Industrial real estate refers to properties used primarily for manufacturing, production, storage, and distribution of goods. These properties are often large-scale and include warehouses, manufacturing plants, distribution centers, and other facilities essential to the supply chain. Industrial real estate plays a crucial role in the global economy by enabling the efficient movement of goods from manufacturers to consumers.

Investing in industrial real estate is gaining popularity among investors due to its stability, long-term leases, and growing demand driven by e-commerce and global trade. With the ongoing evolution of supply chains and the rise of online shopping, industrial properties have become a cornerstone of commercial real estate investment portfolios, offering strong potential for both income and appreciation.

If you’re new to industrial real estate investing, it’s important to understand the different types of industrial buildings and how industrial properties fit into the broader category of commercial real estate.

Before we get into the specifics though, let’s explore why investing in industrial real estate is a smart choice in the first place.

Why Invest in Industrial Real Estate?

Investing in industrial real estate offers several advantages:

- Stable Income: Industrial leases are typically long-term (ranging from 5 to 15 years), providing consistent cash flow.

- Low Vacancy Rates: Industrial properties often have lower vacancy rates compared to other sectors due to high demand, especially in logistics and warehousing.

- Resilience to Economic Cycles: Industrial real estate tends to perform well even during economic downturns, as businesses continue to require storage and distribution facilities.

- E-commerce Boom: The rise of online shopping has increased the demand for warehouses and distribution centers, making industrial real estate a hot investment.

Compared to other real estate sectors, industrial properties often provide higher yields. Industrial real estate generally offers higher yields compared to residential and office properties.

Another benefit of investing in industrial real estate is lower maintenance costs; industrial buildings typically have lower maintenance and management costs, making them more cost-effective. Furthermore, adding industrial properties to a real estate portfolio can increase portfolio diversification, reducing overall risk.

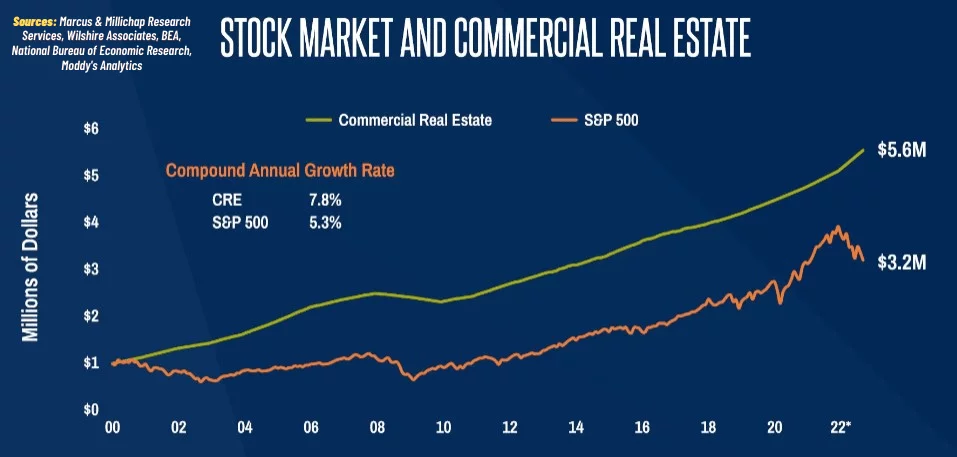

Source: Willowdale Equity

Typical Returns and ROI

Historically, industrial real estate has shown strong performance. Over the past decade, industrial properties have consistently outperformed other commercial real estate sectors in terms of rental growth and capital appreciation. For instance, according to recent studies, industrial real estate has seen average annual returns of 10-12%, driven by demand from the logistics and e-commerce sectors.

The growth potential of industrial real estate is promising. As e-commerce continues to expand, the need for modern, strategically located industrial facilities is expected to rise. Investors can anticipate robust returns, particularly in regions with strong logistics networks and growing populations.

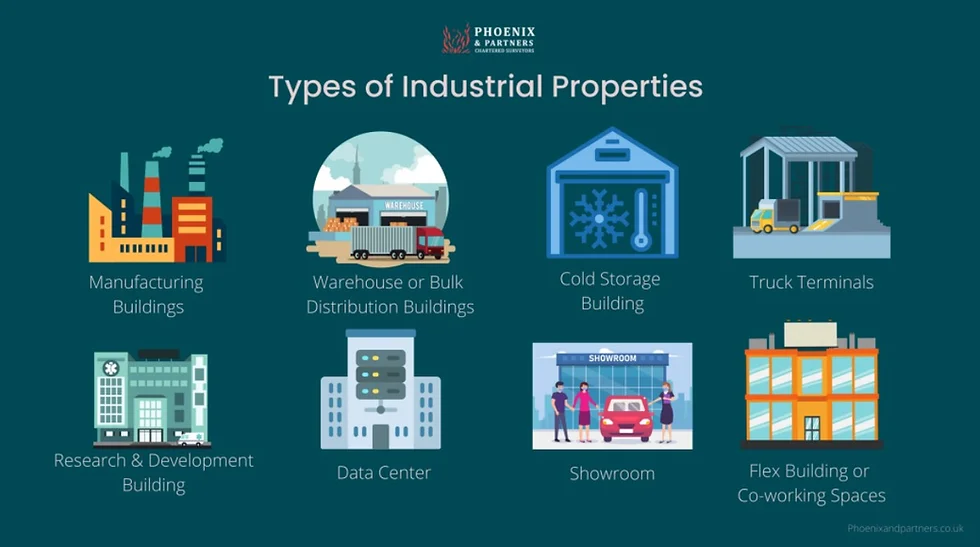

Understanding Industrial Buildings

An industrial building is a property primarily used for manufacturing, warehousing, and distribution of goods. Key characteristics of industrial buildings include large floor spaces, high ceilings to accommodate machinery and storage racks, loading docks for easy loading and unloading of goods, and proximity to transport networks for efficient logistics.

Source: Peak Frameworks

Types of Industrial Buildings

Warehouses

Warehouses are used for the storage of goods. They can vary in size from small storage units to large distribution hubs and often include loading docks, high ceilings, and large open spaces.

Manufacturing Facilities

These buildings house the production of goods and include space for assembly lines, machinery, and sometimes office areas. Manufacturing facilities are typically customized to the needs of the business.

Flex Spaces

Flex spaces are versatile industrial properties that can be adapted for various uses, including office space, warehousing, and light manufacturing. They offer flexibility for tenants, making them attractive for small and medium-sized businesses.

Distribution Centers

Distribution centers are specialized warehouses designed to efficiently move goods from manufacturers to retailers or directly to consumers. They are often located near major transportation hubs and feature advanced logistics systems.

Cold Storage Facilities

Cold storage facilities are industrial buildings designed to store perishable goods at controlled temperatures. These are essential for the food industry, pharmaceuticals, and other sectors requiring refrigerated storage.

Market Trends in Industrial Real Estate

The industrial real estate market is currently experiencing strong demand, driven by the growth of e-commerce and the need for more sophisticated logistics infrastructure. Urbanization and the expansion of global trade networks are also contributing to the sector’s growth.

"E-commerce has been a huge driver of the industrial boom over the past several decades. As e-commerce has grown, the need for keeping inventory and for distribution and warehousing has massively increased."

-Bob Fraser Tweet

E-commerce, in particular, has fundamentally changed the landscape of industrial real estate. The need for rapid delivery and large-scale distribution has led to a surge in demand for warehouses and fulfillment centers, especially in urban areas. This trend is expected to continue as online shopping becomes more prevalent.

Looking ahead, the future of industrial real estate looks bright, with continued growth expected in e-commerce, global trade, and supply chain optimization. Innovations in technology, such as automation and robotics, will likely drive further demand for modern, high-tech industrial facilities.

Economic factors, such as interest rates and global trade policies, will influence industrial real estate, while technological advancements, including the rise of smart warehouses and the Internet of Things (IoT), will play a significant role in shaping the future of this sector. Our analysis of growth trends in the industrial and manufacturing sectors highlights expected growth over the coming years as industrial vacancy has dropped and demand has soared.

How to Get Started Investing in Industrial Real Estate

Public Market Options for Investing in Industrial Real Estate

For those looking to invest in industrial real estate through the public markets, there are several accessible options, including Real Estate Investment Trusts (REITs), Exchange-Traded Funds (ETFs), and mutual funds.

- REITs allow investors to buy shares in companies that own and manage industrial properties, offering a way to gain exposure to the sector with the added benefit of liquidity.

- ETFs, which often track indexes of industrial real estate companies or REITs, provide a diversified and cost-effective way to invest in this sector,

- Mutual funds offer professionally managed portfolios that may include industrial properties as part of a broader real estate strategy.

These public market options are ideal for investors seeking diversification, liquidity, and lower entry barriers compared to direct property ownership.

Private Market Options for Investing in Industrial Real Estate

Another way to get started in industrial real estate investing is by investing through private channels, such as Aspen Funds. These private investment firms work directly with operators who manage, renovate, and lease industrial properties.

Investing through private channels offers several advantages compared to public markets like ETFs or REITs.

First, private investments often provide access to unique opportunities that are not available in the public market, including off-market deals and properties with higher potential for value-add through renovations or strategic leasing. Additionally, private investments typically involve working closely with experienced operators who have in-depth knowledge of the industrial sector, leading to more hands-on management and potentially higher returns.

However, it’s important to consider factors such as the investment horizon, liquidity, and the credibility of the operator. Private investments often require a longer commitment and are less liquid than publicly traded options, so it’s crucial to align them with your financial goals and risk tolerance. By choosing a reputable firm like Aspen Funds, you can gain access to well-managed industrial properties and leverage our expertise to enhance your investment portfolio.

Next Steps in Industrial Real Estate Investing

Before diving into industrial real estate investing, it’s important to clarify your long-term and short-term investment goals. Are you seeking income, capital appreciation, or a combination of both? Your goals will guide your investment decisions. Additionally, consider whether adding industrial real estate to your portfolio mix is the right investment strategy. Industrial real estate can provide diversification and stable returns, but it’s essential to assess whether it aligns with your financial goals.

Once your goals are clear, identify the right type of industrial real estate fund to support your investment objectives. Depending on your needs, you may choose to invest privately in industrial real estate funds, or through REITs, ETFs, or mutual funds. Each option has different risk and return profiles, so selecting the right investment vehicle is crucial.

Conclusion

Investing in industrial real estate offers a range of benefits, including stable income, strong growth potential, and diversification. By understanding the types of industrial properties, market trends, and investment options available, investors can make informed decisions that align with their financial goals.

Frequently Asked Questions About Investing in Industrial Real Estate

The minimum investment required for industrial real estate can vary widely depending on the type of investment. If you’re purchasing an industrial property directly, the cost can range from hundreds of thousands to millions of dollars, depending on the location, size, and type of property. However, if you’re investing through a Real Estate Investment Trust (REIT) or an exchange-traded fund (ETF) that focuses on industrial real estate, the minimum investment can be much lower. For instance, you can start investing in REITs or ETFs with just the price of a single share, which could be as low as $50 to $100, depending on the fund.

Investing in industrial real estate, like any investment, comes with risks. Some of the key risks include:

- Market Risk: The industrial real estate market can be influenced by economic downturns, changes in trade policies, and fluctuations in demand for industrial space.

- Tenant Risk: Industrial properties often have single or a few tenants with long-term leases. If a major tenant defaults or vacates, it can significantly impact your rental income.

- Location Risk: The value and demand for industrial properties are closely tied to their location. Investing in a less desirable area may result in lower returns and higher vacancy rates.

- Maintenance and Operational Costs: While industrial properties generally have lower maintenance costs compared to other real estate sectors, unexpected repairs or operational issues can still arise and affect profitability.

- Regulatory Risk: Changes in zoning laws, environmental regulations, or property taxes can impact the profitability of industrial real estate investments.

The industrial real estate market differs significantly from the residential real estate market in several ways:

- Tenant Profiles: Industrial properties are leased to businesses rather than individuals, leading to longer lease terms and more stable income streams. Residential properties, on the other hand, typically have shorter leases and are more susceptible to turnover.

- Market Demand: Industrial real estate is driven by factors such as e-commerce, global trade, and logistics, whereas residential real estate is influenced by population growth, employment rates, and housing supply.

- Return on Investment: Industrial real estate often provides higher yields compared to residential real estate, but it also comes with different risks, such as reliance on single or few tenants. Residential real estate, while typically offering lower yields, can benefit from steady demand for housing and appreciation over time.

- Management Requirements: Managing industrial properties generally involves less hands-on work compared to residential properties, which require ongoing tenant relations, maintenance, and turnover management.

Evaluating the potential return on investment (ROI) of an industrial property involves several key steps:

- Analyze the Location: Assess the property’s location in relation to major transportation networks, supply chains, and demand for industrial space in the area. A prime location can lead to higher rents and lower vacancy rates.

- Examine the Lease Terms: Review the length and terms of existing leases, including rental rates and any escalation clauses. Long-term leases with creditworthy tenants can provide stable income.

- Calculate the Cap Rate: The capitalization rate (cap rate) is a common metric used to evaluate industrial properties. It is calculated by dividing the property’s annual net operating income (NOI) by its purchase price. A higher cap rate indicates a potentially higher return, but also higher risk.

- Consider the Property’s Condition: Assess the property’s physical condition and any required maintenance or upgrades. Unexpected expenses can impact your ROI.

- Evaluate Market Trends: Stay informed about local and national industrial real estate trends, including supply and demand dynamics, economic factors, and emerging technologies that could influence the property’s value and rental income.