Inflation is not neutral. It’s a transfer of wealth from savers to borrowers. It’s a time where you can lose purchasing power of your money, or a time where your investments can benefit. How you fare depends on how you invest. In this episode, Bob and Ben dive into different asset classes relative to inflation. They cover the historical performance of asset classes in high-inflation and talk through which are poised to perform the best moving forward. Wondering where to put your money right now? Listen in!

—

Watch the episode here:

Listen to the episode here:

Where You Should Invest in a High-Inflation Environment

Today, we’re going to do a podcast about inflation. You’ve been hearing a lot about inflation. We’ve even talked about it in a past episode, breaking down what’s driving inflation. And today, we want to take it one step further. A lot of investors are seeing the headlines, hearing about inflation, but as investors, what do we do from here? And looking back historically, we have not had periods of high inflation for a long time, really, since the ’80s. And so it’s kind of a new concept to a lot of investors. And what we want to do is look at historical data. And what Bob has done here and is going to present is looking at macro time periods, 10 year time periods in inflation numbers, and what asset classes have performed the best during those time periods. We’re going to talk about a host of other things, including gold.

We recently had a great guest on who runs a gold royalty company. And where does that fit in a portfolio? And we’re going to talk about the national debt. And is this something to be concerned about, especially in a period of inflation. How is that impacted? Those things, and a lot more, we’re going to be talking about right now. So, let’s jump in. First off, maybe a quick recap of inflation. How do we get here? And is this going to be a persistent thing we’re going to see for a period of time? And just give us a real quick rundown of some of the things driving it.

Yeah, sure. We’ve seen pretty high inflation prints, around 7.5% annualized inflation, which is fairly high. Certainly, historically that is quite high for America. It’s driven … Well, I think it’s important to say first off it is virtually an entirely US phenomenon. We are seeing about half these levels of inflation in Asia, and pretty much not any inflation in Europe. It’s a US phenomenon, and it’s pretty much entirely stimulus driven. It’s stimulus driven and COVID driven. Let me say that. There’s several components to inflation, and some of these components are both transitional, so they’re transitory, rather. They’re going to dissipate. But some are going to be a little bit more persistent. The transitional, of the components you have the supply chain disruption. And we think that’s going to be kind of solved this year, and maybe into next year. You have one of the big components is demand.

What has happened is because of the stimulus and other things, we have an extraordinarily healthy consumer. Now, a lot of times when I’m saying that, most people are not tracking with me. When I say the consumers are incredibly financially, fiscally healthy right now. And in this podcast, we’re not going to go over that. But if that’s a question mark to you, please go look at our previous blog post. But you see record high net income per capita, record high household net worth, record low debt service payments as a percentage of disposable personal income, record low household financial obligations. Literally, it’s historic. We have never seen a consumer this healthy before. And a lot of it has been due to transfer payments because of stimulus payments, right? In the past, easing easy, the business cycle was controlled in the ’80s and ’90s through basically the maintaining of interest rates.

You raise interest rates to cool the economy, you chill the economy by lowering interest rates. Well, what happened in 2009, they created a new methodology called monetizing the debt, or quantitative easing. Where they actually printed money, so to speak, to purchase government debt. And in the latest installment, in 2020, they actually did direct payments to individuals. So literally what Ben Bernanke joked about in the ’90s about helicopter money, what would happen if we actually put money in people’s pockets? Well, now we know what happens. They stand straight up and they start spending like crazy. And it’s really exactly what you would expect.

And there’s something like $6 trillion of cash sitting in savings accounts right now?

Excess savings.

$6 trillion, massive amounts. And as soon as confidence increases, you’re going to see that flowing into the economy.

We have these two sides of both the supply side, as well as the demand side. Supply side, there’s the supply chain issues, which we’re seeing. There’s also the labor shortage, which we talked a lot about.

And that’s the third element. You have this basically crushing consumer demand, and it meets a supply disruption and labor shortage. And a lot of the labor shortage also, unfortunately, is stimulus based. A lot of people, when they got their wages increased, they got their stimulus checks, and they basically quit their jobs or retired. And dual family earners, one of the earners quit, that kind of thing. And others retired. So you see a lot of people that you just left the workforce and figured it’s time to exit the workforce. All of that is this perfect storm causing inflation. Well, some of it’s persistent, as we pointed out. What’s persistent? What’s going to be persistent is the consumer demand. That’s going to diminish somewhat, but stay strong for several years.

And the supply chain, I believe, is transitory supply chain disruption. So, that’ll diminish. But the consumer demand is resilient, as well as the labor shortage, it’s going to be resilient. So, we’ve got inflation. Our view is that inflation is going to remain stubbornly high, but probably not spike up much higher from here. But it’s something we want to get used to. We want to understand how it affects us. And what I’ve found in all the research lately is that inflation has been all but forgotten in amongst research and analysts. It’s something that in the last 30 years, we really haven’t had much of. And so people have forgotten how to underwrite to it, how to invest to it et cetera. So I want to just do a little bit of review of how do we really manage an inflationary regime? And inflation is not neutral. It is both a time to lose a massive amount of money and a time to make a massive amount of money, whichever side of the coin you’re on.

Right. And really, the whole point of this podcast is to provide education for investors and have this macro economic thesis and viewpoint and framework that we can make decisions to invest wisely. And so looking at these trends, we want to take it a step further, this podcast, and actually look at the data and break down, how have different asset classes fared in periods of high inflation historically? Let’s maybe jump to that first, is you’ve pulled a lot of data, and some of the data is more challenging to get, especially maybe the commercial real estate space. But we really tried to break it down as best we could into a few different categories, and looking at how different asset classes have performed.

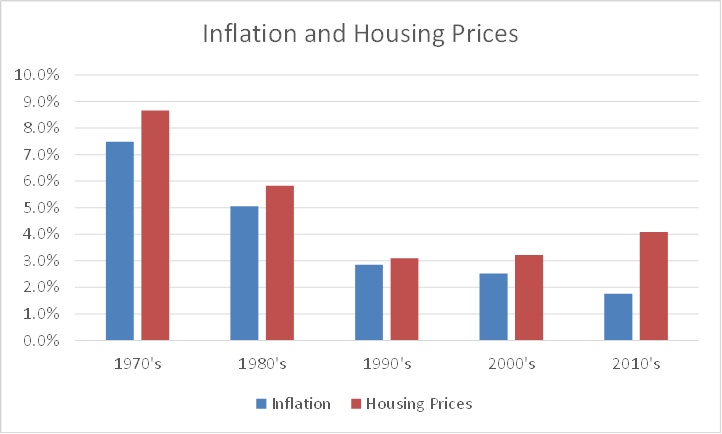

Right. All right. What we’ve done is just the biggest picture imaginable. I just looked at decades. And in fact, inflation falls neatly into decades. You have the decade of the ’70s, and it was a very high inflation. Jimmy Carter years, Whip Inflation Now. And to the 1980s was also fairly high inflation. But by the ’90s, inflation was, by and large, tamed. We had inflation was hitting, let’s say, in the 7 to 7.5% on average in the ’70s. During the ’80s, was 5.1%. We’re at 7.5 right now. Then it dropped in the ’90s to 2.9%, 2.5%, and then 1.8%. So it has kind of been trending right around the 2 range, above the 2 range. And so we’ve forgotten how to do it. It’s super important to look back in the ’80s and see what was trending well.

But one of the things that we want to show is just first of all, you can see this housing chart to show by decade. I just looked at, okay, how did housing prices do relative to inflation? And housing was really one of the best ways to beat inflation. It beat inflation every single decade. And so you can see from the chart … And it’s not surprising. I think we’ve known that, but again, that’s a really good way to beat inflation.

And really, the concept of being inflation protected. We don’t want to overlook what that actually means. And so when we’re looking at what are asset classes that are going to perform best in inflationary periods? Is the asset classes where you have the pricing power, where that inflation can be pushed through to the end user. And so residential housing and single-family housing especially does very well in inflation because you can increase your revenue in the form of higher rents. And that is generally expected and accepted by renters in those periods of higher inflation. And by doing that, you’re actually increasing your net operating income and can keep up or even beat inflation.

Right. And we can go to that chart. What’s interesting here is one of the best ways, as Ben was just saying, as an investor to make money in inflation is to buy assets that have pricing power. And that could be Apple Inc, which they can raise the prices of their iPhones, just as an example. It can also be your commercial real estate, where you have pricing power. As long as you can raise your rents, or you can raise the prices of your product to keep pace with inflation, then that asset is going to go up. And in fact, during the 1980s, the stock market did well. And in fact, over the last 40 years, if you could buy a cup of coffee for a dollar in January 1st, 1980, 40 years later, that same cup of coffee costs you $3 and 30 cents.

So, inflation went up basically 300%. But the stock market went up 83 times, 83 X versus the cup of coffee, which went up 3 X. So, just FYI. But let’s say you have a dollar to spend, or you have a cup of coffee to sell, a year later that coffee costs $1.07 today, at 7% inflation. If you have a dollar of savings, that dollar a year later is worth 93 cents. Because deflation works two ways. One, it increases the value of the cost of an asset. And it also decreases the value of a dollar of cash. And so one of the greatest ways to make money in an inflationary environment is actually to borrow money at fixed interest rates.

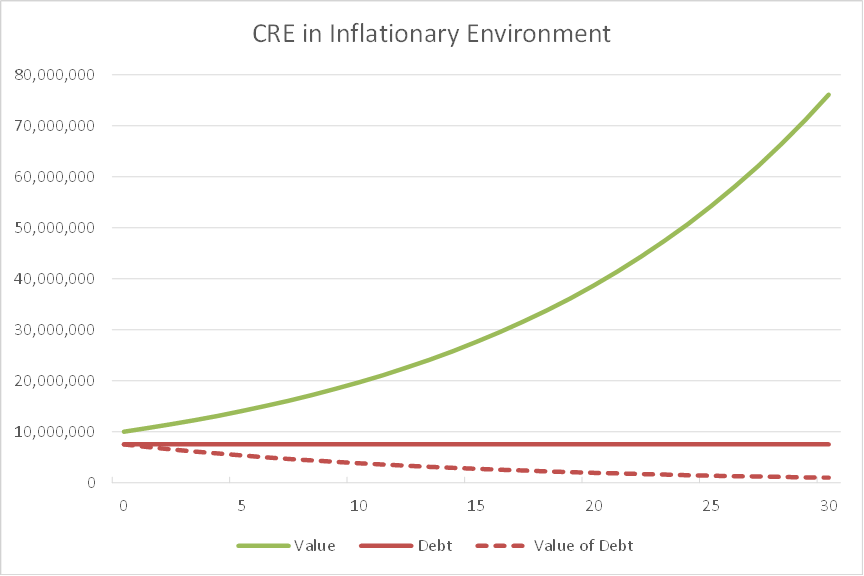

This is what our government knows with the national debt. Here’s the actual numbers. At 7% inflation, and we’re at 7.5 right now, but at 7% inflation, if I have $100 in the bank today, in 10 years, that $100 is worth $50. It drops 50% of its value, of it’s purchasing power. I want to have as much of that as I possibly can, of other people’s money, borrowed. So, I pay them back with dollars that are worth a lot less. Let’s look at this chart here. The CRE in an inflationary environment, and you can see what Ben is talking about. Let’s say we bought a $10 million apartment complex, and it’s worth $10 million. And that is priced on, let’s say, it’s a five cap, right?

It has got a net operating income of X. But if that net operating income, if that’s growing up every year with inflation, we’re raising our rents according to inflation, that net operating income is increasing 7% per year, divide by the cap rate. It means the value of that property is increasing. And in fact, it’s extraordinary.

If you look at this chart, you can see that in 10 years, that property has basically doubled in value by doing nothing. By doing absolutely nothing. And what I’ve done in this chart is theoretically, I’ve taken out an interest-only loan for 10 years. And so we’re paying out an interest-only loan for 10 years, but the value of what I owe, the value of the dollars that I owe, actually decreases every year because of inflation. The number may stay the same, but the value of it stays.

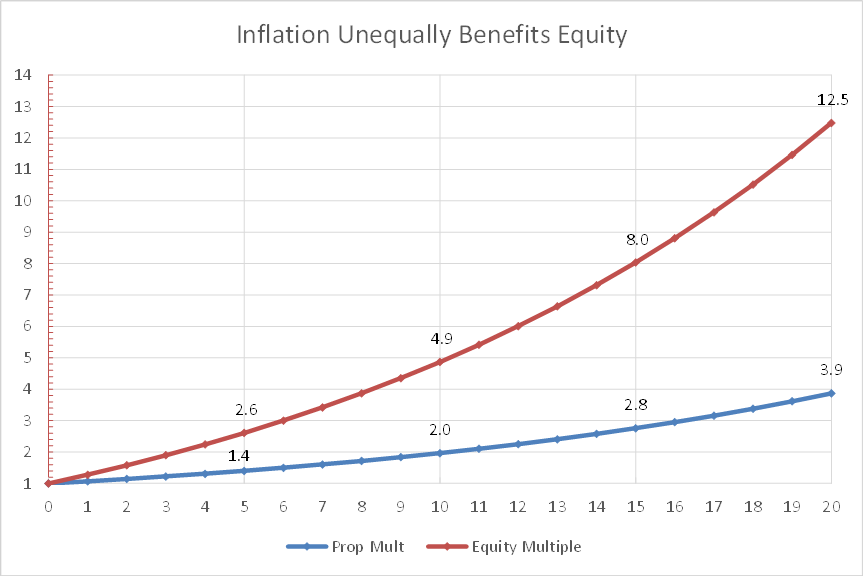

So, you’re letting time pay off that loan for you. And so it has this outsized gain on equity. And the last chart I want going to show here shows this point, is that just based on inflation, a property value in five years would increase by 1.4 X, right? To 1.4 X in 10 years, 2.0 X. The best value-add strategy is inflation, right? If you want to do multi-family value add, just buy inflation-protected assets. In 10 years, you’ve got a 2 X by doing absolutely nothing to that property. But you have a 4.9 times, 4.9 X of your equity multiple in 10 years, simply because you’re benefiting from the value of that debt being paid off as well. Commercial real estate, especially, is going to be an outsized benefactor of inflation.

And I will point out, and as you pointed out, that there’s the different asset classes, different real estate classes, are going to perform vastly different. Some of the ones that are going to respond well to inflation that have pricing power are self-storage. Because you just raise rates, super easy. They probably could lag inflation by just a quarter, even, is all. Multi-family is going to have a lot of pricing power because you can raise rates. Maybe it lags by six months or a year, because it takes you that long to raise rents. Other asset classes, less so. Office space is typically on five or 10, seven, 10 year leases. Industrial, much less pricing power there. So overall, they’re going to do fine, but they have less pricing power. Same with retail. I think the ones that are going to have the most pricing power are self-storage and residential.

Yeah. And just to underscore that point, what we’ve been talking about. Even you were just on a panel last week at a conference, the Best Ever conference, discussing what’s the future of real estate this year? And as far as what’s the transaction volume going to be, it’s going to be a big buy year. It’s going to be a big, big boom. And to your point here, if you can buy inflation-protected real estate, which a lot of the real estate is, with fixed-rate debt, you are going to massively be successful and be set up for good success going forward.

Right. And we do want to make this point. It isn’t just multi-family that’s going to do well. It’s particular multi-family. What we’re seeing today, a lot of these larger deals are being driven high. Prices are being driven up in multi-family and the multiples, the cap rates are being driven super low, especially in high demand markets. But in order to close these deals, a lot of these operators are using bridge financing, which basically is adjustable rate after three years. It has other terms, and this is not what you want to be doing in this environment. The worst case scenario in a multi-family scenario like that is, well, let’s say there is a cap rate adjustment that goes against you in three years. I’m not expecting that, but if there was, well all of a sudden … And maybe you’ve got a higher interest rate. You put that higher-risk interest rate on, well, now it actually reduces your debt operating income significantly. And you actually maybe will fail your debt-service ratio covenant. And you could lose the property. And they’re doing it in order to close deals with less equity because these bridge lenders allow higher leverage rates. And so it’s not really something you want to be playing with. You want to be very careful about the structuring of your deals, and as an LP, as an investor, you want to make sure that your operators understand the risks of leverage and understand how this is going to play out in this inflationary environment. It’s not just getting in the right assets, but it’s getting in the right assets that are structured well.

Exactly. Yeah. It’s increasingly important. It’s always important, but increasingly. So now, looking at deals you’re investing and what is the debt structure, and to the extent you can invest in deals that are locking in interest rates now, those are going to be the ones that perform the best, that have the least amount of interest rate risk, in the chance that interest rates do adjust and reset at higher rates down the road.

And just to make the point, it’s the same in the stock market. The companies that have pricing power are going to actually track just fine with inflation. The companies that do not have pricing power will not track the same. And so Procter & Gamble, which produces Pampers and Crest toothpaste … I think they do, at least. They’re going to track just fine. They’ll raise the prices. Companies that do not, may not be able to raise prices. And their stocks won’t do as well. So, it’s the same thing. It bifurcates the economy into those with pricing power and those without pricing power. So, super important.

You want to walk through some of the asset classes and the data you’ve gathered?

Yeah. This is super interesting. I point out, this stock market was one of the outsized performers. If you had a dollar in January 1st, 1980, today what you could buy with that dollar would cost you $3 and 30 cents.

Yeah. Inflation increased by 3 X, to your point.

By 3.3 X in 40 years. 3.3 X. How about gold? Gold, the ultimate inflation hedge. How did gold do? Well, if you had bought an ounce of gold, January 1st, 1980, it would’ve cost you about 500 bucks. And for you to exit it 40 years later, at 12/31/2019, that was about $1,500. So, you would have made 3 X on your money. Basically, gold has been a very disappointing asset class. And it has not even kept pace with inflation. So, talking about the gold as a inflation hedge, it sounds great, but it really has not been reality. It has not been a great inflation hedge.

Now, a lot of people may take issue with that and say, “Well, let’s look at the ’70s, when we had very high inflation.” But it’s a little bit unfair because gold began the 1970s pegged to the dollar at $35 an ounce. And so when it got unpegged, it was then free floating for the first time in history. So yeah, it shot up, but that’s not going to be repeated. And you can’t really measure that as an inflation kind of metric.

Right? A lot of investors, and us included, up until really several years ago when we were looking at the data again, the assumption is that gold is the ultimate hedge against one, volatility and two, against inflation. Because it’s viewed as an alternative currency. So, if we’re debasing the value of the dollar, then the gold will increase correspondingly. And especially in the real estate world, there’s a lot of investors where they just believe gold is an equivalent asset class as far as value and returns that you can get. And it used to kind of be in that camp, in the Austrian school of economics where the hard money school of thought, where as you increase the money supply, you can expect hyperinflation. And gold is going to help prevent the erosion of your value of your dollar. And talk a little bit about maybe your viewpoints and how they they’ve changed over time.

Right, yeah. I was what you would call of the Austrian school, the hard money school of economics, really until about 10 years ago. And when I saw what happened in 2009, when the Fed began monetizing the debt by buying treasury bonds and buying mortgage debt, and I immediately thought, like pretty much all the hard money guys, that this meant the end. And you’re going to see the dollar collapse and you’re going to see hyperinflation, and it didn’t happen. And so I really began to look at all the data again and rethink all my assumptions, and came to some very different conclusions after that that I represent today. And you’re seeing the this idea of inflation being tied only to M2 just isn’t actually true. It’s not correct. The M2-

Explain what M2 is for those may not know.

It’s the money supply. A lot of people are saying, okay, the money supply basically represents the amount of liquidity and dollars. And as that increases without the equivalent GDP increasing, it’s money printing and therefore it’s inflationary. But the M2 has not been highly correlated to inflation. In fact, the M2 in 40 years has gone up 10 X. 10 X. Inflation has gone up 3.

3 X.

3.3 X in 40 years. So, all this money printing has not resulted in high inflation. It has not. By the way, and then there’s the argument that the dollar is going to fail. The dollar is going to fail because of the money printing. Again, you see this in Argentina. They print money, and it destroys the value of the Argentine currency, but we’re not Argentina.

Now, the dollar is measured by what’s called the Dollar Index, which is the value of the US dollar relative to a basket of foreign currencies. And that Dollar Index 40 years ago was 85. The value of the Dollar Index 40 years later was 96. It went up. It went up. The dollar increased in value by 1.2 X during this, while the value of the dollar in fact went down by 3.3. The point is the Dollar Index, in other words, the dollar as value relative to other currencies, is not as super correlated to inflation and even money printing. And that makes sense, because guess what? Everybody else is printing money too.

It’s all relative.

It’s all relative.

Talk a little bit about … And this is more of an aside, and we’ll talk about this in future podcast. But a lot of investors are concerned that if the dollar loses its status as the world reserve currency, well, that kind of changes the conversation. Because if the dollar loses its status and that is pretty impactful to-

And it’s hard to take that seriously. And I’ll tell you, the people that are propounding that view are people who are primarily invested in other countries as their main bet on the future. And to be unnamed, or maybe you should name them. But the dollar as reserve status is not under any threat whatsoever. I believe it’s 87% of global trade today is in US dollars. 87%. And most people are saying the ascendant currency, of course, is the Chinese currency. But I remember back in the ’80s, the most ascendent currency was the Japanese yen, and everybody believed we were going to be speaking Japanese, and we were going to all be transacting in yen, and it didn’t happen.

And the idea that you are going to instead go into your bank around the corner and deposit your money in Chinese yuan is ridiculous. This is a police state without democracy, under the control of a Communist government, without human rights. That’s really ridiculous. They are not going to be the global financial plumbing. They’re simply not. They’re not ready for that. It’s not going to happen in the next 10 years or the next 20 or the next 30. It’s not going to happen. What is going to replace the dollar? There’s really nothing that could even come close. Europe is possible, but the euro has structural problems as well. They are more of a hard money. They have more of a hard money stance than America does. They have less ability to print currency than America has.

For example, all of the member countries in Europe can borrow money in euros, but they have no authority to print money. And that’s when you go broke, because when you borrow money in a currency you can’t print … America, we both borrow your dollars and print dollars. And let me make this point too about inflation. One of the things that inflation does, as I made the point, inflation is a massive transfer of wealth from savers to borrowers. Massive transfer of wealth from savers to borrowers. One of the ways to get ahead is to be a big borrower. And that goes against some people’s ethos. Well, that is the way to get ahead. Well, who is the biggest borrower?

Federal government.

The federal government, and they benefit massively. If I said a dollar in your bank account in 10 years is worth 50 cents, well, it works for the federal government too. What they owe, the $24 trillion they owe, in 10 years will be worth … The buying power of that is half what it is today. So the taxes will go up, will be double by then just because of inflation alone. And the value of that debt is unchanged, if it is. And in fact, most countries, having high debt-to-GDP ratios is often quite common. But default amongst countries is not common. And the reason is they simply can pay their debt off through inflation.

And that’s exactly what has happened. America had a debt-to-GDP ratio right around 100 after World War II because of all the borrowing. And guess what? We didn’t default. In fact that debt, while it never diminished, as a percentage of the GDP it massively diminished. So, GDP is the gross domestic product. It’s the productivity of every single person times the population. And so GDP is going to increase with inflation.

Yeah. Especially when 70% of it is from consumer spending and there’s $6 trillion in pent-up savings.

But the point is, if there’s pricing power for that Apple, costs 7% more, that iPhone costs 7% more than it did last year, well, that increases the GDP by that much. So as this pricing power works through the system, it also benefits GDP. So, you see higher GDP growth as well. And so the debt-to-GDP ratio, which is the most relevant kind of statistic, actually is diminished. That’s all hyper-technical. I hope that’s not over your heads, but the point I think you should walk away with here is that one, inflation benefits debtors. And real estate is perfect for that, because it allows us to be large debtholders as long as we have fixed-rate debt. And then not to fear the collapse of the dollar, not to over-invest in gold, not to worry about the M2 money supply. And-

And really, I mean, the sentiment from that conference we were at, the Best Ever conference, hearing from several big name economists and many others is that they really see a runway of at least three to five years where the economy is going to remain strong. And the consumer, being as healthy as they are, is really the foundational underpinnings of that to drive GDP forward. And so again, there’s some trepidation and fear with external factors going on the market, but we just believe it’s a very good time to be backing up the truck, buying good assets with good debt terms, and using all these kind of pieces to our advantage as an inflationary environment.

That’s it. Well, hopefully these are some helpful thoughts for you guys, and we’re going to be doing more on these kind of topics. And again, just helping educate investors. So if you guys are enjoying this podcast, we really appreciate any support you guys can give on iTunes or Spotify with a review, and telling your friends about it. And really appreciate the support so far. So, thanks for listening. Join us next time.