The Rise of Private Credit Markets

Private credit markets have exploded in recent years, transforming from a niche field to a powerhouse in finance. Here we look at the history of private credit, its recent trends, comparisons with traditional lending, current private credit market size, and forecasts for private credit beyond 2024.

A Brief History and Emerging Trends

Private credit dates back to the early 1900s, when non-bank entities started lending directly to companies. The 2008 financial crisis was a game-changer. As banks tightened their lending belts, private credit funds jumped in, filling the void. Over the last ten years, private credit growth has blossomed, fueled by a thirst for alternative financing and regulatory shake-ups, like the Dodd-Frank Act, which added stiff rules to traditional bank lending.

The COVID-19 pandemic turbocharged this growth, as businesses clamored for flexible money to bounce back. With interest rates low and stock markets shaky, investors have been drawn to private credit for its high yields and diversification perks. This era is often dubbed the “golden age of private credit.”

Private Credit vs. Traditional Lending

Private credit stands apart from traditional lending in several ways. It typically offers higher returns to offset higher risks, such as illiquid investments and the looming threat of defaults. Unlike banks, private credit operates in a less regulated space, allowing for more inventive deal-making but also introducing additional risks.

Private Credit Market Size and Growth Projections

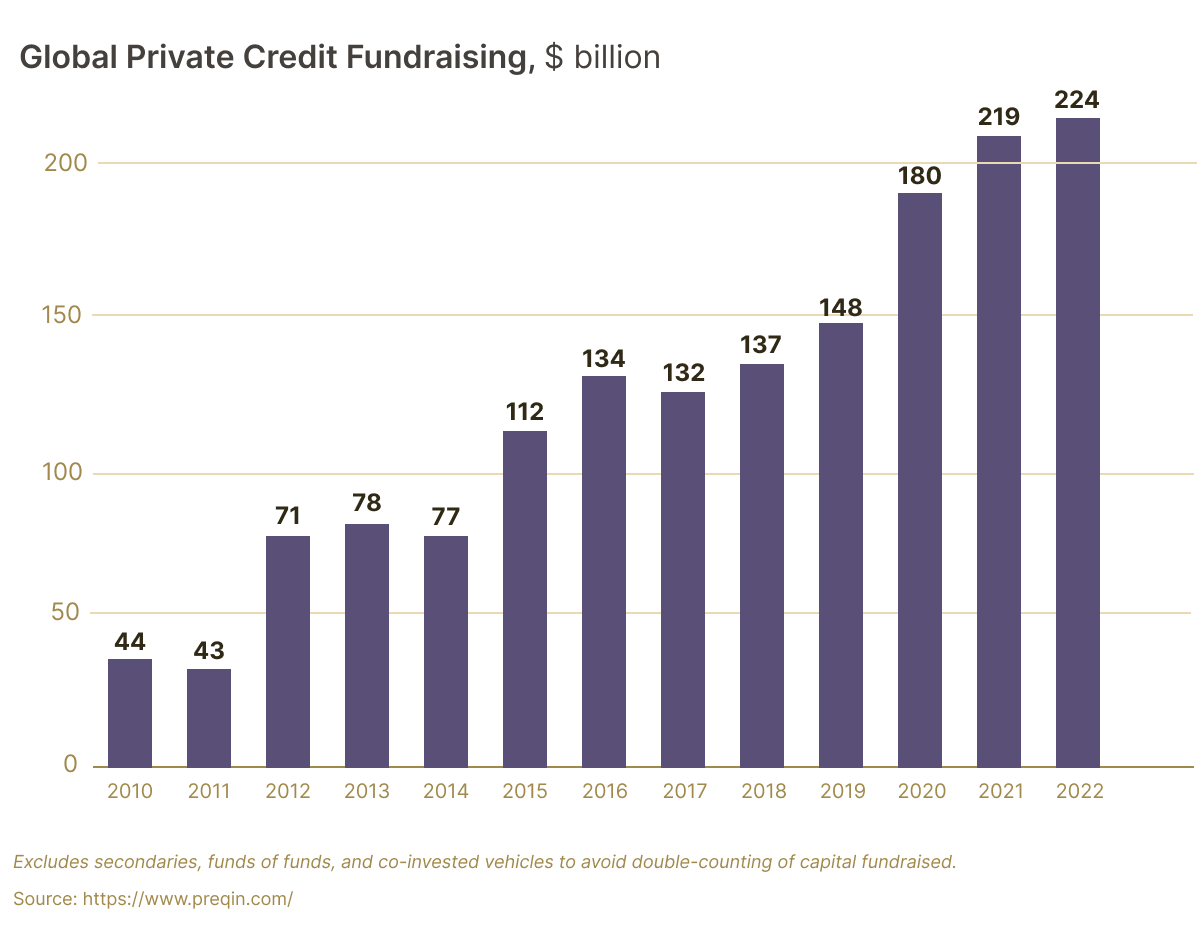

As of 2024, the private credit market is valued at over $1.5 trillion—more than double its size from just a decade ago. The growth isn’t slowing down, with expectations of a steady annual growth of 10-12% in the next five years. The reasons? A continuing appetite for alternative financing, investors hungry for yield, and economic conditions that lean toward non-traditional lending. This outlook suggests that investing in private credit isn’t just a passing trend.

Source: Heron Finance

Case Study of Market Growth

A standout moment came in 2022 when a group of private credit funds, spearheaded by global alternative asset manager Ares Management, poured $3 billion into software firm Epicor. This deal exemplifies the flexibility and scale direct lending private credit can offer compared to standard banks, highlighting how it’s becoming a crucial player in high-stakes financing, especially in sectors like tech, where companies need quick, tailored funding.

Key Drivers Fueling Market Growth

Several key players are pushing the private credit market engine forward:

Investor Demand for Bigger Returns

With traditional fixed-income investments struggling in a low-yield environment, investors are eyeing private credit for its higher returns, a result of its greater risk and illiquidity. Compared to other alternative investments like private equity or real estate, private credit often offers more stable cash flows and lower volatility, making it an attractive prospect for investors looking for income. This has led to a surge of capital into private credit funds, further driving market expansion.

Borrowers Embrace Private Markets

Companies are increasingly moving away from public debt, drawn to the flexibility, reduced regulatory scrutiny, and swifter execution that private credit provides. For example, PetSmart and Ancestry.com opted for direct lending private credit to fund acquisitions, benefiting from customized solutions and faster deal closure.

The Rise of Non-Bank Lenders

Non-bank lenders, such as private credit funds and asset managers, are stepping into the limelight, offering the kind of flexible financing traditional banks can’t match. Their ability to pursue riskier opportunities, especially in the middle-market and distressed debt sectors, has allowed them to capture market share. This competition has sparked innovation in the lending landscape, which benefits borrowers but also intensifies market dynamics.

Regulatory Transformations

Since the 2008 crisis, regulations like the Dodd-Frank Act have constrained traditional lending, paving the way for private credit to thrive. While rules vary across regions—tougher in Europe than in the US—they influence both investor and borrower strategies as the hunt for less regulated territory continues.

The Influence of Institutional Investors

Institutional investors like pension funds and insurance companies are diving into private credit, bolstering liquidity and stability. Their involvement has led to more partnerships with private credit firms and has contributed to market growth by improving overall credibility and reducing volatility.

Risk Management in Private Credit

Navigating Credit Risks

Understanding credit risk in private markets is crucial. The biggest threat is default risk–borrowers failing to meet their obligations. Several factors come into play, including the financial health of borrowers, market conditions, and broader economic factors.

Private credit involves less transparency and standardization than public markets, so investors need to carefully evaluate borrower profiles and market conditions. Investors should also pay attention to borrower leverage, economic downturns, and sector-specific challenges as they delve into evaluating credit risk in 2024 and beyond.

Strategies for Mitigating Default Risk

To combat default risk, thorough due diligence and detailed credit evaluations are vital. Investors should scrutinize the borrower’s financials, management, and the industry outlook as a whole. Protective clauses, known as covenants, help safeguard investments. Diversification across sectors and regions also reduces the impact of any single default.

The Role of Covenants and Structuring

Covenants are essential for managing risk. These contractual agreements impose financial and operation standards on borrowers–sea maps guiding lenders through choppy waters. Common types include financial covenants (e.g., debt-to-equity ratios) and performance covenants (e.g., revenue targets). Effective deal structuring, including the priority of debt and collateral agreements, also plays a key role in risk management.

Macroeconomic Influences

Larger economic factors—like fluctuating interest rates, economic cycles, and geopolitical uncertainties—cast long shadows over private credit. Rising interest rates can hike borrowing costs, potentially squeezing borrowers. Economic downturns may lead to higher default rates, while geopolitical tensions can create uncertainty in credit markets. Investors should stay tuned in to these macro influences to navigate the market’s ebbs and flows.

Tools to Aid Risk Assessment

New and advanced tools like AI and data analytics are transforming credit risk assessment. This tech can provide deeper insights, which helps in evaluating creditworthiness, and it can also make more accurate predictions, which helps in monitoring portfolio performance.

Opportunities Abound for Investors

Private credit is ripe with opportunities fueled by sector growth, emerging markets, and innovative strategies.

Spotting Good Investment Opportunities

Investors should look for solid credit quality, borrower reliability, and collateral offerings. Many high-growth areas emerge, such as technology, healthcare, and real estate. While emerging markets can promise high rewards, they come with their own risks. Mature markets, on the other hand, often provide a more stable investment backdrop. Investors may be drawn to one market over the other, depending on their appetite for risk.

Sectors Leading the Private Credit Boom

Private credit is booming across several key sectors:

- Tech and Innovation: Fueling growth capital for advancements.

- Healthcare and Life Sciences: Riding the wave of medical innovation demand.

- Real Estate and Infrastructure: Particularly in industrial real estate, urban development and sustainable projects.

- Consumer and Retail: Financing for expansions, acquisitions, and restructures.

Geographic Hotspots

Private credit opportunities vary significantly by geography. North America leads the charge with a robust market, followed closely by opportunities burgeoning in Europe, albeit with complex regulations. The Asia-Pacific region is emerging rapidly, especially in tech and manufacturing, while Latin America and Africa reveal untapped potential, albeit with higher stakes.

The Role of Private Equity in Private Credit

Private equity firms are increasingly integrating with private credit, creating synergies that maximize returns. Co-investment strategies allow for optimized deals, particularly in tech and healthcare through leveraged buyouts, showcasing the strength of these partnerships. The intersection of private equity and private credit allows for more sophisticated financing solutions, which benefits both investors and borrowers.

ESG Considerations in Private Credit

Investors are weaving Environmental, Social, and Governance (ESG) criteria into their strategies, guiding borrower selection. This alignment with sustainable practices is gaining traction, attracting socially conscious investors to dedicated ESG-focused private credit funds.

Private Credit Investment Strategies for 2024

Based on the current private credit landscape in 2024 and looking toward 2025, there are some standout strategies to consider for navigating this market.

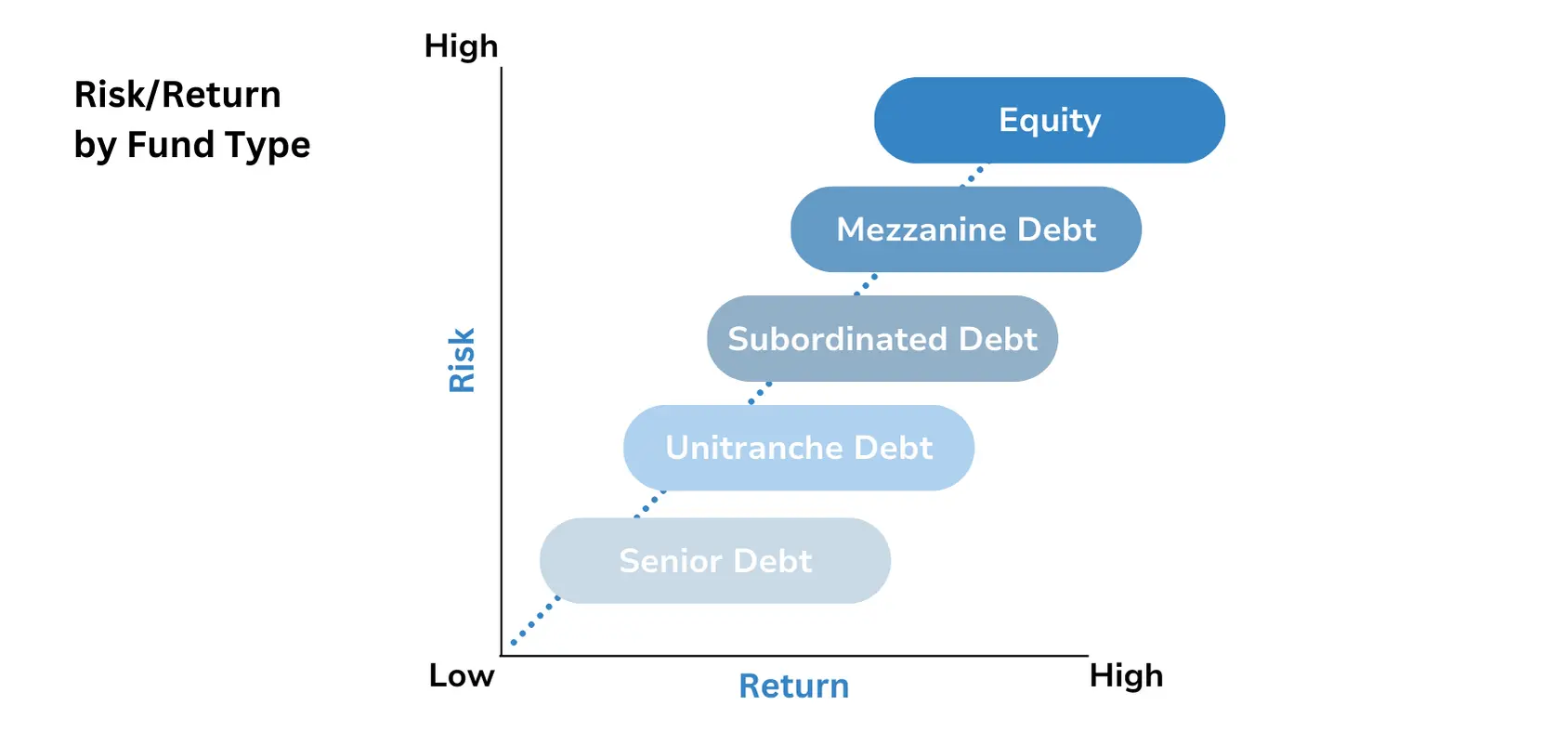

One option is distressed debt, which lets investors focus on companies that are facing financial challenges, offering the chance for high returns if they bounce back. Another important decision is whether to choose direct lending or syndicated loans, as each presents different risks and rewards to think about. Then there’s mezzanine financing, which acts as a bridge to equity and can provide higher returns compared to senior debt, though it comes with added risk.

Source: SafeRE

Challenges and Future Outlook

With all this growth, challenges remain on the horizon. Investors will need to brace for market volatility due to fluctuating interest rates and geopolitical tensions, like trade disputes and conflicts. Investors will need to brace for market volatility due to fluctuating interest rates and geopolitical clashes.

Potential Regulatory Shifts and Their Impact

Looming regulatory changes could also have a large impact on the private credit industry. For example, in the US, regulators are considering stricter rules on leverage ratios and enhanced disclosure requirements for private credit funds to help address concerns about systemic risk. The SEC is also evaluating new rules that could require more detailed reporting on fund performance and risk exposure in an effort to bring more transparency. Investors should stay in the loop about policy developments and create contingency plans to navigate these potential regulatory shifts.

Market Forecast for the Next Decade

The private credit sector is expected to grow and become an integral part of the global financial system. Emerging markets in Asia, Latin America, and Africa are anticipated to drive future growth due to expanding economies and infrastructure needs. Monitoring these regions and evolving market dynamics will be crucial for identifying opportunities.

Learning from Market Leaders

Insights from leading private credit firms provide invaluable lessons in risk management and investment strategies. Current case studies highlight effective practices for navigating the dynamic landscape, emphasizing the importance of adaptability.

Conclusion

As we wrap up our journey through the private credit market, several insights stand out:

- Growth Drivers: A surge in investor demand for yields, a shift toward private markets, non-bank lender expansion, and evolving regulations are reshaping the landscape.

- Opportunities Galore: Investors can capitalize on promising sectors like tech and healthcare, hot geographical markets, and innovative strategies in 2024 and beyond, such as distressed debt and mezzanine financing.

- Navigating Challenges: Keeping an eye on market volatility, regulatory changes, and technological advancements is essential for managing risks effectively.

- Future Growth: The private credit outlook is set to soar, with emerging markets likely playing a vital role. Adapting to technological advances and regulatory landscapes will be crucial for future success.

Staying informed will be key in this ever-changing world of private credit. Embracing these insights and forecasts will help investors navigate complexities and seize promising opportunities in the road ahead. As we look toward 2025, the private credit landscape brims with both challenges and exciting prospects, demanding careful strategy and proactive engagement.

FAQs About the Private Credit Market

Private credit is all non-bank lending, where private investors or institutions, like private credit funds, provide funds directly to borrowers. Unlike traditional credit, which typically follows a set structure, private credit often involves more personalized loans with terms that can vary.

In general, private credit tends to carry higher risks and the potential for higher returns than traditional credit. Traditional options usually come with stricter guidelines and more regulatory scrutiny, while private credit can offer the chance for better returns due to its unique nature and illiquidity. Types of credit like mezzanine financing, distressed debt, and direct lending are common in private credit, each with its own blend of risks and rewards.

Private credit is on the rise because it offers the potential for greater yields in a landscape of low-interest rates. Investors are on the lookout for alternatives to traditional fixed-income investments, which just aren’t delivering strong returns anymore. The recovery of the economy after the pandemic has also boosted the private credit market, increasing the demand for customized financing solutions.

Investor feelings toward private credit are increasingly positive, thanks to its potential for higher returns and diversification. There’s a noticeable uptick in interest from institutional investors, spreading into various sectors and helping to propel private credit’s popularity even further.

While investing in private credit can be appealing, there are some risks to keep in mind:

- Credit Risk: The chance of borrower default is higher than with traditional credit because private deals are less standardized.

- Liquidity Risk: Typically, private credit investments can be harder to sell or turn into cash quickly.

- Market Risk: Economic slowdowns or geopolitical issues can affect how private credit investments perform.

To manage these risks, it’s wise for investors to diversify across different sectors and locations, carefully research potential borrowers, and keep a well-balanced portfolio that includes various types of assets. Using strategies like investing in high-quality credit and employing risk assessment tools can also help.

Private credit is growing fast in a variety of sectors. The technology and innovation space is a big player here, as companies are eager for funding to boost their growth and advancements. Healthcare and life sciences are thriving too, driven by a consistent demand for medical innovation and infrastructure. Real estate and infrastructure projects, especially those focusing on urban development and sustainability, are also popular choices for private credit investments. Plus, the consumer and retail sectors are seeing more financing activity, especially around acquisitions, expansions, and restructuring.

The future looks bright for the private credit market, as it’s expected to keep growing thanks to rising investor interest and the expansion of emerging markets. Technological progress and changes in regulations will be key to shaping the market moving forward.

For long-term investment strategies, it’s important for investors to think about trends like the growing significance of ESG factors, the impact of technological changes, and the possibility of increased regulations. Staying updated on market shifts and being ready to adjust strategies will be essential for navigating the future of private credit.