Part 3 of our 2021 economic forecast will examine Biden’s proposed tax plan and it’s effect on the US economy, including an overview of the proposed changes and their impact on investments and asset prices, as well as minimum wage increases and unemployment rates, and post-crisis stimulus and recovery.

And in case you missed them, here are part 1 and part 2 in the series.

At the time of writing, it’s unknown whether or not Biden will be able to get his plan pushed through. But for the sake of this forecast, I’m going to assume that the Biden tax plan passes and we’ll look at its potential economic effect in 2021. Let’s dive in.

The Biden Tax Plan Overview

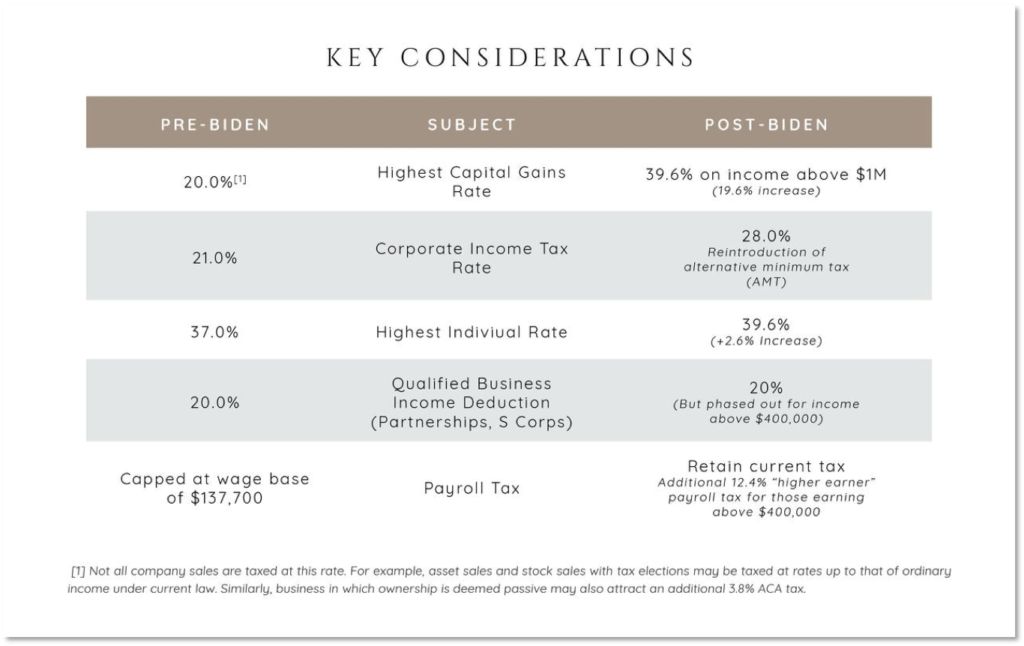

The biggest change reflected in the proposed tax plan is a rise in the long-term capital gains tax rate, which would almost double from a 20% capital gains to a 39% capital gains tax. This means that if you buy an asset, hold it over a year and then sell it, you would pay about 20% on the revenue pre-Biden. Post-Biden, you’re paying almost 40%. This is a massive increase, and we’ve never seen anything like that.

While we can’t see the future to predict exactly what will happen as a result of this increase, we can look at past similar scenarios and what happened in those cases.

The other big change is the corporate income tax rate. In 2018, Trump passed a 21% rate, massively reducing the corporate income tax rate. Biden proposes to increase it to 28%, a fairly significant increase, and reintroduce the alternative minimum tax. There were several other changes in the new plan as well, but I’m not going to spend time on them as they’re smaller and less impactful. We’ll focus here on the first two measures.

What’s the Impact on Businesses from the Long-Term Cap Gains Tax Rate Increase?

With the long-term cap gains tax rate increase from 20 to 39% applying to income over a million dollars, it’s primarily going to affect businesses or wealthy individuals.

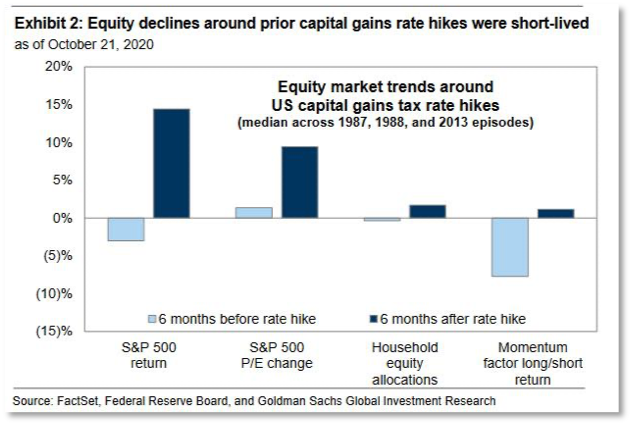

The below chart is from Goldman Sachs and they look at the impact of previous capital gains tax increases in 1987, 1988 and 2013.

What happened in those cases is tri-fold:

- The S&P 500 initially dropped significantly, but then recovered within six months.

- The household equities dropped, which is the investment of households in the stock market.

- Momentum dropped but then recovered.

In all three of these cases there was a felt impact, but recovery soon followed. My opinion is this is going to have a chilling effect on investment and prices, primarily in real estate and the stock market.

Combined with elimination of 1031 exchanges, the Cap Gains Tax increase could have significant depressive effect on RE liquidity and pricing

Combined with the elimination of 1031 exchanges, this tax hike is going to have a significant depressive effect on real estate, liquidity and pricing. With a 1031 exchange, you can sell an existing property, buy a new property, and in essence swap out your cost basis and defer your taxes. This has been a pretty big tax savings for real estate investors.

Here’s Goldman’s take on the elimination of 1031 exchanges: “Eliminating 1031 exchanges would likely lead to a decrease in commercial real estate prices in many markets, less reinvestment in commercial and residential real estate, greater use of leverage to finance acquisitions, and an increase in investment holding periods that would result in a decrease in market liquidity and a slowdown in related industries.” So a lot of people will simply hold their existing property rather than sell and pay the taxes. It means fewer properties available for sale, and less liquidity in their terminology. It also means possible sell-off in stocks and commercial real estate prior to a cap gains tax increase.

Possible sell-offs in stocks and commercial real estate prior to cap gains tax increase

So again, according to Goldman, “history shows stock prices fall, equity allocations decline, and Momentum underperforms ahead of increases in capital gains tax rate. However, any potential equity selling will be short-lived and reversed in subsequent quarters.” Goldman believes it’s going to possibly create a sell-off, but there will be a quick recovery. I’m not so sure because of the sheer magnitude of the increase. I believe that because we have never seen a doubling of taxes and capital gains combined with 1031 exchanges, the effect could be more pronounced.

The other thing that’s very different from these periods that Goldman mentioned is that today’s wealthiest households are sitting on $1 trillion in unrealized equity gains.

Let’s say you’re an investor and you have $1 billion in unrealized gains and you know the tax rate is going to double on January 1st, what are you going to do? You’re going to sell ahead of the tax change, pay your taxes, and then maybe buy it back.

So we’re going to see a big selling crush. The unrealized equity gains is currently about 4x larger than it’s ever been, and there’s a lot of incentive to sell. If the tax plan passes in 2021 and becomes effective on January 1st of 2022, I believe we’ll see a possible market selloff in Q4 2021 in anticipation of that. And it may have a slight depressive effect on long-term prices.

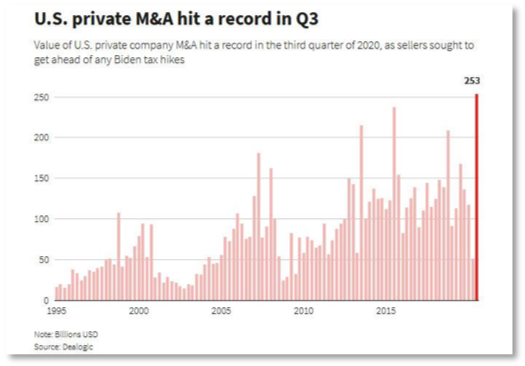

We’re already seeing the beginnings of a selloff in private mergers and acquisitions, with a lot of privately owned companies looking to sell. Many wealthy business owners who are looking for exits are already moving M&As forward in order to save in taxes. So this is possibly a very significant tax increase.

The Corporate Income Tax

The factor that may have the biggest economic impact in 2021 is the corporate income tax increase from 20% to 28%.

The Trump tax plan implemented at the beginning of his term reduced corporate taxes to global norms. Prior to this tax change, the US was one of the highest tax jurisdictions in the world for business taxation. At that point, tax law penalized US-based businesses. The US was the only country in the world that actually demanded that US corporations pay taxes on foreign earnings. So if you have a foreign subsidiary, you pay US taxes on when those earnings came home.

And so what happened is that businesses basically didn’t pay the taxes, they just held them in those foreign entities. Trump’s tax plan allowed them to repatriate all that cash–it was trillions of dollars–and pay their taxes on it. This eliminated this very weird disparity of the US corporate taxes in the globe. My prediction at the time was that it was going to dramatically impact the economy, and it did.

How Corporate Income Tax Affects Unemployment Rates

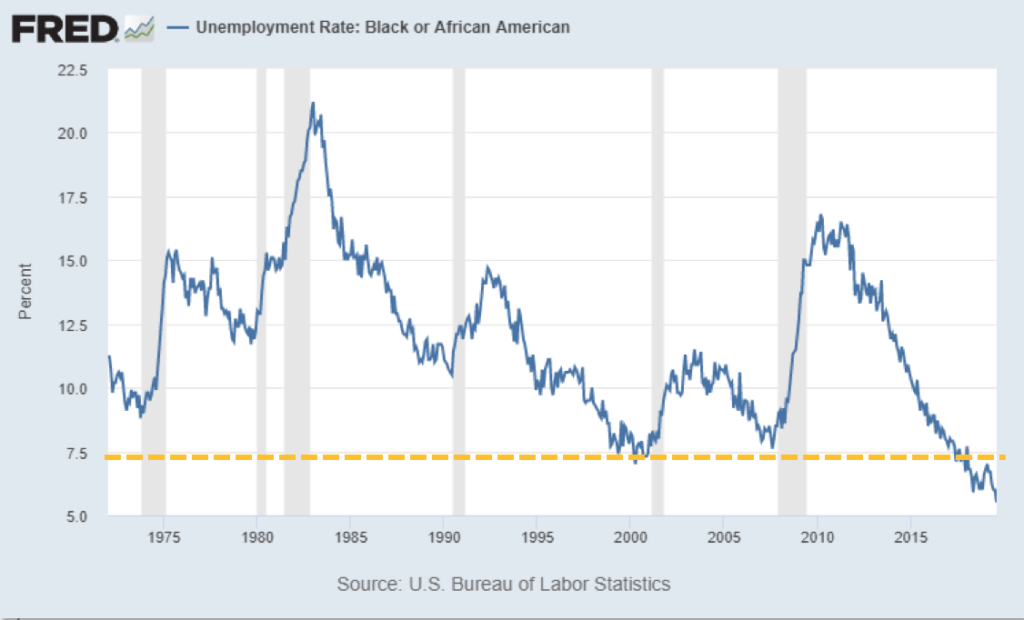

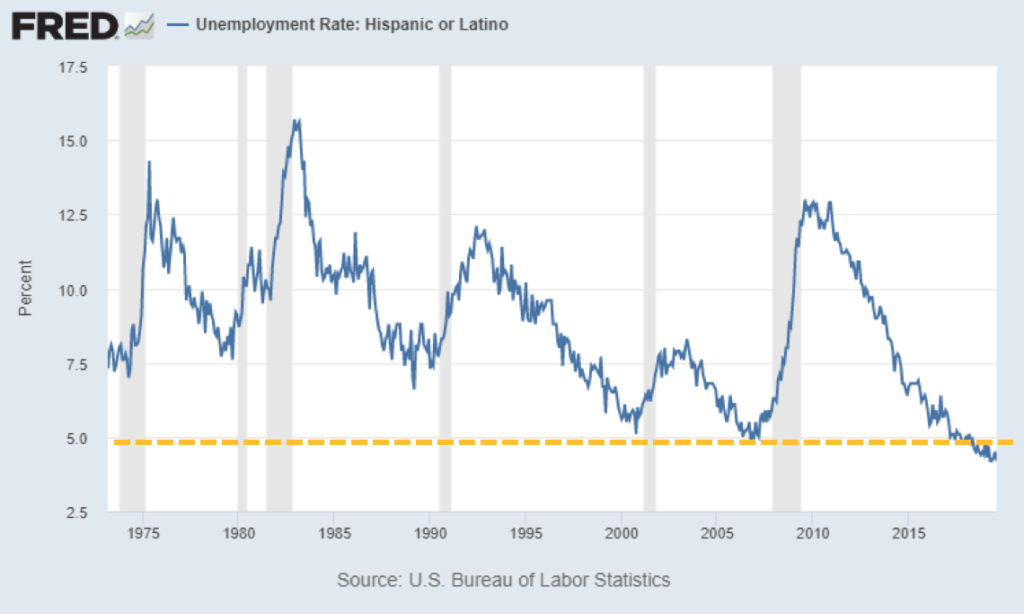

This tax change was the single largest factor in driving pre-COVID unemployment rates to historical lows. This is the unemployment rate for black or African-Americans, which we saw literally setting a record low.

And for Hispanics as well, also a record low we’ve never seen before.

Contrary to politicians’ economic fantasies, jobs are created almost entirely by healthy businesses. When businesses are healthy, they hire people. And that’s exactly what happened after this tax change. As these businesses were flush with cash, they began hiring, and you see the unemployment trend continue downward in the chart.

How Will an Increased Minimum Wage Affect Businesses and the Economy?

Biden has also pledged to boost the minimum wage to $15 an hour. I understand that this move is born from the desire to create a livable working wage for all, but in actuality it has a very harmful effect.

Raising minimum wages will have a very detrimental effect on the marginally employable and on youth looking for their first job. Think about someone coming out of high school, most of whom have no skills whatsoever, and who may not have really developed a good work ethic. What would someone pay them $15 an hour to do where it actually makes financial sense?

For part-time workers and those without deep skills and job history, a minimum wage increase is going to have a very, very negative effect. A friend of mine runs a computer recycling business where he pays those in homes for the severely mentally handicapped to disassemble computers. If he had to pay them $15 an hour for this job, he wouldn’t be able to afford to employ them.

A minimum wage increase has a long-term effect of delaying and/or preventing the marginally employable from entering the workforce. That first job is so hard to get and raising the minimum wage, essentially increasing the high-jump bar for that first job, creates a long-term burden of support on society and will disproportionately affect the poor and people of color, unfortunately.

US workers compete for jobs with globe and automated solutions

What a lot of politicians don’t realize is US workers compete for jobs with global workers and automated solutions. We’re already seeing automated kiosks at McDonald’s and other places because it’s cheaper to spend $10,000 on a kiosk than it is to hire a worker. So a worker competes with a computer or an automated solution, but also competes with global workers (not in the case of McDonalds, but more in the manufacturing space).

A minimum wage increase will have a depressive effect on employment, unfortunately. I appreciate the heart behind doing that, but the increase needs to be tailored so that there are exceptions to the $15 per hour rule. We’ll see what actually passes. If there are exceptions, then this will have not as detrimental an effect.

Stimulus Measures Supersede All

The bottom line is the stimulus measures supersede all. According to Goldman Sachs: “our political economists outlined roughly $7 trillion in gross fiscal expansion spread out over several years that Biden has proposed, including roughly $2 trillion of front-loaded COVID-realted stimulus as well as spending on infrastructure, healthcare and other policies.”

Whether Biden’s stimulus ends up $1 trillion or $7 trillion, this is going to produce a massive stimulative effect. This really trumps everything else. We’ll see as Biden takes office what actually he is able to pass.

For comparison, early 2020 stimulus measures totaled $2 trillion with another $0.9 trillion in December. Even if no additional stimulus passes in 2021, we are still going to see a fairly strong economy as the stimulus that’s already been spent begins to work it’s way through the economy. But if the stimulus measures continue, we’re definitely going to see a boom, again, primarily affecting asset prices.

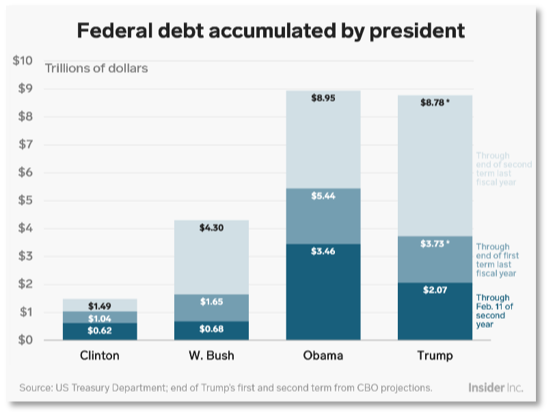

A lot of people are concerned about the deficit spending and the monetization of debt that the Federal Reserve is doing, which we covered in part 2 of this series if you’d like to read more.

The Biden Tax Plan Bottom Line

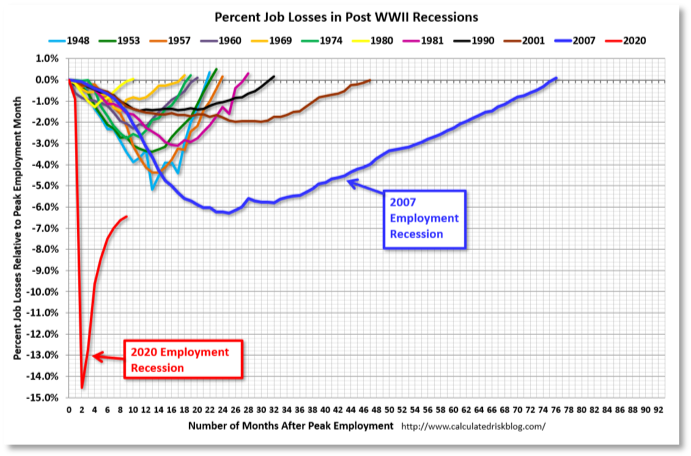

Obama was elected at the tail-end of the great financial crisis, and his term was marked by historical stimulus and deficit spending–both central bank and government spending–and emphasized social spending and policy. But the recession was just stubborn, and we could not get out of it. The below chart shows job losses since post-World War II recessions. Most recessions took a couple years to recover.

But notice the blue line, the 2007 employment recession during Obama’s presidency, took six and a half years to recover. Now, it was deeper than other recessions, but it was also a much slower recovery. This was partly because it was a systemic crisis, but partly because social spending doesn’t necessarily help the economy or jobs. The historical level of spending during Obama’s term basically increased asset prices but not the economy or jobs. We saw slow job recovery, but great asset price recovery.

Biden’s economic legacy might be similar to Obama’s. Biden was elected at the tail-end of the COVID crisis, his solution is very similar to Obama’s and I expect to see the same two results: 1) massive asset price inflation and 2) a slower jobs recovery. However, job recovery during Biden’s presidency will not be as slow as during Obama’s because the COVID-19 shock is an exogenous shock versus systemic, it’s an external shock.

If you look at the red line in the above chart mapping out the employment recession during 2020, you can see the extreme speed of the job losses. But we also have seen nothing like the speed of this recovery. So again, because policy makers and Congress acted so quickly with stimulus measures, I would expect to see unemployment continuing to improve, and I believe it will not take as long as the 2007 recession to fully recover.

Recap & Next Article

Up to this point, we’ve covered what happened economically in 2020, where we believe the economy is headed in 2021, and how Biden’s proposed tax plan with impact the economy.

Next article in series: Housing Market in 2020

About the Author

Mr. Fraser has 20+ years’ experience as a finance and technology executive and is a former E&Y Entrepreneur of the Year Award winner. In 2012 Fraser co-founded Aspen Funds, a fund management company focused on mortgage investments. Fraser is responsible for financial management, portfolio modeling, as well as systems and processes, designing and deploying Aspen’s scalable state-of-the-art back-end platform.