You may have heard the phrase “cash is king.” From my days as a business banker, this was drilled into my head as one of the keys for evaluating deals. The idea is twofold. One, businesses or investors should have substantial cash reserves. And two, when evaluating financial statements, what may be reported as income coming in does not always equate to cash coming in the door. This is related to how income is accounted for.

I would like to take this one step further.

Applying this to a personal investing strategy, “cash flow is king.” A subtle difference. But it makes all the difference in the world.

Why Cash Flow is Important for Investors

Most investors are taught that to be able retire, they need to build a large nest egg for retirement – usually invested in the stock market. Then, once they hit retirement age, they can then “safely” withdraw 3-4% per year without running out of money.

This presents two problems: 1) the hurdle for most people to replace their current lifestyle becomes very high if you can only withdraw 3-4% per year, and 2) your wealth is not backed by any hard assets. And as we’ve all experienced, the stock market is very volatile. You are putting a lot of trust in the financial system.

Robert Kiyosaki blew this concept out of the water in his perennial best seller, Rich Dad Poor Dad. Very simply, his strategy is to invest in assets that produce cash flow.

As most investors approach retirement, cash flow is the crucial, important piece and yet the huge gap in their portfolio. Fixed income investments don’t yield much and are very volatile.

Two investor scenarios that demonstrate the value of cash flow in retirement

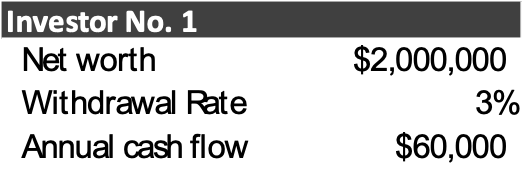

Investor No. 1:

He has slaved for 30 years working for a salary in a job that wasn’t his dream job. His boss made his life difficult, but it was manageable. He was diligent to put money away and wanted to provide for his family’s future. He ended his career making a salary of $150,000 per year. He followed the traditional advice of putting everything into low cost mutual funds or ETFs. He was able to build his net worth to $2,000,000. He is ready to retire, but is still unsure he’ll have enough to last. His financial advisor is telling him he can “safely” withdraw 3-4% per year, but he might as well err on the conservative side of 3% to be sure.

His before-tax annual cash flow will be $60,000. Now $60,000 is nothing to scoff at, and surely his expenses will be less once he retires (at least he thinks so). But he was used to making $150,000 per year, so he may need to downgrade his lifestyle. Further, what is this cash flow backed by? The expected future performance of the stocks that comprise his mutual funds. There are no hard assets.

Let’s move on to Investor No. 2.

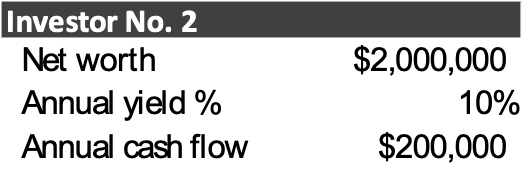

Investor No. 2:

This investor is still young; she’s only been in the workforce for 10 years, and has had a successful career thus far. She makes a good income of $80,000 a year, but has a lot of room left to run in her earning power. Instead of just focusing on growing her salary, she has been consistently accumulating assets and investments that are generating strong cash flow. She’s purchased several single-family homes, she’s bought mortgages notes, and is also a passive investor in a multi-family property and a mortgage note fund (like our Income Fund). Overall, her annual return is 10%. This is not an uncommon return.

Say she works for a full career similar to our Investor No. 1 and is able to build a net worth of $2,000,000. She also ends her career making a salary of $150,000 per year. However, instead of mindlessly putting money away into the stock market, she has gone against the tide and has continued to build her investment portfolio with various types of real estate, notes, oil & gas, and other alternative investments.

Her annual cash flow from investing activities on the same amount of net worth is $200,000, well above her previous salary. On top of this, her investments are backed by hard assets, which are less volatile. She worries a lot less than Investor No. 1 and makes over 3x what he does.

But, our Investor No. 2 is still young and she doesn’t want to have to work for 25 years in a job she doesn’t love. She wants to travel, and explore other countries. Let’s also say she is happy living on an income of $60,000 a year, like our Investor No. 1. She would rather have the flexibility and be financially independent. How much in net worth does she need to generate $60,000 annually? At a 10% return, the answer is obvious, $600,000.

How much quicker is she able to reach $600,000 versus $2,000,000? This is a made-up example, but the answer is much quicker! Some would say that she shouldn’t retire with only $600,000 in net worth, but that’s not the point. She could if she wanted to, because she has some strong passive income. She now has the flexibility and financial independence that many dream of. This is why cash flow is so important.

Another aside that should not be overlooked are the tax implications of the two strategies.

Investor No. 1 – to the extent he’s invested with a Roth IRA, he will have tax free income. But the contribution limits are restrictive, so it’s more likely that his investments are held in traditional IRAs/401-Ks (that he now has to pay taxes on) or invested in non-tax sheltered accounts. This will substantially reduce the amount of income after-tax income that he will take home.

Investor No. 2 – when you invest in direct investments (either in a private fund or directly purchasing an asset like real estate), you generally get direct ownership of that asset. As a direct owner, all of the tax benefits get passed through to you. This investor has substantial tax benefits such as depreciation and long-term capital gains that allows her to keep more of her income.

Clearly Investor No. 2’s situation is much more appealing. The problem is that most investors think this is unattainable. But what we find is it comes down to lack of education. There are more good opportunities that any one person could ever invest in. It’s knowing where to look.

Additional Reading

Benefits of Alternative Investments

Mortgage Note Investing Overview