In today’s complex financial landscape, private credit funds have emerged as a compelling investment opportunity for investors seeking alternative avenues beyond traditional fixed-income options. Private credit funds provide capital directly to private companies or borrowers, bypassing traditional financial institutions like banks. This alternative source of financing caters to companies that may not qualify for traditional bank loans or prefer private funding for various reasons.

What are Private Credit Funds?

Private credit funds are investment vehicles that pool capital from investors to provide direct loans or other forms of debt financing to private companies or borrowers. These funds operate outside the public markets, offering bespoke financing solutions tailored to the needs of borrowers who may not access traditional bank loans due to risk profiles, sector focus, or specific financing requirements.

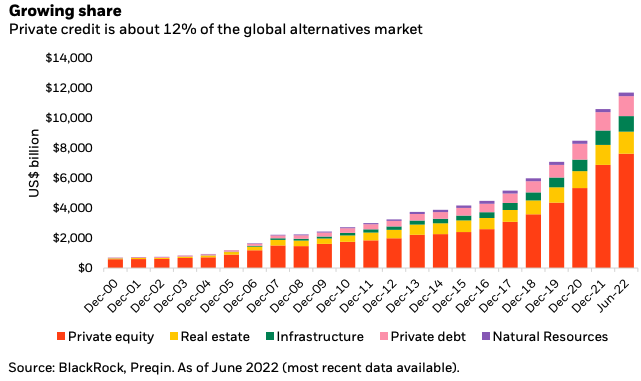

The Growing Popularity of Private Credit Investments

In recent years, private credit investments have gained traction among institutional investors, high-net-worth individuals, and family offices seeking to diversify their portfolios and enhance returns. Unlike traditional fixed-income securities, private credit funds offer the potential for higher yields and provide investors with exposure to a diversified portfolio of private debt instruments.

Source: https://fortune.com/2023/12/28/2024-investing-ai-private-credit-small-cap-resurgence/

Who Should Consider Investing in Private Credit Funds?

Private credit funds are suitable for investors looking for stable income streams and attractive risk-adjusted returns. Institutional investors seeking to diversify their portfolios beyond public markets, high-net-worth individuals interested in alternative investments, and entities requiring specialized financing solutions can benefit from allocating capital to private credit funds.

Understanding Private Credit

Private credit encompasses various forms of debt financing provided to non-public entities:

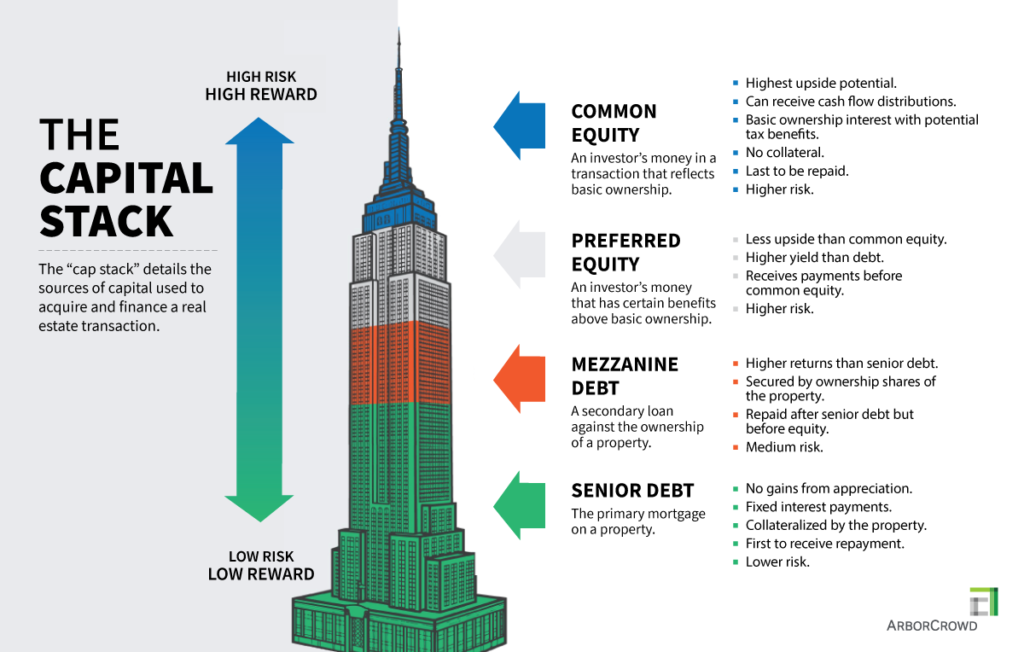

Source: https://www.arborcrowd.com/real-estate-investing-learning-center/capital-stack-and-equity-debt/

- Direct Lending: Providing loans directly to private companies, often to support growth initiatives, acquisitions, or refinancing needs. Direct lending allows investors to earn interest income from loan repayments and fees.

- Mezzanine Financing: Offering subordinated debt that combines elements of debt and equity. Mezzanine financing provides higher potential returns through interest payments and equity participation, often used to fund leveraged buyouts or expansions where traditional financing is insufficient.

- Distressed Debt: Investing in the debt of financially troubled companies or distressed assets at discounted prices. Distressed debt investing aims to capitalize on potential recovery through restructuring or liquidation processes.

- Specialty Finance: Providing financing to niche sectors or specialized industries that require customized funding solutions. Specialty finance includes areas such as real estate finance, infrastructure projects, and healthcare financing, among others.

Private credit differs for investors from traditional fixed-income investments in several key ways:

- Risk and Return Profile: Private credit investments generally offer higher yields compared to traditional fixed-income securities like government bonds or corporate bonds. This higher yield compensates investors for the additional risks associated with private credit, including credit risk and liquidity risk.

- Investment Structure: Private credit funds often have longer investment horizons and less liquidity compared to publicly traded bonds. Investors typically commit capital for a specified period, during which they receive periodic interest payments and eventual return of principal.

- Direct Exposure: Unlike traditional fixed-income investments that trade on public exchanges, private credit provides direct exposure to the underlying borrower or project. This direct relationship allows investors to potentially negotiate better terms and have more control over risk management strategies.

- Diversification Benefits: Including private credit in a diversified portfolio can enhance overall risk-adjusted returns by reducing correlation with traditional asset classes. This diversification can mitigate portfolio volatility and potentially increase income stability over the long term.

How to Invest in Private Credit Funds

Now that we’ve covered the basics of what private credit funds are and the benefits of investing in them, let’s talk about next steps. Investing in private credit funds requires a structured approach to navigate opportunities and potential risks effectively, so it’s important to keep the following considerations in mind as you prepare to invest in private credit funds.

Accessing Private Credit Funds

First, let’s review where you can invest in private credit funds. These funds can be accessed through various channels, including:

- Direct Investment: Accredited investors and institutions can directly invest in private credit funds offered by fund managers or financial institutions, like Aspen Funds Private Credit Fund. Direct investment provides direct exposure to fund strategies and potential returns, but typically requires substantial minimum investment amounts.

- Financial Advisors: Working with experienced financial advisors or wealth managers specializing in alternative investments can provide access to curated private credit fund opportunities. Advisors can offer insights, due diligence support, and portfolio allocation recommendations tailored to investor preferences and risk tolerance.

- Private Equity Firms: Private equity firms often manage diversified investment portfolios that include private credit strategies. Investors can gain exposure to private credit funds through private equity firms’ offerings, benefiting from their expertise in alternative asset management and access to institutional-quality investments. Learn more about the differences between private equity and private credit.

Investment Minimums and Fee Structures

Once you’ve identified the best channel for investing, it’s time to consider your principal. Private credit funds typically impose minimum investment thresholds, which can range from several hundred thousand dollars to several million dollars per investor. These minimums ensure fund viability and may vary based on fund size, strategy complexity, and investor qualifications.

- Fee Structures: Understanding fee arrangements is essential for evaluating the cost-effectiveness of private credit investments. Common fees include management fees, performance-based fees (often referred to as “carry” or “performance allocation”), and administrative expenses. Fee transparency and alignment with fund performance are critical considerations for investors.

Building a Diversified Private Credit Portfolio

One final consideration for investing in private credit funds is diversification. Allocating assets across private credit funds and strategies can optimize risk-adjusted returns and mitigate specific investment risks by providing a buffer against market volatility. Two primary strategies for this are

- Asset Allocation: Allocating capital across different private credit strategies, such as direct lending, mezzanine financing, and distressed debt, diversifies risk exposure and enhances portfolio resilience. Each strategy offers unique risk-return profiles and may perform differently across economic cycles.

- Sector and Geographic Exposure: Considering sector-specific opportunities and geographic diversification can further enhance portfolio stability and capture market inefficiencies. Investing in diverse industries and regions mitigates concentration risk and aligns with broader investment objectives.

Practical Steps to Start Investing

- Set Investment Goals: Define investment objectives, risk tolerance, liquidity preferences, and return expectations to establish clear guidelines for portfolio construction and fund selection.

- Some questions to ask at this stage: What do I want my investment to do for me? How liquid does the investment need to be? What is my investment time frame?

- Perform Due Diligence: Conduct thorough due diligence on prospective funds, including reviewing offering documents, historical performance, fund manager track records, and investment strategies. Assessing fund manager expertise, credit underwriting processes, and risk management practices is critical for informed decision-making.

- Some questions to ask at this stage: What is your firm’s investment philosophy? How do you source and evaluate potential investment opportunities? How do you manage risk?

- Execute the Investment: Committing capital to selected private credit funds involves completing subscription documents, meeting minimum investment requirements, and complying with fund-specific terms and conditions. Fund managers may provide guidance on investment timing and capital deployment strategies based on market conditions, and should offer at least an annual portfolio review, if not more.

- Some questions to ask at this stage: How often do you report to clients? How frequently are return distributions paid out? How is my portfolio diversified? What trends do you think are on the horizon? How do you plan to mitigate risk moving forward?

Private credit funds offer investors an alternative to traditional fixed-income securities, providing direct loans and debt financing to private companies for stable income streams and attractive risk-adjusted returns.

By adopting a structured approach that includes due diligence, fee analysis, and strategic portfolio diversification, investors can effectively navigate private credit investments to enhance their portfolios and achieve financial objectives.

Sign up for Aspen Funds’ free masterclass on investing in private credit to learn how to unlock the power of your money.