Our investment thesis has always been to invest with the economic tides, or broader, underlying economic trends. Where we see the budding opportunities from these economic tides is where we want to be investing.

We have a 4-step process that we use to filter through all the deals out there, to curate the best of best that we are very confident about given underlying economic factors.

ASPEN INCOME FUND – OPEN

Aspen Income Fund is a residential mortgage fund designed to provide current income for investors. This secured real estate income Fund purchases and owns a diversified portfolio of income-producing mortgages, purchased at a discount, to produce above market returns at 9% annually. The Fund is secured by residential real estate across the United States.

Learn More

ASPEN OPPORTUNITY FUND – OPEN

Aspen Opportunity Fund is a diversified real estate fund focused on investing in what we believe to be the best risk-adjusted opportunities.

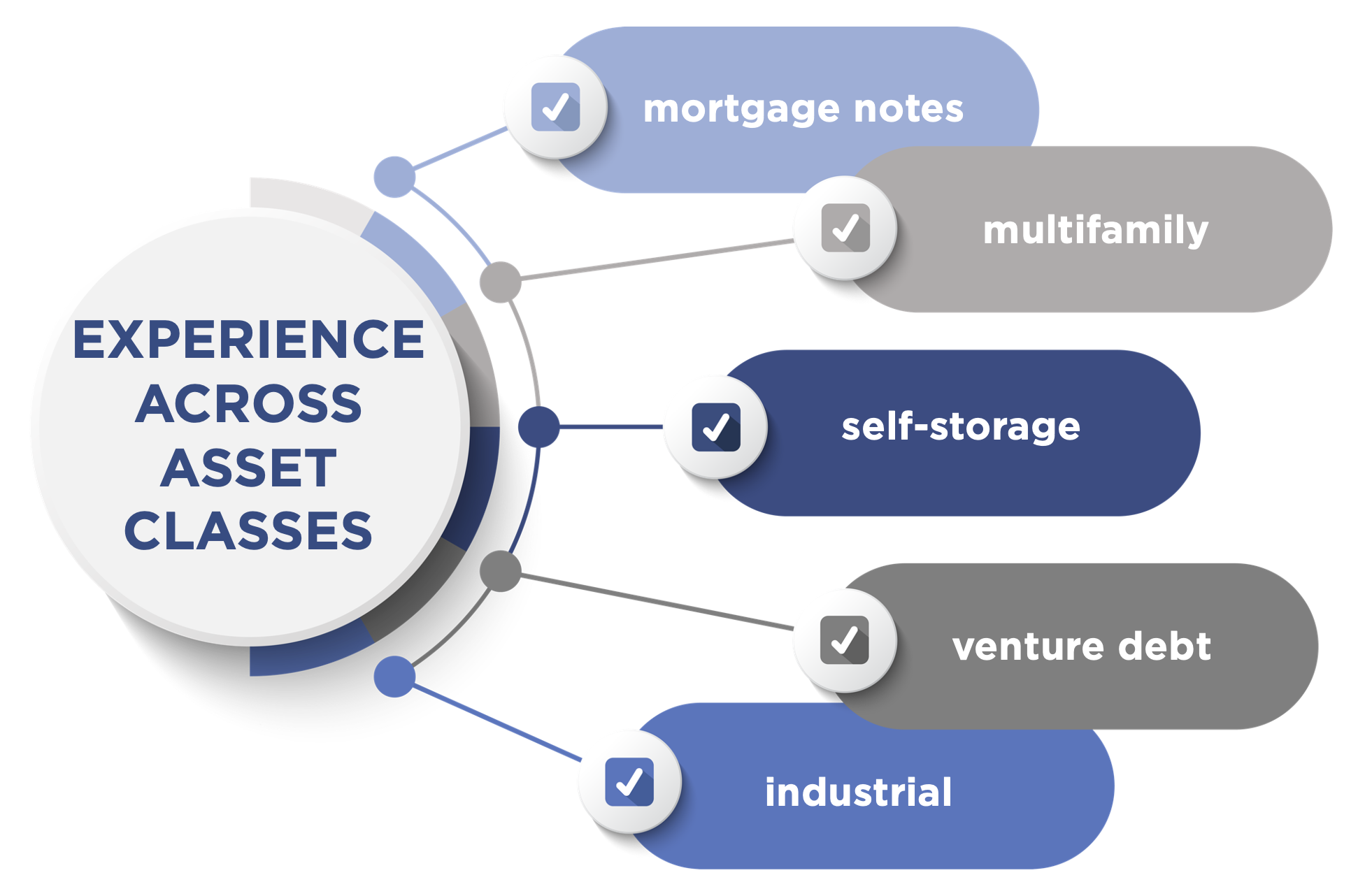

This Fund will be focusing on multiple asset classes giving you better diversification across strategies and asset classes. Following our economic research, we’ll be targeting strategies that are supported by economic megatrends.

The Fund will target deploying capital anywhere from $2-10MM+ equity positions, with a focus maximizing total return and investor IRR.

ASPEN PRIVATE CREDIT FUND – OPEN

An open-ended fund focused on providing credit to commercial real estate properties.

A dislocation in the capital markets has created a unique opportunity for non-bank lenders to provide capital through preferred equity, mezzanine debt & bridge loans.

This Fund will be focused on providing current cash yield and upside through profit share while investing in preferred positions in the underlying investment.