flowing into the region, and the demand for industrial land is rising. In fact, Aspen Industrial has already secured an anchor asset in one of the most sought-after locations. This property serves as the foundation for the fund and positions early investors at the forefront of this trend.

🔷 Limited Availability: Our fund has a set capacity for investors, and once those slots are filled, access to this exclusive opportunity will close.

🔷 Institutional Capital is Moving In: Large private equity firms and corporations are aggressively acquiring land in this area. Investing now allows you to secure a position before land prices are fully driven up.

🔷 Early Investors Gain Prime Positioning: Those who act now will benefit the most from both the natural appreciation of this high-demand region and the value creation through entitlement and permitting.

Aspen Industrial is already executing on this strategy, and this is your opportunity to invest alongside us before the next wave of capital floods into Kansas City. The transformation is underway—don’t wait until the best opportunities are gone.

Get Early Access Today

If you’ve been looking for an investment that is aligned with long-term macro trends, has massive upside, and requires zero management, this is your moment.

📢 Here’s what to do next: click below to secure your spot in the Aspen Industrial Land Fund before this exclusive opportunity is fully subscribed.

I look forward to helping you capitalize on this historic moment in industrial real estate.

Sincerely,

Ben Fraser

Chief Investment Officer, Aspen Funds

Hear from some of our current investors

"The communication has been great, so I know exactly where I’m at. The returns have been consistent."

-Dan E, Psychologist and Professor of Psychology

"You all have really figured out how to make intelligent investments in the mortgage market that really pencils out on a risk-reward ratio."

-Larry D, Retired Real Estate Appraiser

"I compared your note fund to some others and decided that your straight-forward approach was the one I was looking for. You haven’t missed any payments. It’s been as stated, no surprises."

-Tim S, Real Estate Broker

"You guys do what you say you’re going to do, and you pick up the phone when I need to talk to someone. The Income Fund has been consistent, on time and predictable."

-Justin G,, Retired Businessman