Funds For Family Offices

overview

At Aspen Funds, we understand the unique financial needs of affluent families.

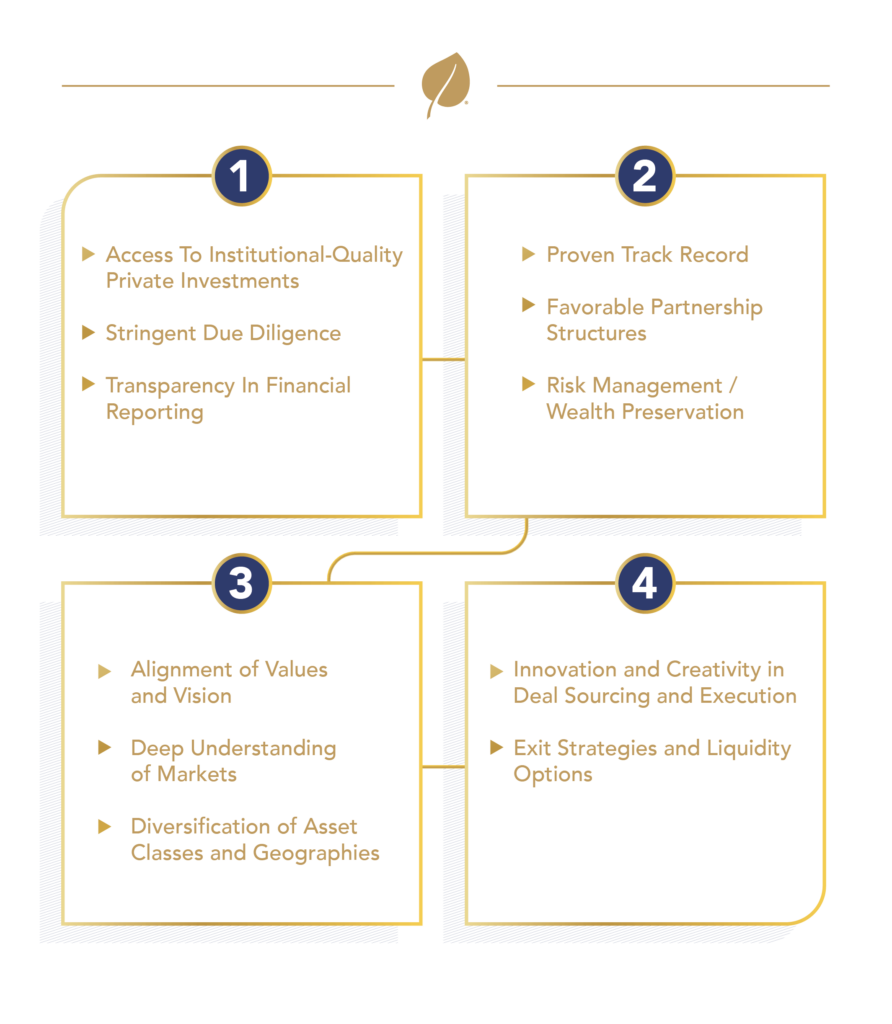

When evaluating prospective partnerships with new family offices, we dedicate the time needed to comprehensively understand their objectives, preferences, and values to ensure that we are aligned.

We know that family offices are increasingly competing with institutional investors, and private equity firms in securing lucrative deals.

We extend our commitment to equipping our relationships with specialized expertise, guidance, and support throughout the investment journey, providing a competitive edge that delivers tangible results.

Our Track Record by the Numbers

Investor Capital Managed

$

0

M +

Assets Under Management

$

0

M +

Years Track Record

0

+

Investor Distributions Since Inception

$

0

M +