SECURED REAL ESTATE INCOME FUND

LEARN HOW YOU CAN

EARN 9% PASSIVELY.

OVERVIEW

Aspen Income Fund is a residential mortgage fund designed to provide current income for investors. This secured real estate Income Fund purchases and owns a diversified portfolio of income-producing mortgages, purchased at a discount, to produce above market returns. The Fund is secured by residential real estate across the United States.

A key challenge for many investors is finding a passive investment that generates income. Our Fund is completely passive and pays investors in cash on a monthly basis, filling this gap in income investments.

When we purchase a mortgage, we essentially become the bank. So, very simply,

our fund work as

follow:

We receive monthly mortgage payments

from our borrowers

We receive profits for

borrower payoffs from refinances or sales

We pay our investors a

preferred return

monthly

Read our Mortgage Note Case Study to see how this process works with an actual mortgage note owned by this fund.

INVESTMENT BENEFITS

Preferred returns are 9%

cash, paid monthly

Fund is lienholder of

residential mortgages

Expected yields can be earned

with minimal leverage

YOUR RETURN

The Fund pays a 9% annualized preferred return on a monthly basis

after 3 months. Since

inception, the Fund hasn't missed a preferred

return payment to investors for 40 consecutive

quarters.

Our Fund also allows reinvestment and quarterly compounding.

On an investment of $100,000, see projected growth over a...

period.

The graph here is for illustrative purposes only, showing all preferred returns being reinvested on a quarterly

basis. Performance is not guaranteed. Past performance is not necessarily indicative of future results.

FUND STRATEGY

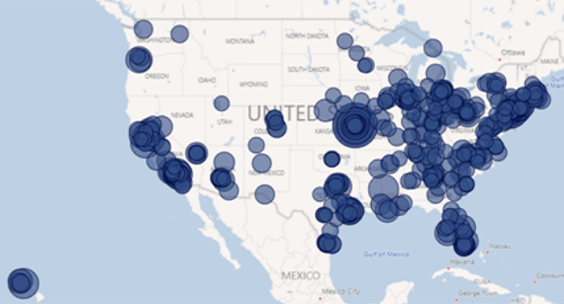

This Fund has been operating for 10 years and has an

existing, well diversified portfolio of

notes. This Fund is

secured by real estate and owns notes in more than 40

states across the

U.S. with an emphasis on Midwest

markets. This Fund only purchases performing notes to

create consistent monthly income. These notes are

generally purchased at significant

discounts which

provides additional capital protection.

Aspen is highly selective in the notes it acquires for this

Fund, purchasing only a small

percentage of what they

evaluate. Prior to purchase, every note is individually

underwritten

using a proprietary model. Aspen

purchases three types of notes: loan modifications, as-

set-based hard money loans, and

seller-financed notes.

The Fund purchases both long-term and short-term notes.

The Fund's strategy is two fold:

Buy & hold cash-flowing, deeply discounted,

long-term first and second mortgages for

yield and capital gains.

Purchase or originate cash flowing, short-term,

hard money loans for yield and liquidity. Excess

cash is continually reinvested into new assets.

The minimum investment in Aspen Income Fund is $50,000.

The initial lock-up period for this fund is 1 year. After 1-year we provide best-efforts liquidity and allow investors the option to redeem their shares on a quarterly basis with 90 days written notice.

Yes, this fund is open-ended, also known as an evergreen fund. We calculate Net Asset Value (NAV) on a quarterly basis and allow investors to subscribe and redeem at the current share price.

On a monthly basis, investors receive their preferred return. Quarterly, we provide capital account statements, investor newsletters, and financial statements. We also always welcome calls from our investors.

If you invest, you become a part owner of the fund versus a specific note. Therefore, your capital is diversified across all the notes in the portfolio.

Yes, our funds currently only allow accredited investors.

Yes, our funds allow investment through qualified retirement money. This must be done through a self-directed IRA or 401K. If you don’t yet have a self-directed account, we can make introductions to several custodians that we have worked with. Additionally, our funds do not generate Unrelated Business Income Tax (UBIT).

An individual or an entity can generally qualify as an accredited investor if they meet at least one of the following criteria:

For more information about the requirements of an accredited investor, see this bulletin from the SEC.

I am a CPA and also the Executive Director of Northen Michigan Angel investment group. I have reviewed many investments, and it is a pleasure to see one like Aspen, with its outstanding business model and professional execution with timely updates on its progress.

-Dave & Deanna

I am a healthcare marketing executive. I have known Bob Fraser for over 10 years and hold him in the highest regard, and I have been with Aspen from the beginning. I couldn’t be more pleased – the dividends and statements come on time, and the team is always responsive and helpful. I feel like my money is in good hands.

-Dawn

I am a business guy from Canada who owns different companies, one with 500 employees. I like to find great opportunities. I have been with Aspen for about four years. I look for people who have very good business experience and that I can trust. Aspen has provided that for me.

-Brian

I'm an accounting professor and real estate investor. In the past, I have not had much free time to oversee my portfolio. In early 2014, Bob Fraser contacted me to tell me about Aspen. I am impressed with the Aspen team. I will be investing more funds with Aspen as I liquidate my real estate investments.

-Marsha

The Aspen Income Fund Deep Dive webinar covers many topics about the Aspen Income Fund in great detail, including:

How to generate consistent income

passively

Real examples of real estate notes and how they work

How private investments compare to other asset classes

The keys to conservatively underwriting these assets

Why it's better to be the bank

About Aspen's historical track record