Aspen Growth IV is a residential mortgage fund designed to provide growth appreciation through highly selective purchasing of residential real estate notes. The Fund owns a diversified portfolio of non-performing mortgages, purchased at a deep discount, to produce above-market returns. The Fund is secured by residential real estate in the United States.

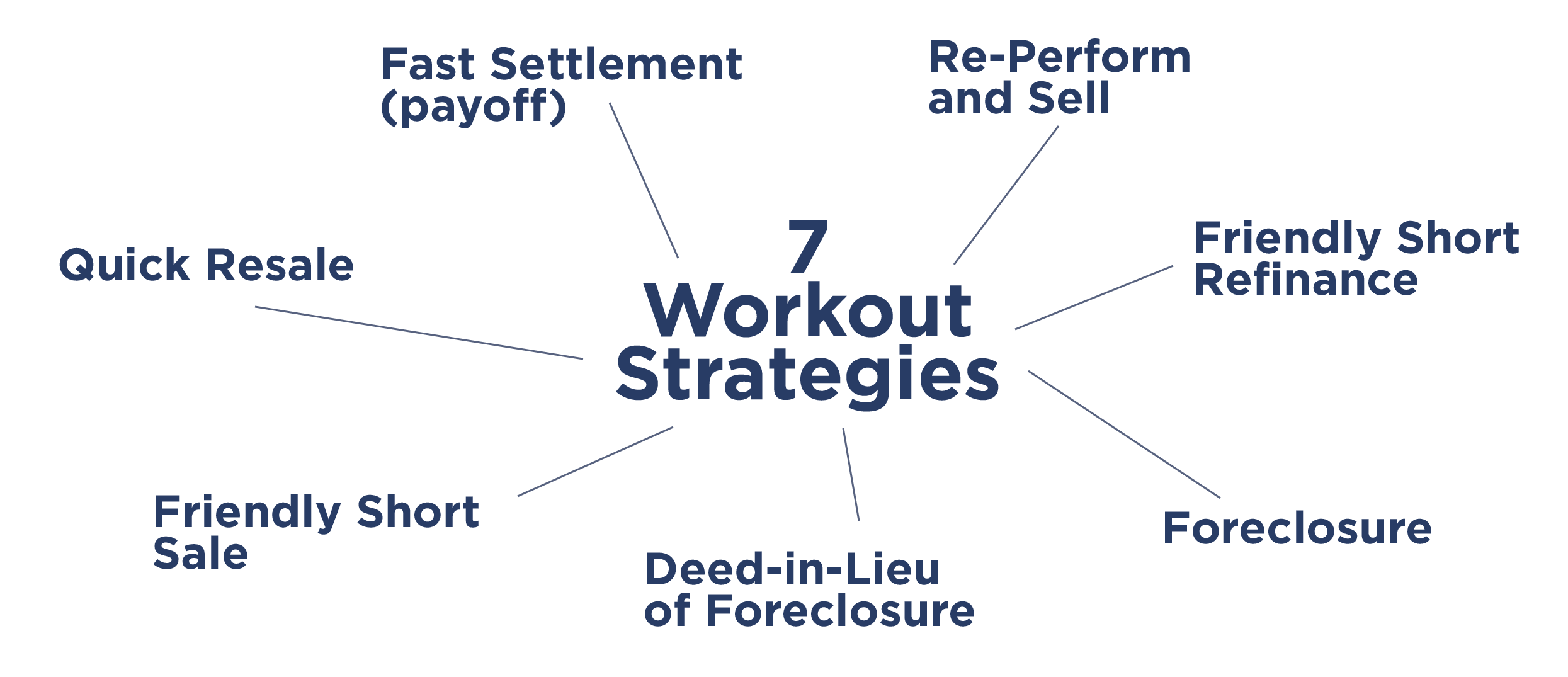

Aspen seeks win-win scenarios for borrowers and investors. They can offer homeowners a wide range of options while extracting significant value for investors. Based on the 7 years of working out these notes, Aspen executes one of 7 workout strategies:

Two offerings available, 12-20% expected returns

Fund is lienholder of residential mortgages

Large portion of earnings are taxed as long-term capital gains

Leading asset manager in note industry with 7-year track record

Team has extensive experience and strong reputation

Aspen Growth IV is primarily focused on delivering high growth to investors, while mitigating risk through their proprietary underwriting model. Aspen’s strong network of note sources allows them to evaluate pools of loans and selectively purchase individual notes at a deep discount. Aspen then utilizes seven workout methods to extract value from the notes to generate capital gains. The strategy for this fund focuses on a highly targeted niche of non-performing second mortgages with a senior performing mortgage. Based on the track record of prior funds, the management team has been able to generate above a 2.25x average exit multiple on these notes.

Aspen seeks win-win scenarios for borrowers and investors. They can offer homeowners a wide range of options while extracting significant value for investors. Based on the 7 years of working out these notes, Aspen executes one of 7 workout strategies: quick resale, fast settlement (payoff), re-perform and sell, friendly short refinance, friendly short sale, deed-in-lieu of foreclosure, or foreclosure.

The structure of this fund will be a closed-end fund and will progress through several phases. During the “Offering & Deployment Period”, the Fund accumulate capital and purchase notes (this period will be up to 18 months). Once the capital has been deployed, no new notes will be purchased and the “Harvest Period” will begin. Workout strategies are implemented for every note, and profits will be paid out as they are realized. After 36 months (manager may extend up to 1-year), any remaining notes will be liquidated, and the fund closed.

Aspen uses mortgage servicing vendors to collect payments and manage reporting.

Watch The Webinar

Aspen Funds operates several private investment funds in real estate notes for accredited investors. Not all of our funds are currently open to new investors but are listed below to showcase our performance track record and various strategies.

Aspen Income fund was started in 2014 and is structured as an open-ended fund. The fund purchases only performing mortgages and pays investors monthly preferred returns. This fund is only open to accredited investors.

Fund opened: 1/1/14

Current preferred returns: 9%

Status: Open to new investors

Aspen G Growth Fund was started in 2014 and is structured as an open-ended fund. The fund purchases only distressed mortgages and generates profits executing various workout strategies. This fund is currently operating but closed to new investors at this time.

Fund Opened: 1/1/2014

Total Return: 15.7% (24-month IRR)

Status: Closed to new investors

MRF1 was our first fund, started in 2013. This was structured as a closed-end fund with a 3-year duration. It purchased only distressed mortgages and generated profits executing various workout strategies. MRF1 met its objectives and was sunset in 2016.

Duration: 3 year closed-end fund

Total ROI: 45% return

IRR: 24%

Status: Closed

A: Aspen has been managing note funds since 2013. The Aspen Income Fund was started in 2014 and since then we have never missed a preferred return payment, nor have we lost any investor’s principal investment capital.

A: The minimum investment in Aspen Income Fund is $50,000.

A: The initial lock-up period for this fund is 1 year. After 1-year we provide best-efforts liquidity and allow investors the option to redeem their shares on a quarterly basis with 90 days written notice.

A: Yes, this fund is open-ended, also known as an evergreen fund. We calculate Net Asset Value (NAV) on a quarterly basis and allow investors to subscribe and redeem at the current share price.

A: Upon initial investment, we have a 3-month delay period (in order to deploy capital). Then, investors will receive their preferred returns monthly either by direct deposit (ACH) or by check.

A: Yes, investing in the private fund is completely passive. When investing in a private fund, you are leveraging our management company’s experience in this business and participate in a diversified portfolio. Investors receive their monthly preferred return by either wire or check.

A: On a monthly basis, investors receive their preferred return. Quarterly, we provide capital account statements, investor newsletters, and financial statements. We also always welcome calls from our investors.

A: If you invest, you become a part owner of the fund versus a specific note. Therefore, your capital is diversified across all the notes in the portfolio.

A: Yes, our funds currently only allow accredited investors.

A: Yes, our funds allow investment through qualified retirement money. This must be done through a self-directed IRA or 401K. If you don’t yet have a self-directed account, we can make introductions to several custodians that we have worked with. Additionally, our funds do not generate Unrelated Business Income Tax (UBIT).

A: An individual or an entity can generally qualify as an accredited investor if they meet at least one of the following criteria:

For more information about the requirements of an accredited investor, see this bulletin from the SEC.

The Aspen Income Fund Deep Dive webinar covers many topics about the Aspen Income Fund in great detail, including:

How to generate consistent income passively

Real examples of real estate notes and how they work

How private investments compare to other asset classes

The keys to conservatively underwriting these assets

Why it's better to be the bank

About Aspen's historical track record