Updated November 14, 2024

Investing in industrial real estate has been an investor favorite for decades, especially for institutional investors. The industrial sector has consistently demonstrated resilience, even during economic downturns, making it an attractive opportunity due to its stability and profitability.

With the rise of e-commerce and the increasing demand for warehousing and distribution centers, the industrial real estate market is thriving. In this article, we will delve into the economic trends behind industrial real estate (including a new driver of growth) and look at some of the key benefits and risks of investing in this asset class.

What is Industrial Real Estate?

Before we go too far, let’s first set the stage – what is an industrial property? Industrial real estate refers to properties used for industrial purposes, such as manufacturing, warehousing, distribution, and research and development. These properties can be standalone buildings or multi-building complexes, and can include features such as loading docks, high ceilings, and heavy power supplies. You’ve probably driven by them and not even realized what they were used for. But this sector of real estate is essential to the growth and vitality of the U.S. economy.

And if you haven’t been following trends for this asset class in recent years, it’s actually experiencing a huge boom. What is happening?

Growth Trends in the Industrial and Manufacturing Sector

Industrial real estate values have been flourishing in recent years, far outpacing other forms of commercial real estate like retail and office buildings.

There was an initial boost to industrial real estate in 2008-2009, rising in pace with retail and office. We can also see in the chart above, that inflation (the dashed blue line) has been growing steadily over the past 40 years. All forms of commercial real estate have been pretty close to the inflation line over all that time. But over the last 10 years, industrial real estate has been skyrocketing, now surpassing retail in the last few years. So, what’s been causing this surge in valuations?

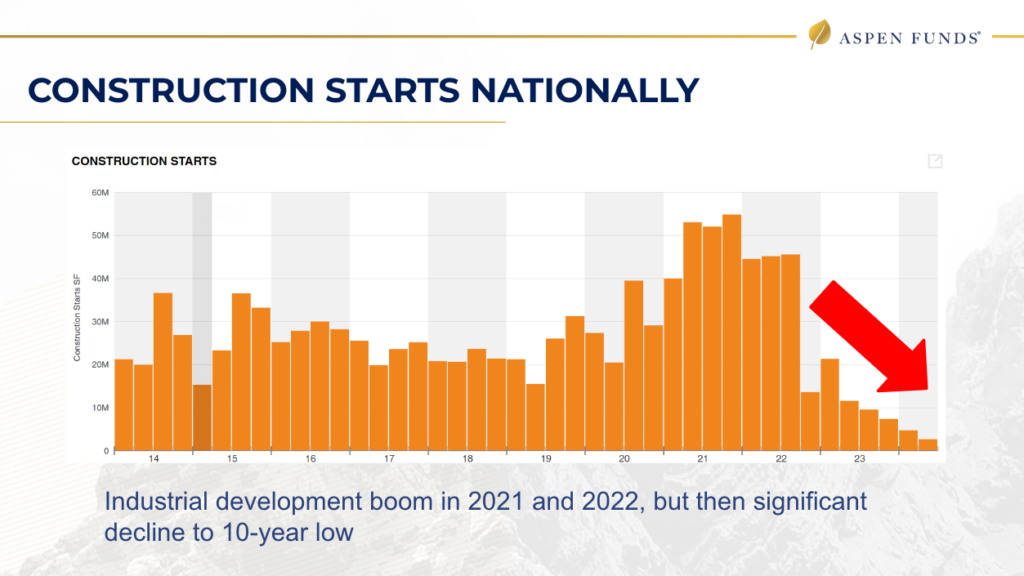

The orange bars indicate the new construction starts on industrial real estate. It reached a peak in 2021 and 2022, but has since fallen to a 10-year low. Why? Much of this development focused on larger properties, but…

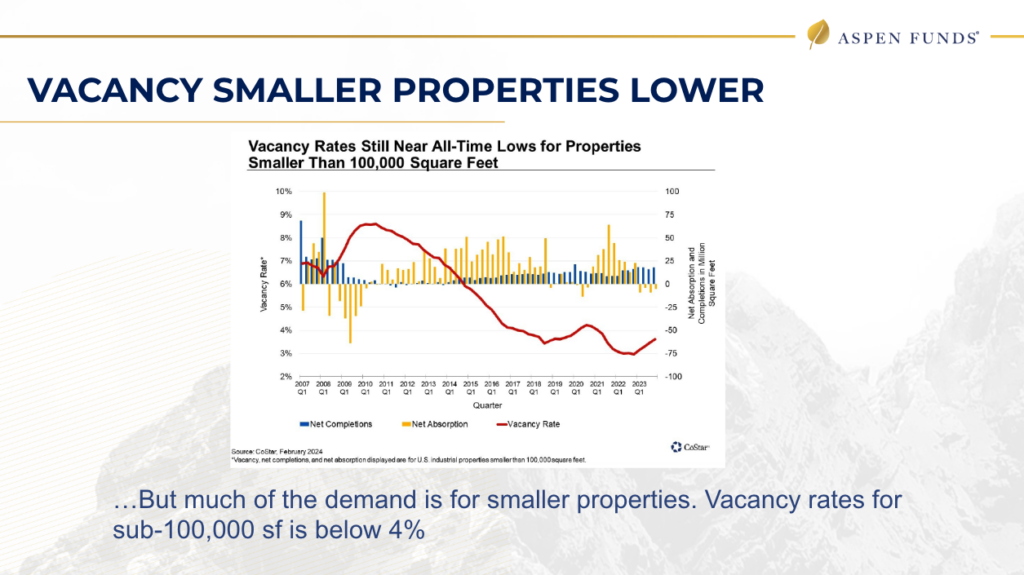

The greater demand has been for smaller industrial properties below 100,000 square feet. This is leading to a trend where the gap between supply and demand will shrink over the next year in 2025.

So what’s going on?

Key Drivers of Growth in Industrial Real Estate

The large growth for industrial real estate can be attributed to several factors: the rapid rise in eCommerce, supply chain disruptions, increasing energy costs abroad, and the re-shoring of manufacturing to US soil.

Rising E-commerce Strengthens Demand for Industrial and Manufacturing Space

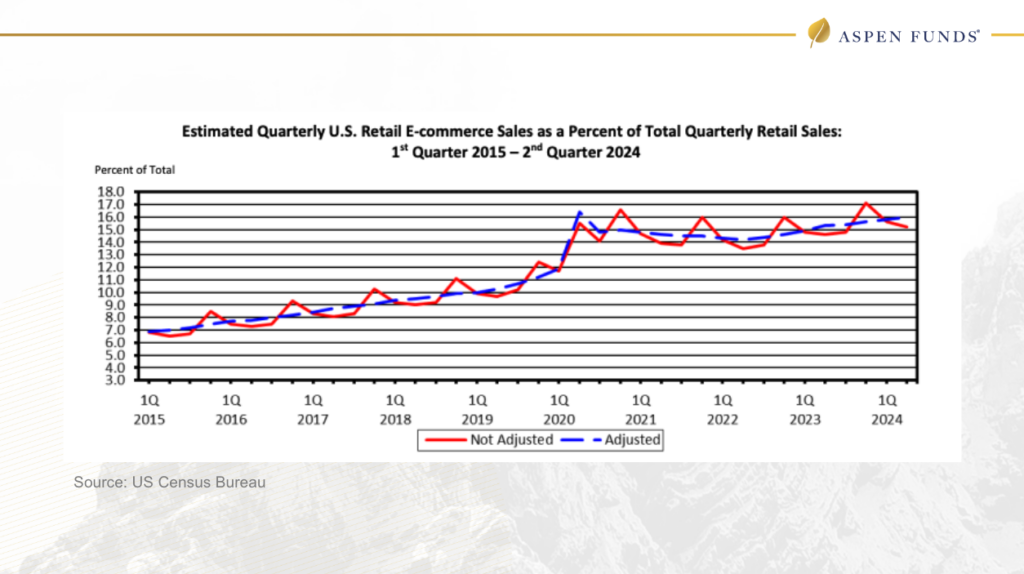

E-commerce has been a huge driver of the industrial boom over the past several decades. As e-commerce has grown, the need for keeping inventory and for distribution and warehousing has massively increased.

In the below chart, you can see e-commerce sales spiked substantially in 2020 as the pandemic hit and people weren’t able to leave their homes and instead needed to get things delivered to them.

After that spike, e-commerce sales as a percent of total retail sales declined, but has since continued to steadily grow.

E-commerce growth has been one of the biggest drivers of industrial real estate for so long. But at the same time, we’re now seeing several new trends causing a resurgence of industrial growth – bringing manufacturing back to America and the “re-inventorying” of critical manufacturing components. And we believe that’s going to be another big rocket booster to industrial real estate as we head into 2025.

Supply Chain Disruptions Highlight Importance of Resilient Operations

We have all seen plenty of headlines in the last few years about supply chain disruptions. Here’s an interesting case study.

Ford, like many other automakers, has been dealing with the effects of a severe microchip shortage. Tens of thousands of Ford trucks are sitting in parking lots, unable to be sold. The missing microchips, which are needed to complete the cars, have been held up by supply chain disruptions. This is a byproduct of having outsourced the manufacturing of these critical components overseas.

Because of this, Ford has over $2 billion of potential revenue that they can’t capture just sitting in parking lots. So the question is, “how valuable is it to Ford to control the manufacturing of this critical component?” The answer is very important!

And Ford isn’t just an isolated case, this is happening all across U.S. (and even European) manufactures. Supply chain disruptions have had a significant impact on industrial real estate in recent years. The pandemic has disrupted global supply chains, leading many companies to reassess their logistics and storage strategies. This has resulted in increased demand for industrial real estate as companies look to bring their supply chain operations closer to the end customer.

Rising European Energy Prices Drive Shift to US

According to the Wall Street Journal, high prices for natural gas are pushing European manufacturers to shift their operations to the US. Shifting operations to the US is advantageous, both to avoid the rising energy costs, and to take advantage of green-energy incentives and stable prices.

Reshoring Manufacturing Drives Need for Industrial Real Estate

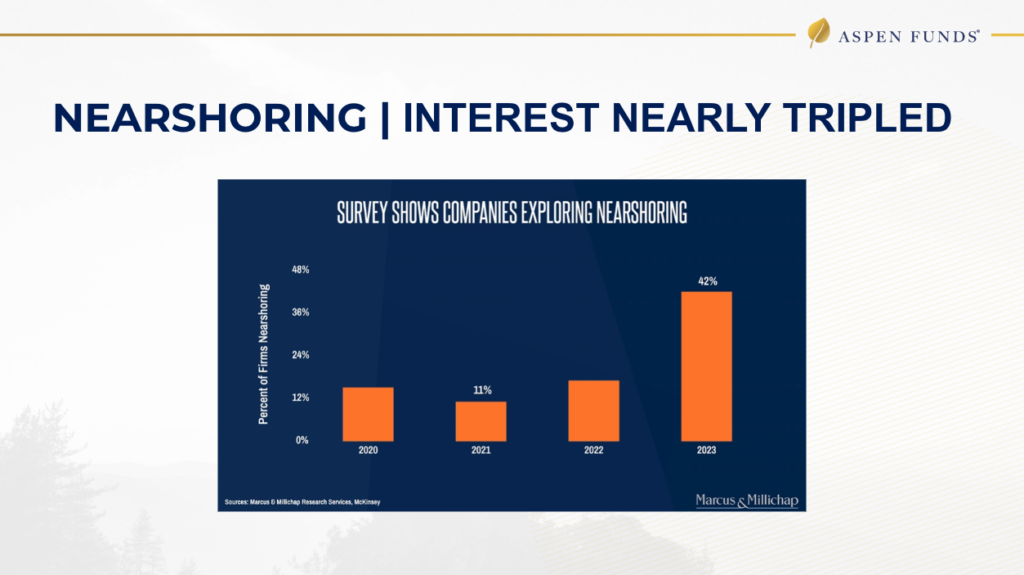

For decades, we shipped our manufacturing jobs overseas for the most. But it has started to shift in the last few years. The number of US companies exploring nearshoring, or moving operations to a region or country nearby, has jumped up to 42% last year.

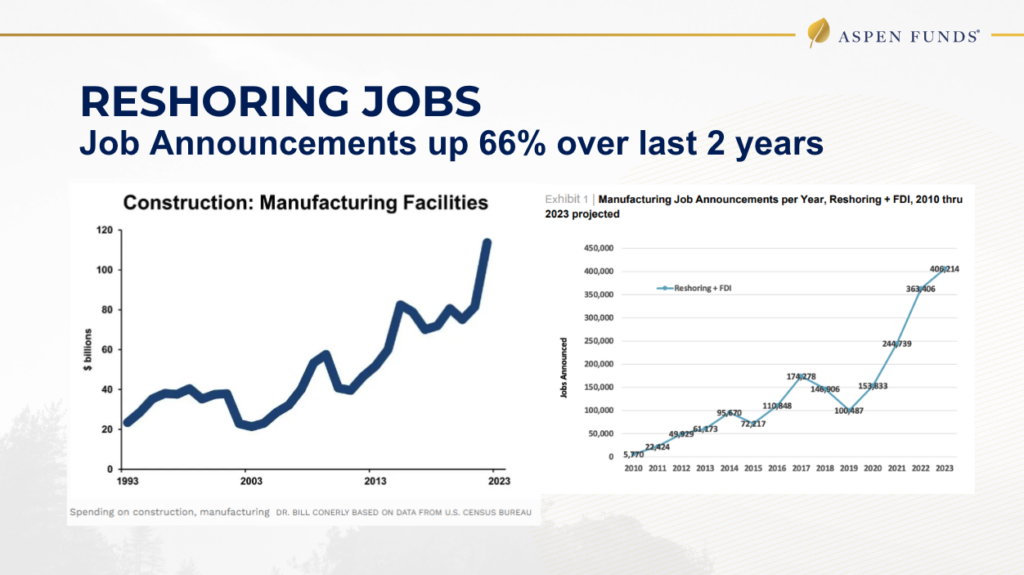

Job postings for manufacturing positions have risen 66% over the last two years, hitting over 400,000 jobs last year.

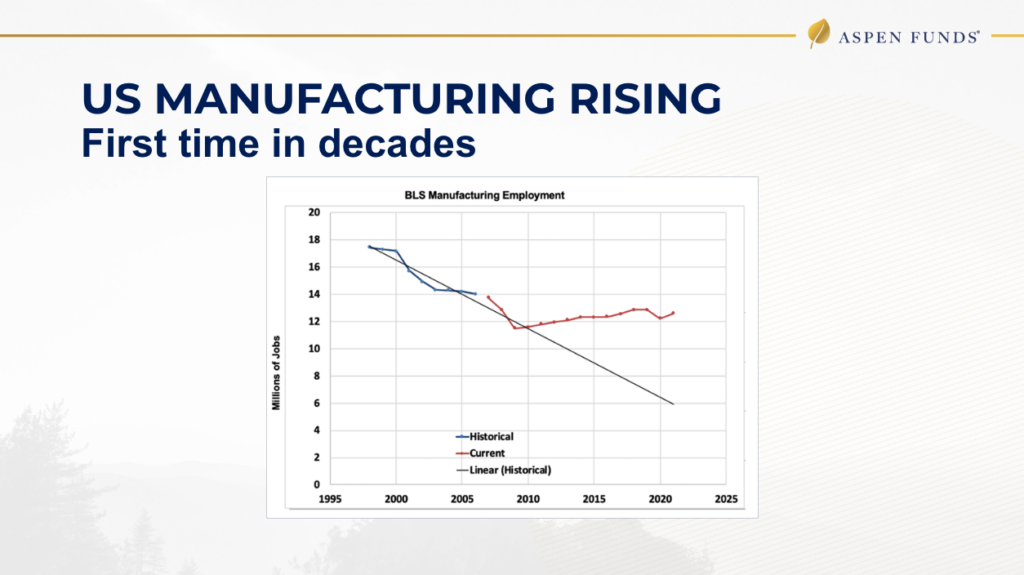

If you look back to the 1990s, the manufacturing employment trend was pretty clearly heading downward. But instead of continuing to see a decrease, we’ve started to see an uptick in US manufacturing jobs in the last 10 years.

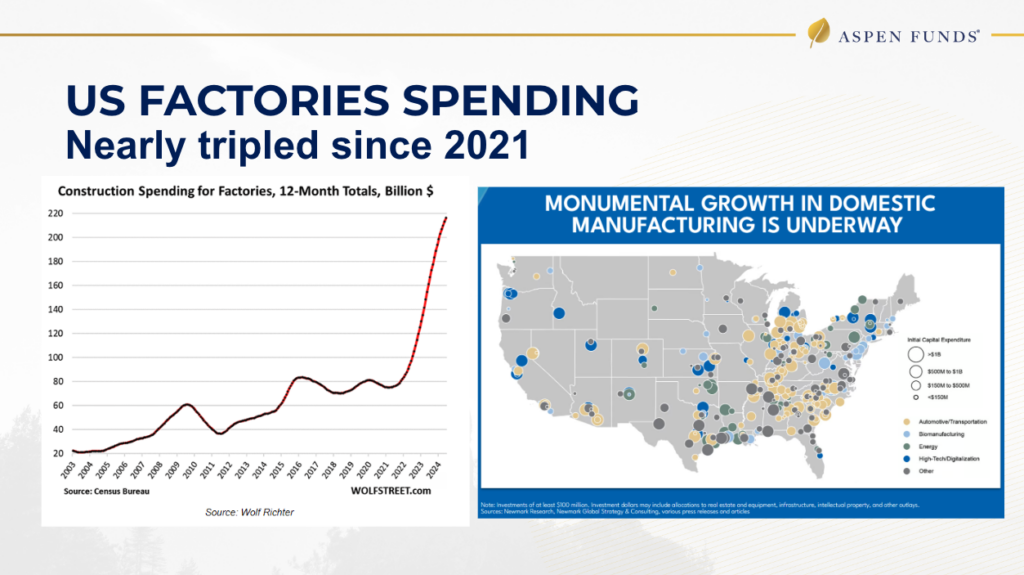

Spending for US factories has nearly tripled since 2021. “Companies invested a record $19.7 billion in June [2024] in the construction of manufacturing facilities, up by 18.6% from the already surging levels in June 2023, up by nearly 100% from June 2022, and up by 209% from June 2019, according to the Census Bureau today” (from Wolf Street).

Outlook on Industrial Growth

BlackRock

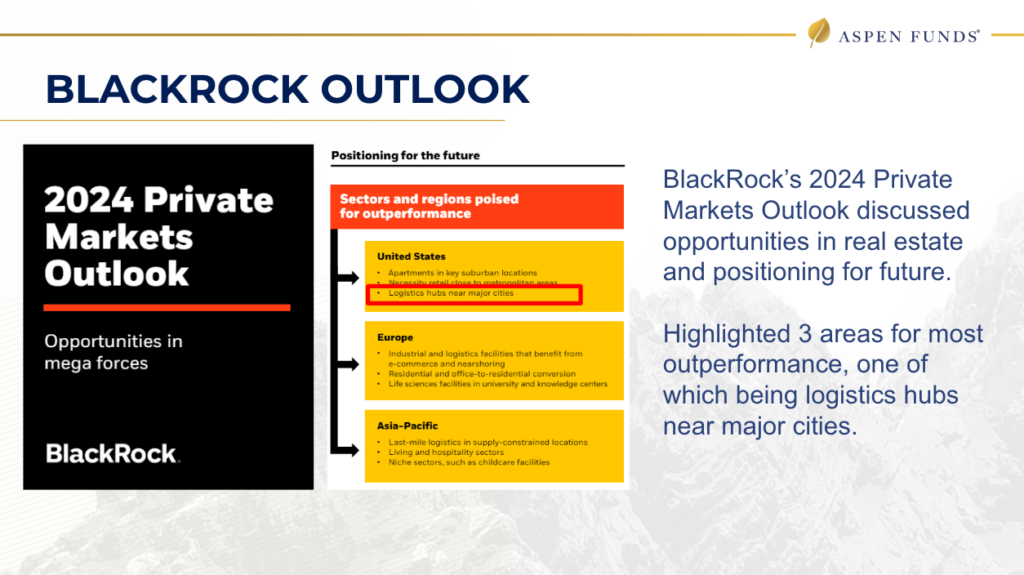

BlackRock’s 2024 Private Markets Outlook discussed opportunities in real estate and positioning for the future, highlighting 3 areas for the most outperformance, one of which was logistics hubs near major cities.

Deloitte

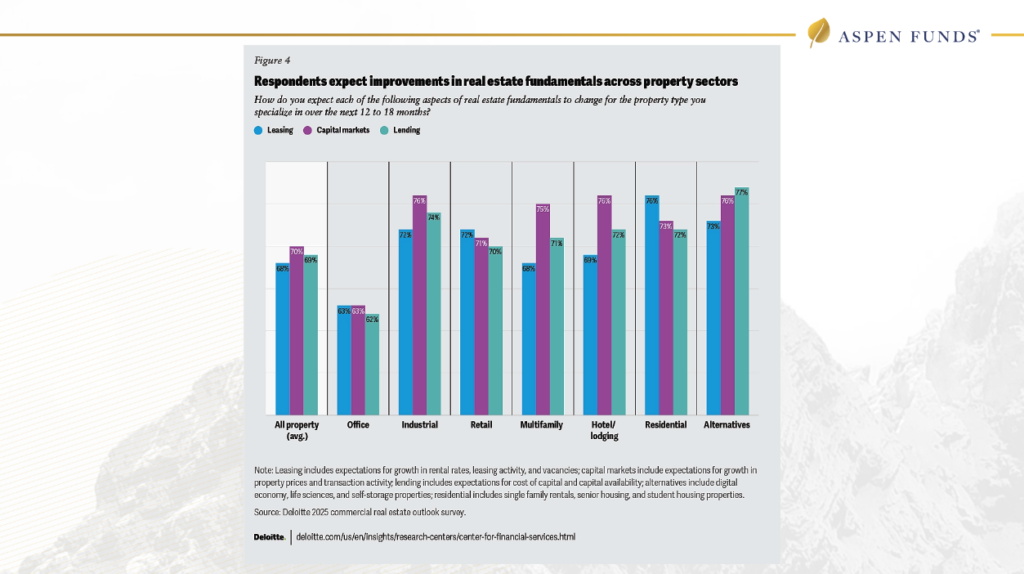

“Responses to this year’s survey reflect a near-term shift in sentiment for commercial real estate in 2025 as well. Over 68% of respondents expect conditions for CRE fundamentals to improve in 2025 across areas such as cost of capital, capital availability, property prices, transaction activity, leasing activity, rental growth, and vacancies. This is a major boost in optimistic sentiment as only 27% of respondents in last year’s survey anticipated improved conditions.”

Global respondents appear most optimistic about leasing conditions for residential properties (including build-to-rent single-family, student housing, and senior housing); industrial, hotel/lodging, and alternative sectors capital markets (including digital economy, life sciences, and self-storage); as well as lending for alternative property types (figure 4).

From An Investor’s Perspective – Is Industrial a Good Investment?

When it comes to assessing the actual opportunity for investors in industrial real estate, there are several things to consider.

Risks of Investing in Industrial Real Estate

- Risk of vacancies: Many times these properties can be occupied by a handful or even a single tenant. If that tenant stops paying or becomes insolvent, that impacts potential cash flow in the short-term.

- Build-to-suit risk: When a developer undertakes building an industrial property to the specifications required by the tenant, that’s called build-to-suit. This customization means the property may be harder to lease out again should the tenant ever leave or stop paying rent.

- Speculative Development: On the other side of the development coin are “speculative” developments, meaning no tenant(s) are identified prior to construction. This could result in a vacant property if not developed correctly or it’s in a non-growth market.

- Modernization risk: The industrial sector is always evolving, meaning requirements for machinery, loading docks, HVAC equipment loads, or building access could change. This can potentially leave the building outdated and in need of expensive modernization.

Benefits of Investing in Industrial Real Estate

- Strong demand: The demand for industrial space has been growing due to e-commerce growth and the increasing need for warehousing, manufacturing and distribution centers.

- Long leases: Because moving large-scale operations to another industrial facility can be a big undertaking, most tenants stay put for a while, and leases can be much longer than in other types of commercial real estate.

- Long-term appreciation: Industrial properties tend to appreciate in value over time, and as shown in previous charts, values have significantly outpaced other asset classes and inflation.

- Inflation hedge: Inflation can increase operating costs, but rental income from industrial properties can also increase, offering protection against inflation.

- Tax benefits: Industrial real estate investments can offer favorable tax benefits, including deductions for depreciation and operating expenses.

- Less oversupply risk: While other real estate asset classes may hit market saturation with more available properties than demand, this is less likely in the short term for industrial real estate, given the steady e-commerce trends, historic undersupply, and growing industrial space needs with the reshoring of manufacturing processes.

Read: How to Get Started with Industrial Real Estate Investing

Investment Opportunities in Industrial Real Estate

Join our Investor Club, where you get exclusive deal launch notifications, behind the scenes economic forecasts and webinars, and a personalized investor relations experience.

*Please note nothing contained in this communication constitutes tax, legal, insurance or advice of any kind, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. If you are not the intended recipient of this message, any use, dissemination, distribution or copying of this communication is strictly prohibited. Investors should conduct their own due diligence, not rely on the financial assumptions or estimates displayed in this email or on the website, and are encouraged to consult with a financial advisor, attorney, accountant, and any other professional that can help you to understand and assess the risks associated with any investment opportunity. Investments in private placements involve a high degree of risk and may result in a partial or total loss of your investment. Private placements are generally illiquid investments. Investors should consult with their investment, legal, and tax advisors regarding any private placement investment. Please review the Private Placement Memorandum for a full explanation of this investment along with key risks.