Public REITs have been a popular way to invest in Real Estate since the 1970s, with around $1.4 trillion in investor cash. But ever since the JOBS Act passed in 2016, we have seen a flood of new real estate investment opportunities enter the mix – in particular, private REITs and private equity.

These new opportunities have investors increasingly asking questions about the distinguishing factors and why they might choose to invest in one over the other. Let’s dive into the differences, advantages, and disadvantages of each.

What are REITs, Private REITs, and Private Equity?

Public REITs

The most common method to invest in real estate that traditional investors know of –and usually the one real estate investment a financial advisor will recommend– are Public REITs. REIT stands for Real Estate Investment Trust, and has a very specific structure defined by the IRS.

Nearly all public companies are C-Corporations, which pay taxes on their income. If the company pays dividends to its investors, the dividend receivers also pay taxes, so there is a double-taxation on income in C-Corps. What’s unique about the REIT tax structure is that if most of a company’s holdings are in real estate and it pays out 90% of its earnings as dividends, the REIT can deduct those dividends so it doesn’t pay taxes on them.

REITs can take a number of forms. The two biggest classifications are Equity REITs and Mortgage REITs.

Equity REIT

An Equity REIT is a REIT that buys and owns actual physical properties, like office space, and collects rent payments from tenants. 90% of all public REITs are Equity REITs.

Mortgage REIT

A less-common type of REIT is a Mortgage REIT, or mREIT. These REITs own mortgages (debt), instead of owning the physical real estate. This can be all kinds of mortgages –residential, commercial, agency.

There are some REITs that invest in both properties and mortgages and are called Hybrid REITs.

Private REITs

Now here’s where things get a little confusing. Private REITs technically don’t exist (except for a temporary designation given to a pre-public REIT). It is really just a marketing term to communicate to investors they are buying pools of real estate like a REIT, but in a private company.

When most people refer to a ‘private REIT,’ what they mean is private equity real estate. Private equity real estate is another phrase investors may have heard, and mostly is interchangeable with Private REITs (except for those “pre-public” REITs).

Private equity real estate investments are generally held in LLCs, meaning they are non-tax-paying, pass-through entities. By virtue of being an LLC, they avoid double-taxation so there is no need to hassle with becoming a C-Corp and applying to the IRS for REIT designation. The only disadvantage is that they generally can’t go public in this structure.

So, for the sake of making comparisons is this article, when we refer to private REITs, we are specifically talking about multi-asset private equity real estate investments. These investments can be both in equity or mortgages, and similarly are income-producing, but the primary difference is they are not publicly traded.

So why would anyone refer to something as a private REIT if it’s not a REIT?

Well, ‘private equity’ is a very broad category that includes investments in any company that’s not public – tech, real estate, hospitality, healthcare, etc. Real estate investments in private companies would be a subset of private equity. Using the term private REIT to describe them lends a familiar context to an otherwise broad designation.

One last distinction to make is that investors may have heard of private real estate syndications. A syndication is often a single-asset investment vehicle. And though most syndications are private (not public), because they generally own only a single asset, they fundamentally differ from a REIT, which has multiple assets. This changes the risk profile significantly when talking about a single-asset investment.

As the purpose of this article is to compare public and private real estate investment options, we’ll be comparing public REITs to multi-asset private equity real estate investments (“private REITs”).

Comparing Public vs Private REITs

Let’s take a look at these two investment methods and compare them from the most important angles.

Tax advantage – Which lets you keep more of your money?

REITs are widely used because of their highly favorable tax advantages. As mentioned before, REITs are required to distribute 90% of their earnings to investors, which allows them to avoid paying corporate income tax on profits they distribute. This benefit trickles down to investors – when their dividends are not double-taxed, they can receive the maximum amount of capital from the REIT.

Private REITs are even more advantageous. One of real estate’s greatest tax benefits is depreciation. And because private REITs are LLCs, this depreciation can be passed through to individual investors. Because you get to offset your income with the depreciation tax deduction, you might be earning $10 per share, but only paying taxes on $7, as an example.

The second primary advantage is long-term capital gains. If you hold an asset for a year or more, you will pay long-term capital gains tax, which is much lower than ordinary income.

Private REITs can also pass through a myriad of other tax-advantaged situations, like Opportunity Zones and 1031 Exchanges to name a few. Because LLCs are pass-through entities, 100% of the tax benefits are automatically passed through to the investors.

On the other hand, dividends from a public REIT are taxed as ordinary income, so investors never get any tax breaks.

The only potential drawback to some investors with a private REIT is that you will receive a K1 vs a 1099 come tax season. Some investors don’t want to deal with a K1, but it’s a small price to pay for the potential tax benefits.

Winner: Private REITs (by a long shot)

Liquidity – Can you get your money out when you want it?

One of the greatest features of REITs is their high liquidity. Like the stock market, there is an active public market where you can easily cash-out your position and access your funds. This is beneficial for investors who want to cash out at a moment’s notice.

Private REITs can’t compete with public REITs in this category, as liquidity in private REITs is limited by internal cash flow, such as earnings or new investors. Most of the time, private funds and syndications have long lock-up periods where investor capital is inaccessible, usually in the 3- to 10-year range. This isn’t inherently bad, as many investors overestimate their need for liquidity, however, there are also several private real estate funds, like ours, that have liquidity built into their offerings.

Winner: Public REITs (by a long shot)

Value – Getting the most bang for your buck

Let’s say you’ve invested $100,000 in a public REIT. You would hope to get something like $100,000 in real estate, right? In reality, it’s not even close. A quick look at the largest public REITs today shows their price-to-book ratio between 1.7x and 21x! This means, for example, that your $100,000 investment in the largest apartment REIT (the last one in the list below) is actually buying just $20,000 in underlying real estate. Stock market REIT pricing in fact rarely reflects the actual value of the real estate. Here is a quick rundown of the price-to-book ratio of the largest public REITs.

| REIT | Market Cap | Type | Price/Book |

| American Tower (AMT) | $126B | Telecom | 21.3x |

| Prologis (PLD) | $107B | Industrial | 3.2x |

| Crown Castle (CCI) | $76B | Telecom | 8.3x |

| Public Storage (PSA) | $57B | Storage | 11.5x |

| Simon Property Group (SPG) | $47B | Malls | 14.9x |

| Digital Reality (DLR) | $44B | Datacenter | 2.6x |

| Vereit (VER) | $11B | Mixed | 1.7x |

| Apartment Income REIT (AIRC) | $8B | Apartments | 5.0x |

This is why investors buying public REITs should understand that they are really not buying real estate, but buying the stock market. Prices are bid up due to investor exuberance in good times, and then crash when investors get afraid. There are times when this can work for you. In the aftermath of the Great Financial Crisis, it was not uncommon to see price-to-book ratios below one – which means your investment in the stock is buying the underlying real estate below its actual value. That’s a good sign of irrational investor fears, and a great signal to buy! But such situations only come along infrequently.

Private REITs on the other hand are nearly always sold at book value – this means that your $100,000 investment is buying $100,000 in real estate.

Winner: Private REITs (by a long shot)

Risk – Are public or private REITs riskier?

Risk is something investors are always trying to mitigate, and one of the primary reasons that people have historically sought to diversify from the stock market into REITs. Since risk takes many forms, let’s break it down a little further.

Fraud risk

All public companies are regulated by the SEC. They enforce for disclosure, accuracy, and reporting, all of which mitigate against risk of fraud. But they don’t regulate at all for operational risk, geographic risk, macro-economic risk, overleverage, market risk, or any other risk. Private REITs don’t have any such regulatory enforcement, but especially amongst larger, seasoned sponsors, fraud is virtually unheard of.

Winner: Public REITs

Market risk

Market risk refers to the risk of the value of your investment dropping because of market forces. Both public and private REITs are subject to the same real estate market forces, so the risk is identical. But public REITs greatly amplify that risk when they trade well above their actual real estate value as they do today.

Winner: Private REITs

Other risk

Looking at other types of risk like operational risk (the risk of operational mistakes), geographic risk, macro-economic risk, or leverage risk, there is really no particular advantage to public or private REITs, you must look at the individual companies.

Overall Winner: a tie

Returns – Where can you make more money?

Real estate has two return components: yield and appreciation. Let’s look at yield first.

Price and yield are inversely related – so if you paid $20,000 for an investment that pays you $2,000 per year, you are getting a 10% yield. But if you paid $100,000 for that same investment, you are getting a 2% yield. Because public REITs are priced so high, yields are much lower than Private REITs. For example, investing in the largest apartments Public REIT, because of its 5x price-to-book ratio, will pay you about a 3.5% dividend. In private REITs it is not uncommon to see yields approaching 10%.

The second component of total return is appreciation. Since Public REITs are priced like stocks and not real estate, it’s impossible to say whether your investment will appreciate or not. If you believe the stock market is going up, then Public REITs are a good investment.

Private REITs will appreciate according to the underlying real estate. In the last 20 years, commercial real estate on average has appreciated 13% per year. Over the same period, the price of Public REITs has increased slightly more, 15.6% per year but as we said, that is determined by the stock market.

Winner: Private REITs

Volatility – Riding out the ups and downs

Volatility is one of the most under-weighted factors investors should be considering. This article we wrote has a great example of just how much volatility can kill compounding over time (#2).

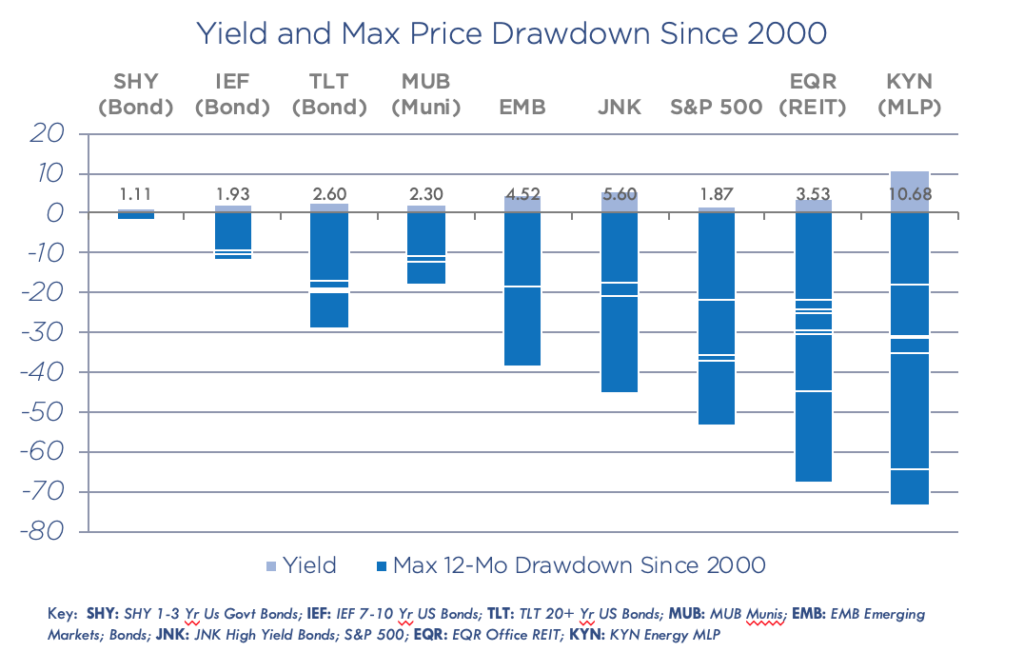

By nature, the public markets are extremely volatile, as the ups and downs are driven entirely by human emotion, and only indirectly by the actual value of a company. REITs are no different, as they are still in the public market. The REIT EQR is a good example, with 7 drawdowns of 20% or more in the last 20 years. In other words, an investment in EQR would have lost 20% or more of its value seven times since 2000. And one of those times you would have lost 45% and another 68%! That’s a lot of risk to earn just 3.5% yields This kind of volatility can make it extremely hard to recover and earn returns.

This is one area where private REITs have a great advantage. Because investors can’t buy and sell on a whim, the value is much more stable and entirely derived from the underlying assets. There is no correlation to the public markets either, which also provides better market diversification.

Winner: Private REITs

Leverage – A healthy balance between high returns and too much risk

Leverage is a powerful tool in investing – responsibly using debt can help investment funds achieve higher returns and grow more quickly. But having too much leverage increases risk if something goes south.

Public REITs are widely known to be highly leveraged, as they have access to debt from non-bank sources like hedge funds and “repos” or repossessions. It’s not uncommon for them to be leveraged 10:1. This means for every dollar invested, they borrowed $10 to buy assets. Our apartments REIT example is leveraged 5:1.

In contrast, private REITs usually borrow from traditional banks that are generally very conservative. It’s unusual to see private REITs leveraged above 3:1.

Winner: Private REITs

Transparency – Knowing what you’re buying

In you invest in rental properties, you have the benefit of knowing exactly what you own. While this is a nice benefit, it is generally not available with the more passive real estate investments like REITs, public or private. The assets purchased by REITs or their private counterparts are usually hidden behind opaque walls. This is largely because REITs own hundreds or thousands of assets and it would be impossible to share an up-to-date run down on all these assets with investors.

There is a perception within the investment world that public investments are more transparent, but this really isn’t the case. If you really want to know the details of the asset you’re investing in, you can go with a private syndication.

Winner: a tie

Final things to consider

If you’re considering investing in public REITs or their private equity alternative, here are a few things to consider:

Strategy – Who’s buying what?

While both public and private REITs have pools of real estate assets they purchase, the types of assets can vary between the two entities.

Public REITs generally go after stable Class A, cash-flowing properties. Private equity real estate funds can often pursue more Class B or C properties with more value-add potential or seek to find something that’s underpriced. Private funds can also take advantage of distressed assets, which can lead to some of the highest returns in real estate. Because public entities usually have larger amounts of capital to deploy, they are limited from going after smaller niches like distressed assets.

Price-to-book value

As we discussed above, when you’re evaluating a public REIT, you want to look at its leverage and its price-to-book value. These numbers will tell you what you’re paying for the underlying assets. Very few people do this, most investors simply look at yield. But yield isn’t always a good indicator of value, as yield is primarily determined by the board of directors, who vote to decide how much dividends they are going to pay, which can change tomorrow.

Dividends can also be paid out of savings rather than profits. In other words, they are paying dividends but are just returning capital, even if they are losing money. So do your due diligence when you buy a REIT.

Correlation

Another thing to be aware of with public REITs is a growing correlation to public equities. While this investment class was originally touted by financial advisors as a great way to diversify, the reality is Public REITs have traded in virtual lock-step with public equities – tracking the S&P 500 at a 70% correlation over the last 30 years, according to Nareit.

Mr. Fraser has 20+ years’ experience as a finance and technology executive and is a former E&Y Entrepreneur of the Year Award winner. In 2012 Fraser co-founded Aspen Funds, a fund management company focused on mortgage investments. Fraser is responsible for financial management, portfolio modeling, as well as systems and processes, designing and deploying Aspen’s scalable state-of-the-art back-end platform.