Billionaire Andrew Carnegie was once quoted saying that “90% of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined.” I don’t know if that number is true, but it’s undeniable that real estate has been a consistent place for long-term wealth creation.

While most investors get excited about the idea of investing in real estate, that excitement quickly dissipates when they imagine buying rental properties and then dealing with difficult tenants and property maintenance issues.

Thankfully, in the last decade there’s been a massive shift in the democratization of investing in real estate. Investors can now invest passively in a variety of real estate assets, without the headaches of traditional property ownership. This is especially enticing if you’re a high-earning individual and you don’t want to leave your day job, or if you are approaching retirement and need passive income. [Note: while there are several investing options for those building their net worth, the majority of opportunities are reserved for accredited investors.]

But with this shift towards opening up the wide world of passive real estate investing, a new challenge has arisen. With so many options available, where do you even start?

This is what I’m going to cover in this article. I want to help create a framework for understanding the wide world of passive real estate investing and what is available. Once you understand the basics of these frameworks, you’ll be better equipped to evaluate potential investment opportunities and their risks.

Before we dive in, the most important question should be addressed first – what are the advantages of investing in real estate?

Why Invest in Real Estate in the First Place?

First, common sense says that to be a successful investor, you should model what other successful investors are doing. And the simple fact is, most ultra-high net worth investors love passive real estate investing. TIGER 21 is an exclusive investor group for ultra-high net worth investors. According to a recent poll of their investor database (which accounts for around $85Bn of collective wealth), these investors have allocated a large portion of their wealth to real estate (their highest allocation percentage, by the way).

Let’s take a look at some of the popular reasons investors choose to invest passively in real estate:

Your investment is backed by real assets

The stock market is arguably the most common investment avenue, given its extreme ease. But, when you invest in stocks, you’re essentially betting on the future earnings of the company whose stock you’re buying. Sometimes those bets work out, other times they don’t. This creates significant volatility (or large price swings) and carries a risk of losing your investment.

But with real estate, your investment is generally backed by a physical asset. If you invest in apartments, you are an owner of that property. If you invest in a self-storage facility, you are an owner of that facility. If you buy a mortgage note or tax lien, you are a secured lender and have a legal right to the property if the borrower doesn’t pay. This provides a hedge of protection around your capital and mitigates the risk of loss.

Returns are generally higher

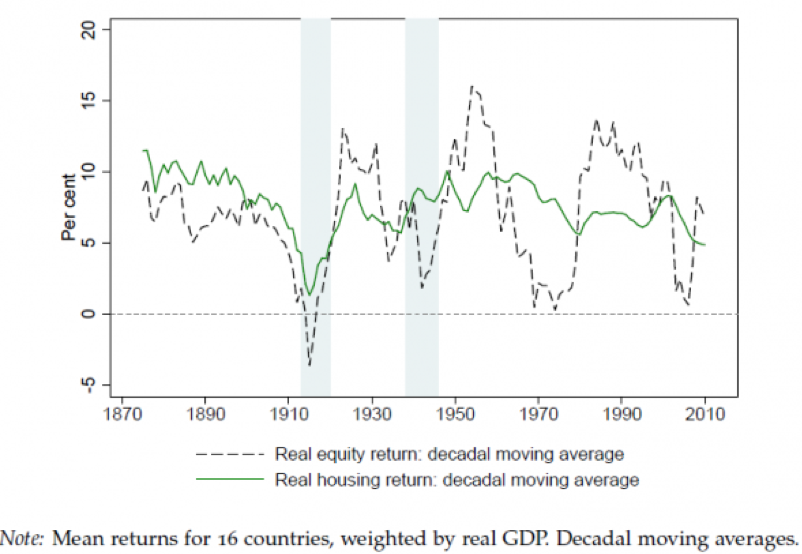

Researchers from the Federal Reserve Bank of San Francisco published an extensive research paper in 2017 called the Rate of Return on Everything, 1870-2015. They found that over the last 150 years real estate was the best-performing investment class.

Lower volatility

The aforementioned research paper also addressed another very important consideration when investing: risk, as measured by volatility.

While two different investments can have the same return, to compare apples-to-apples, you must look at the risk-adjusted return. This accounts for volatility, or the degree to which the value (price) of an asset changes. If an investment has wild price swings, it is more volatile, making it more risky.

And based on their exhaustive research over the last century and a half, the bank found that real estate was significantly less volatile than the stock market.

Next, I’m going to break down the broad categories of passive real estate investing by:

- Types of passive real estate investment

- General investing strategies across different investment classes

- Different parts of the capital stack

- Most common structures when passively investing.

Types of Passive Real Estate Investments

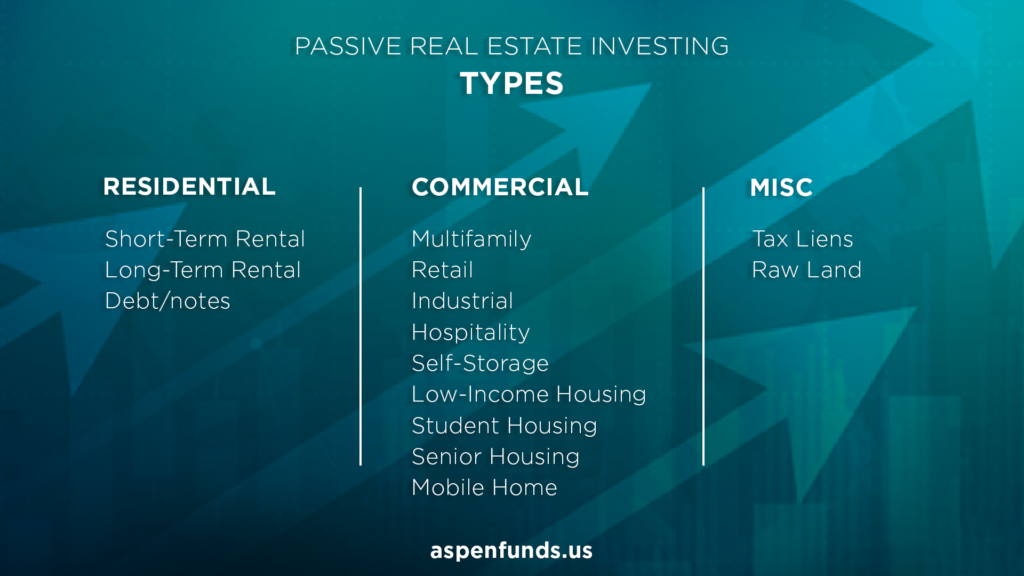

When looking at the types of real estate investments available to investors, I group them into 3 broad categories: residential, commercial, and miscellaneous.

Residential

Passive real estate investments that fall into the residential category are mostly short- and long-term rentals. A second kind of residential real estate investment that is less well known is to purchase the debt or mortgage note on a property. When you own the mortgage on a property, you are paid the monthly payments and interest as though you were the bank. In many cases, these notes are bought at a discount and can generate high consistent income for investors.

The value of these residential investments is driven by comparable sales. We’ve written about this extensively, but we are bullish on the residential market due to limited housing supply and increasing demand.

Commercial

Commercial investments in real estate span quite a range. The most well-known is multifamily housing (or apartments), another common choice for those looking for investment properties. But beyond multifamily, there is also:

- Retail

- Industrial

- Office

- Hospitality

- Self-storage

- Mobile homes

- Low-income housing

- Farmland

- Senior housing

- Student housing

That’s quite a list. The world of commercial real estate investment is expansive. And while it is beyond the scope of this article to break down the pros, cons, and value drivers of each asset class, it is best to view each asset class from a macro-economic perspective, looking at the long-term drivers of supply and demand, when evaluating an opportunity. This is important as many of these types of investments have long-term time horizons, where you may be invested for 5, 7, or 10 years.

In contrast to residential real estate, the value of commercial real estate investments are driven by cap rates, or capitalization rates, which is the net operating income generated by a property divided by the price. This is effectively the yield (or rate of return) a property generates on an unleveraged basis.

Miscellaneous

The last category is a catchall for more unique real estate investing strategies. Two that I’ll briefly highlight are tax liens and raw land.

Tax liens are issued by a municipality when a borrower fails to pay their property taxes. Similar to a mortgage note on a property, tax liens can be purchased at discounts and secured by the property.

Raw land, just like it sounds, is a plot of undeveloped land. For investors, this is often a long-term play, banking on the land appreciation and/or future potential development, or it can be wholesaled for a quicker profit.

Passive Real Estate Investing Strategies

There are 5 main strategies when it comes to investing in real estate, each with their own set of advantages and disadvantages. I’ve ranked them in order from most risky and highest potential return, to least risky and lowest potential return.

Distressed real estate investing

Distressed real estate investing is when an investor buys an existing asset that has some level of distress and fixes it. Oftentimes these assets have price tags far below the actual intrinsic value, selling at a discount because not everything is operating as it should.

While there are always opportunities to invest in distressed assets, greater volume of distressed assets often comes in counter-cyclical waves. When there is distress in current economic cycles, it creates pressure and often results in underperforming assets.

Because of the nature of fixing an asset in distress, investors should make sure the operator they work with has the track record and expertise needed to turn the asset around. This is critical.

While distressed asset investing can carry significant risk, it can also produce outsized returns.

Real Estate Development

Real estate development is when an investor identifies there’s a need for a particular type of property (e.g. apartment building, hotel, etc.) and builds it. Investing with experienced developers is very important as the development process can include buying the raw land, taking it through the entitlement process, getting the development plan approved, securing building permits, etc.

Opposite of the distressed real estate investing strategy, development is often pro-cyclical. Meaning, as the economic cycle is booming and demand increases, development projects do well. As the economic cycle turns, development is usually the first to take a hit.

Because of the scale and long timelines of these projects, there can be a lot of risk:

- Market risk – no demand for the asset by the time it’s finished

- Interest rate risk – project takes too long and return is minimized from high interest rates

- Construction costs risk – overhead costs of development increase (e.g. materials, labor, etc.)

- Plan approval risk – plans or permitting may not come through

Again, though there are many risks involved, there is also opportunity for significant gain.

Opportunistic Strategies

Opportunistic strategies in real estate represent an opportunity to reposition an asset, for example turning a hotel into multifamily housing, an old mall into a warehouse or office space, or an industrial facility into a storage facility. Many times the cost to reposition as asset is less than a new development, which creates margin for potential profit.

As trends change over time, it stands to reason that properties uses can change too. Opportunity in this strategy is driven both by macro-economic trends, as well as changes in particular markets.

Again, since these opportunities are often big and expensive undertakings, it’s very important to find sponsors with a good track record doing this before investing. But like the distressed and development strategies, there’s potential for high returns.

Value-Add Strategies

The value-add strategy is one of the most common strategies when it comes to investing in real estate. As the name indicates, value-add means taking an existing asset and improving it somehow. The majority of passive investment opportunities in real estate likely fall into this category.

Here’s an example. We know someone who bought an apartment building with several hundred units. The new owner researched the market to find out what was in demand in the area and found that 1-bedroom apartments were in greater demand than the 3-bedroom layouts in his property. So, he took a portion of his large 3-bedroom units and converted them into two 1-bedroom units. The 3-bedrooms would rent for $875 a piece, but the 1-bedrooms would each rent for $600, creating an extra $325 in monthly rent for each of the units he converted. The new owner created $2M in value on a $10M asset by doing that, and because the units were then new, could rent them at top-tier prices.

Value-add strategies seek to increase the net operating income by either reducing expenses or increasing revenue. These strategies are used on underperforming properties (though not necessarily distressed) and carry less risk than the strategies mentioned prior.

Core Strategies

The final strategy is investing in core assets. Opportunities that fall into this category are usually institutional assets in metropolitan areas, like a beachfront apartment complex in Miami. It’s a stable asset without a lot of downside. Because of the high-quality assets, however, the returns will be lower, though they are lower risk.

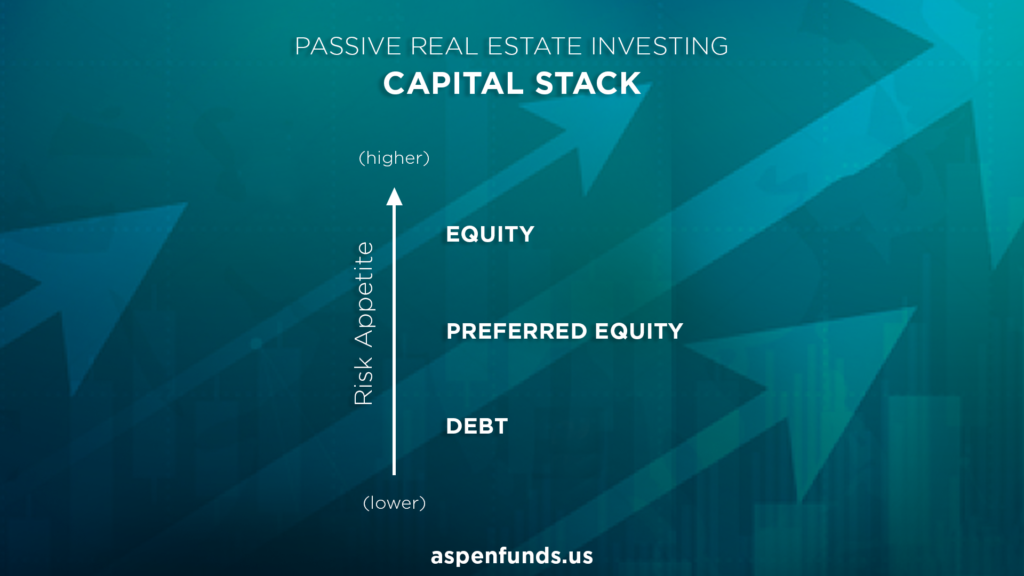

Capital Stack in Passive Real Estate Investing

There are 3 primary ways to passively invest in real estate. Capital stack is a common phrase used, which refers to how an asset is owned, either through debt, equity or some combination.

Debt

Senior debt is generally in the first position, meaning it is the first money paid out and is often secured. This level carries the least amount of risk.

Typically, institutional investors invest in debt because they get paid first. Because of this, there is lower risk, and your capital is more protected.

Debt is often thought of as low-yield but can actually be high-yield in many cases, especially in distressed debt investing.

Preferred Equity

The preferred equity position in the capital stack is a junior position, paid out after senior debt, but before the equity investors.

Sometimes there are may be two types of equity offered by a sponsor: preferred and common. Preferred equity investors get paid first and often at a higher rate (like 8-10%), but they do not share in the upside if the project performs well. There is less risk, but returns are usually capped.

Equity

The second type of equity and final part of the capital stack is common equity. Equity investors are usually betting on the upside of the project, and as such have to believe in the strategy of the sponsor. At this level, they’re taking the most risk that the asset will perform well. If it does, they will make the most money, but lose the most if it doesn’t.

In every deal, there is something call the cash flow waterfall, which is simply the order and timing that each position in the capital stack gets paid. When evaluating real estate opportunities, these are the questions you want to be asking:

- Where am I in the capital stack?

- How do I get paid?

- When do I get paid?

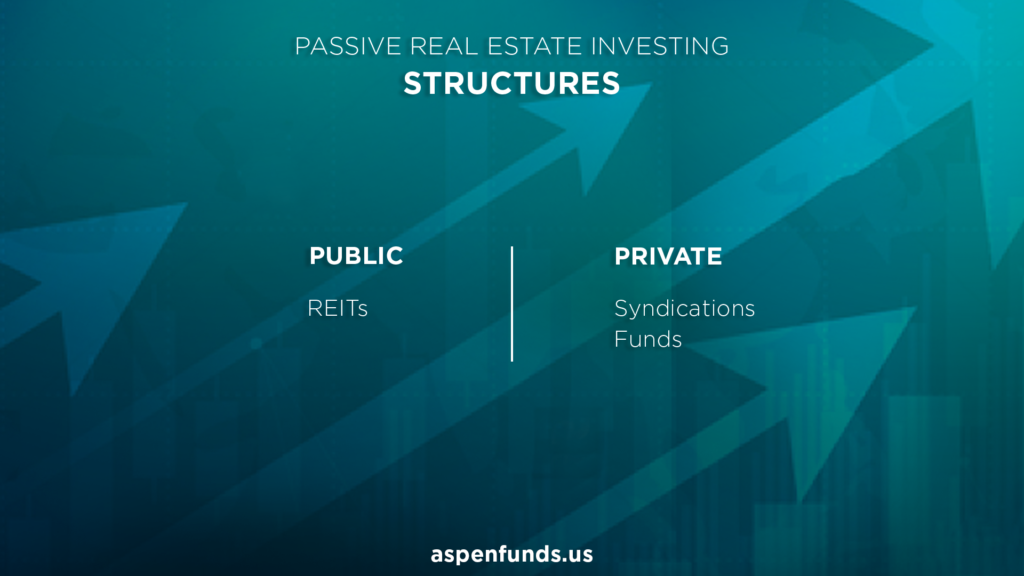

Investment Structures in Passive Real Estate

There are 3 common structures when investing in real estate passively, generally falling into one of 2 buckets: public and private.

Public

Public REITs are what most investors are experienced with. In general, investing in publicly-traded investments can give investors greater insight into their investments and can provide high levels of liquidity, as there is an active market to buy and sell shares. The downside is there can be lots of volatility.

REITs

REITs are usually the first step for investors looking to diversify outside of stocks and bonds.

REITs purchase or finance income-generating commercial real estate, everything from offices and warehouses, to medical facilities and data centers. They are publicly traded on major stock exchanges.

While REITs can provide some diversification, over the last few years the correlation of REITs tends to follow the trends of the broader stock market fairly closely, providing less diversification over time. Because of that, REITs tend to be volatile. You also don’t get any of the tax advantages of investing directly in real estate when investing in REITs.

Private

In a private real estate investment, you are investing directly with the operators of an asset. Successful operators have a specific strategy and a good track record. Private investment opportunities do not trade in the public market. These are often called alternative investments, or alts, and can be a powerful addition to an investor’s portfolio.

Syndications

Syndications generally pool money from numerous investors in order to purchase a large, single asset. It will have a specific strategy and timeline associated with executing said strategy. Once the execution is complete (which can take several years), they will either refinance or sell the property, hopefully for a profit, return your capital, plus whatever interest you got paid along the way.

Pros of syndications include a higher level of visibility into the specific asset being purchased, as you are aware of the property prior to investing. The primary drawback is a lack a diversification, with your investment all going to a single asset.

Funds

Funds gather investments from numerous investors and deploy it to buy many assets in a single fund. This can be within multifamily, commercial, or residential real estate notes. These are often blind pools, and you won’t always know what’s included. Instead, you might know a range of requirements the sponsor is evaluating against. Because of this you need to trust the sponsor’s track record, underwriting process, and that they have the expertise to execute their strategy.

Generally, the benefits include greater diversification within the number, type, and geographical location of assets, while drawbacks include limited visibility into the assets being purchased.

Drilling down even further, there are closed-end funds and open-end funds. Closed-end funds generally have a target investment goal and raise funds for a window of time, before closing new investments, deploying the capital, and then working through their determined exit strategy. An open-end fund, also called an evergreen fund, allows investment at any time and deploys capital and works out exit strategies on a continual basis. This is how the fund we operate works.

I know this was a lot of information to digest, but understanding these frameworks will make you a better investor as you pursue investing passively in real estate.