In this 2021 economic forecast, we’re looking at the major trends and tides that are affecting our economy and our investment world. In part one, I shared about the general economy and what’s happening. And in this part, we’re going to look at the coming COVID recovery and what’s likely to happen for our economy throughout 2021.

Vaccine Rollout Will be Met With Skepticism

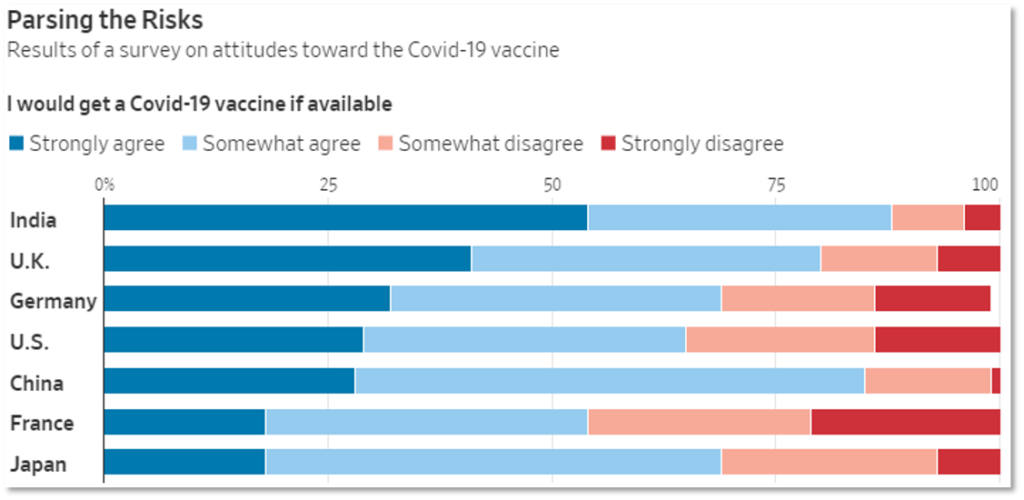

At the time of writing, the first two vaccines have been approved, with more in the works. One of the trends we’re seeing is a lot of people are saying they’re not going to take the vaccine. This is from the Wall Street Journal.

In the US, roughly 60% of people said they would take the vaccine if it’s available. These vaccines are clearly pretty safe, but if people don’t believe that then they’re not going to take them. A low vaccination rate is a risk to economic recovery.

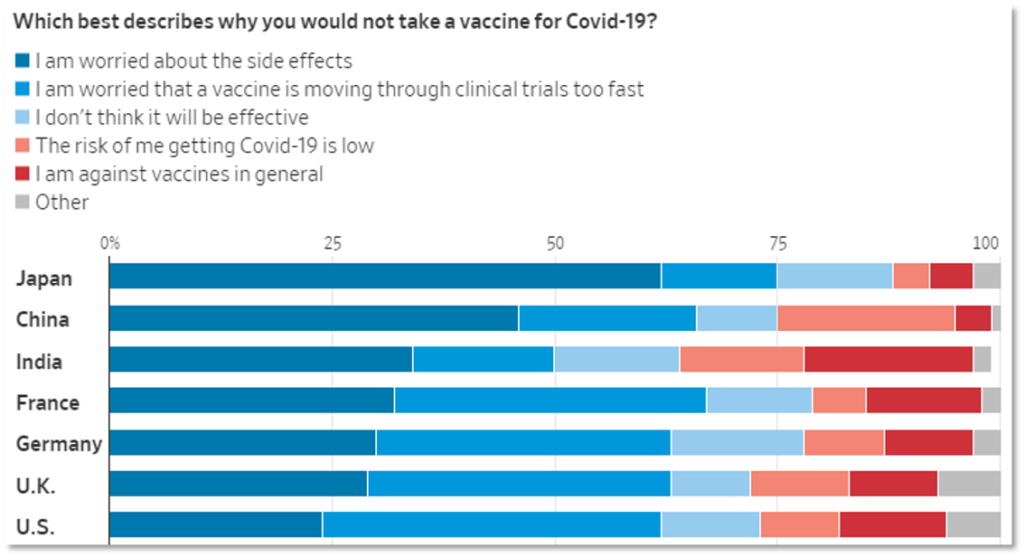

Of the people that indicated why they wouldn’t take the vaccine, about 25% are worried about the side effects. Another 35% are worried that it was pushed through clinical trials too quickly. Roughly 10% more think it wouldn’t be effective. And others, probably young people, think they are not much at risk for getting COVID. Vaccine adoption is likely to be slower than one might anticipate.

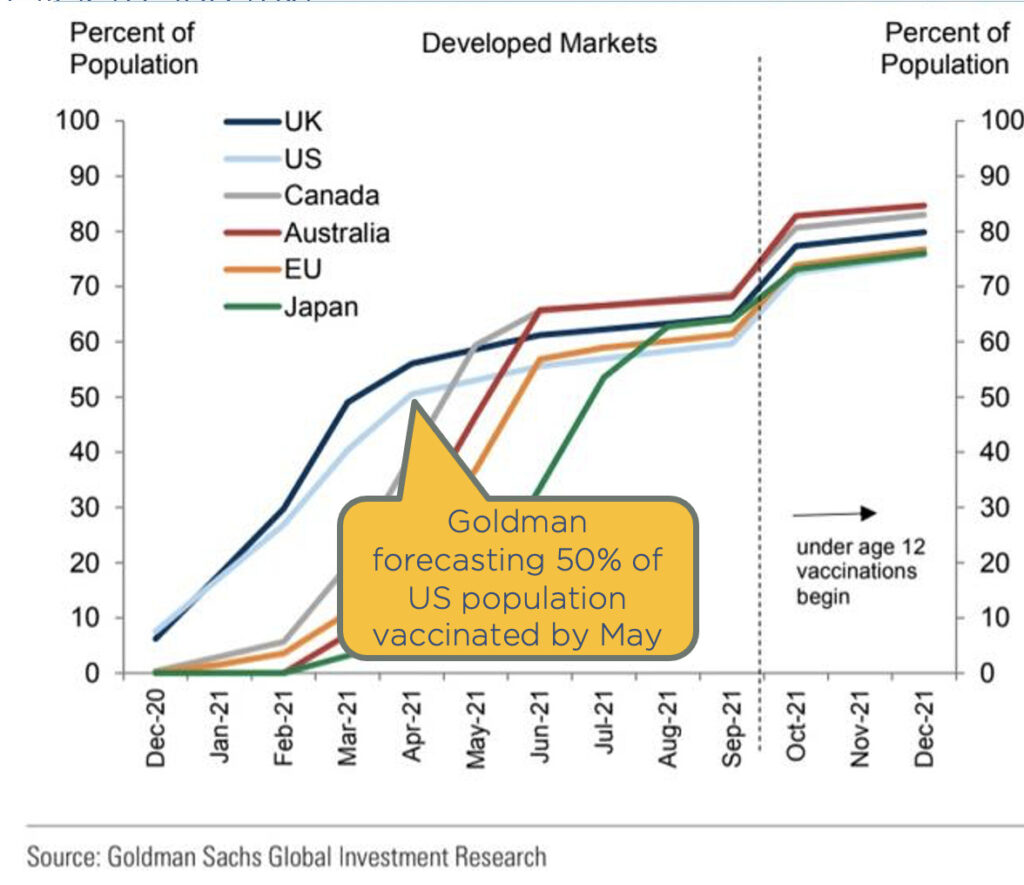

And here’s perhaps the most important chart, this is from Goldman Sachs. Goldman is forecasting 50% of the US population will be vaccinated by May. So this vaccine is being rapidly rolled out with a massive logistics and deployment effort.

The CDC has highlighted who will get this vaccine first, and unsurprisingly, it’s healthcare workers and those that are high-risk. Goldman also points out that this method of vaccinating the higher risk people first means that the hospitalization rate is going to drop much faster than the infection rate. So we’re going to see a lot of pressure quickly coming off the economy and off hospitals as we roll through 2021.

So with 50% of the population vaccinated and possibly a much higher number of at-risk people vaccinated, we’re going to see a rapid end to the record death rates and the hospitalization rates that we’ve been seeing.

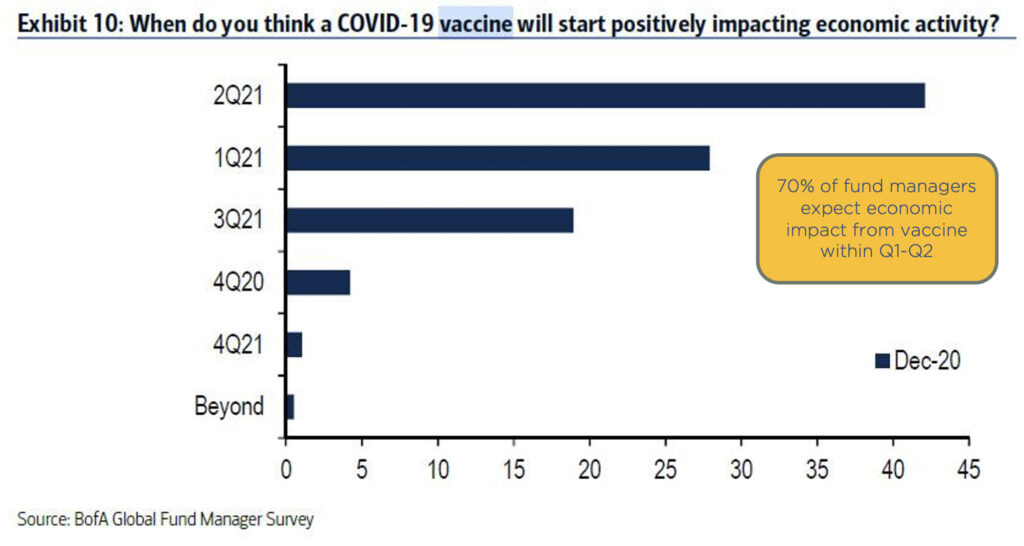

Timeline for COVID Vaccine to Positively Impact Economy in 2021

The Bank of America fund manager survey asked fund managers when they expect a positive economic impact to hit from the vaccine. About 70% of fund managers believe it’s going to happen in Q2 or Q1 of 2021, which is exactly what I would say. We’re seeing the beginning of the end of the COVID crisis, primarily due to this vaccine.

GDP Projections in the Wake of COVID Recovery

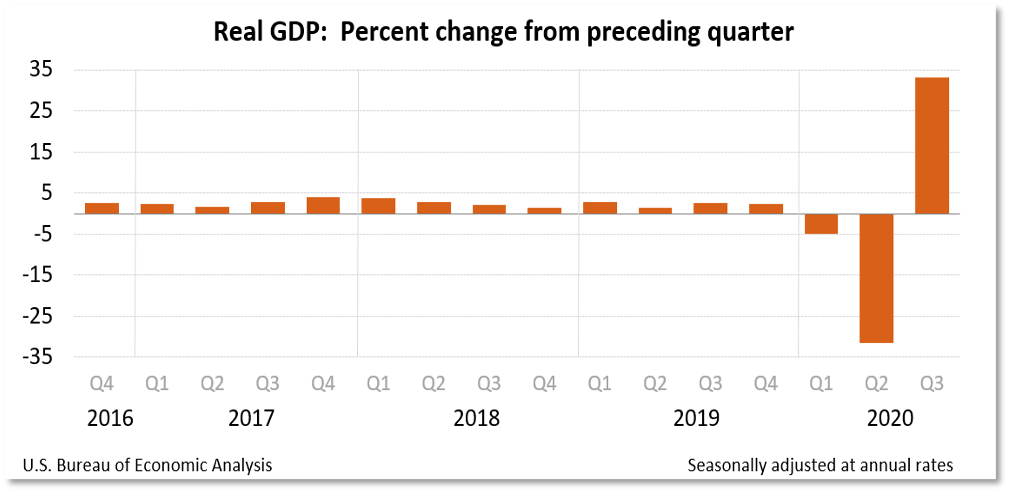

What about the economy? The chart below shows the real GDP with the percent change from the preceding quarter. This is the change in GDP in annualized numbers.

Now the GDP is the entire economy of the United States. So when we saw a 33% decline in Q2, that was absolutely extraordinary, we’ve never seen anything like that. The huge drop was due to consumers not spending, not traveling, and the economy literally being shut down. A 33% drop means a third of the economic activity in the United States stopped. If that trend wasn’t halted, we would certainly have been in another great depression.

But in Q3, we saw a 33% GDP gain. This growth really blew past what most economists were predicting. The PPP program, the stimulus spending, the direct payments to individuals all contributed to this GDP growth. When you actually drop money into people’s bank accounts, that is about as stimulative as you can get. Same thing with the PPP program dropping cash quickly into businesses, it had a massive and immediate impact.

Direct payment stimulus programs like these are much different than a tax change or something else that may take two or three years to roll through the economy. They are immediate and intense. So while a lot of people are very critical of the stimulus programs, I’m not. They’re certainly imperfect, but given the fact that the government put them together in a matter of weeks and actually executed them, they were exactly what was needed and far preferable to a perfect program that takes a year to roll out. These programs nipped a potential depression in the bud.

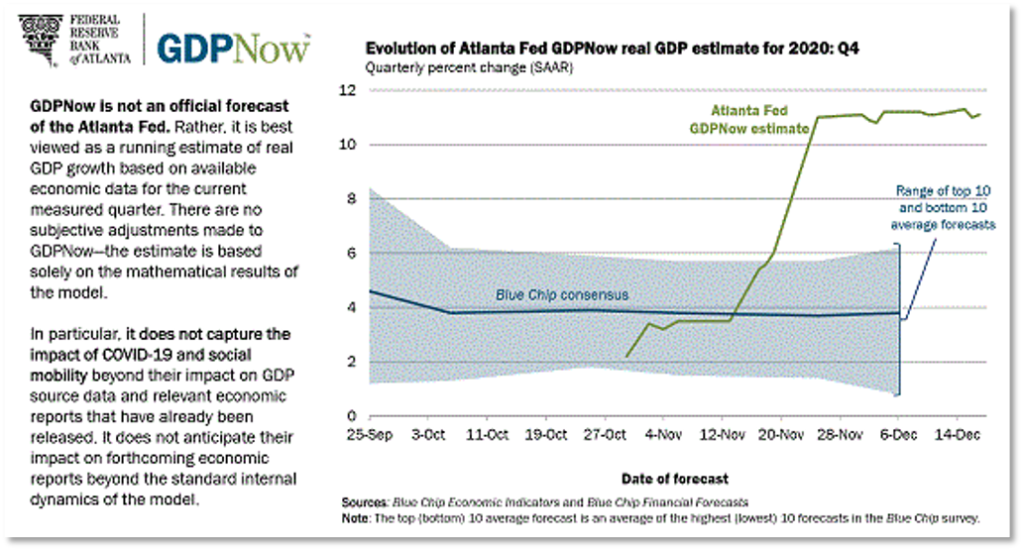

So what about GDP in Q4? The Blue Chip consensus, which are the big economists, are now predicting a plus 4% growth in Q4 GDP. The Atlanta Fed’s GDP Now model is currently predicting 11% GDP growth for Q4, which would be extraordinary if we do see that. Given the second stimulus package coming, we’re probably going to continue to see strong growth throughout Q1 of 2021. Our nation and, in a large part the globe, took the right steps at the right time and averted what could have been an incredibly difficult crisis, giving us a very bright hope for 2021.

The Spring 2020 Stimulus Plan Impact on Economy

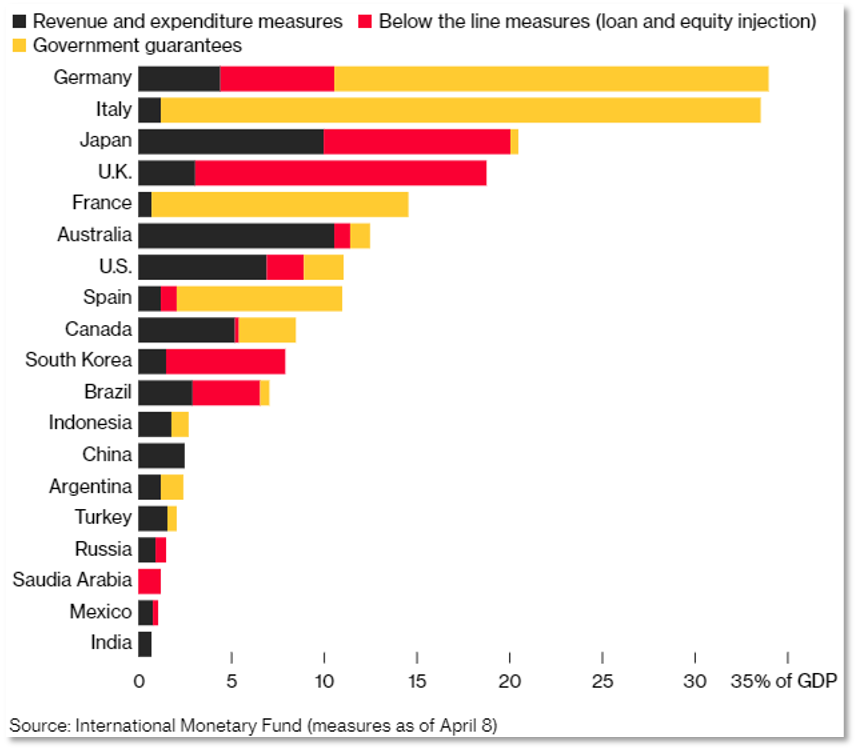

The spring 2020 global stimulus was about $8 trillion. This is a great example of the economic tides that drive investment that I look at when making economic projections.

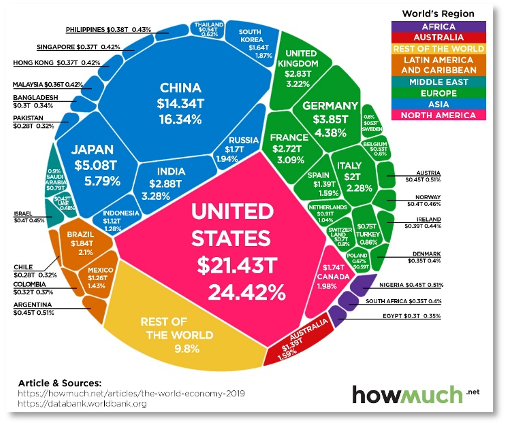

The US stimulus was $2 trillion, and doesn’t include the nearly $1 trillion coming at the end of 2020. $8 trillion in global stimulus is a very, very large number. I put this chart in here just for scale. Here’s the GDP of the United States, $21 trillion. So when you’re talking about an $8 trillion global stimulus, or $2 trillion US stimulus, that’s equal to 10% of the GDP of the United States.

We should look at stimulus from a global perspective, because money is global today. When there are trillions of dollars pumped into the economy in Germany, a lot of that money is going to find its way to the United States (or any other investment location), so money is truly global. According to Morgan Stanley, $2.8 trillion in central bank bond purchases are expected this year. This is a huge amount of stimulus.

Stimulus Measures and How They Impact the Economy

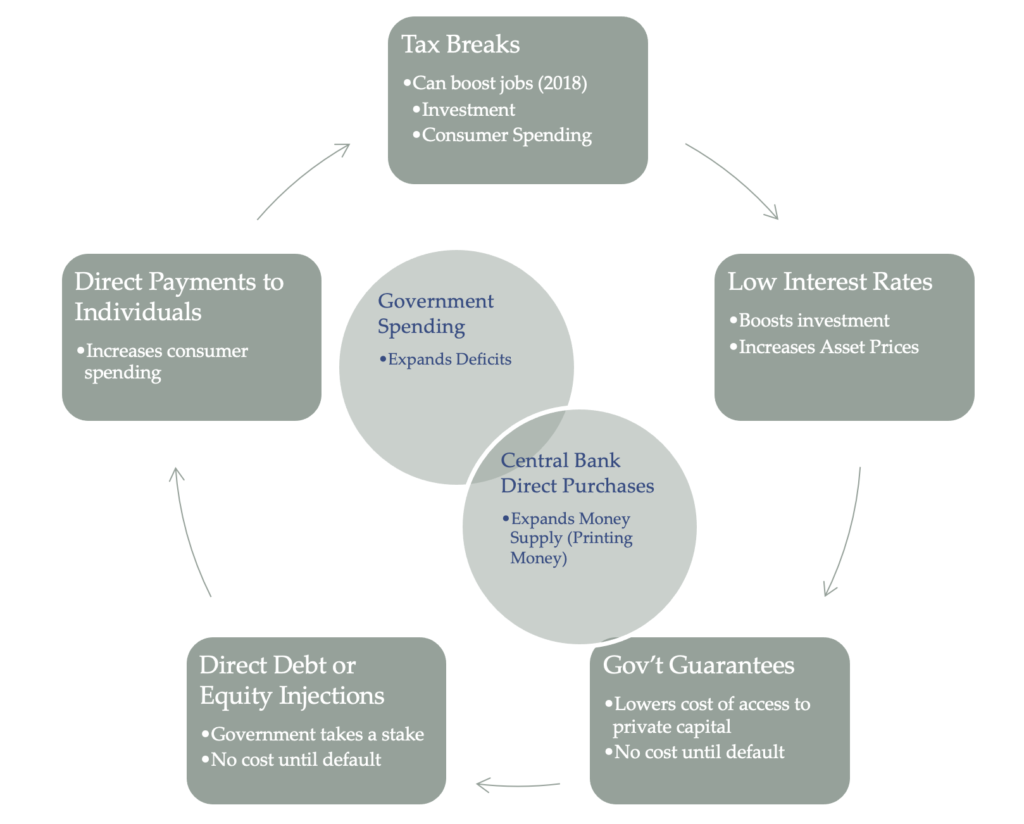

When we talk about a ‘stimulus’ plan, there are actually several different measures the government can take to stimulate an economy. Here are the major stimulus efforts in order of increasing intensity.

The two mechanisms used to fuel the stimulus (represented by the two circles in the center of the diagram) are 1) government spending where the government writes checks, which has a stimulative effect depending on who the recipients are. And 2) the central bank (Federal Reserve) purchases things, also creating a stimulative effect.

Now initially, stimulus was mostly just government spending. But we’ve started to see a gradual increase in the effectiveness and impact of the central banks’ purchases over time.

Tax Breaks

So initially, about 100 years ago, tax breaks were really the only tool that the fiscal planners and the fiscal policy makers had, and they can still be very effective. When the Trump tax plan came into place in 2018, I said it was going to be a game-changer in terms of jobs. Tax breaks can boost jobs and they can boost investment. And depending on how they’re constructed, they can boost consumer spending too. Trump’s tax break was especially friendly to businesses, and since businesses are primarily the driver of job creation, we still have quite a bit of benefit today from these tax measures.

When looking at stimulus, many people focus on the area of direct payments to individuals, the headline numbers — the $2 trillion, $900 billion. But what they miss is the fact that we have a lot of other stimulus measures in place too, including tax breaks and low interest rates.

Low Interest Rates

The next tool came with the advent of the Federal Reserve in the early 1900s. The Federal Reserve had a mandate to basically keep inflation low and keep growth steady. They did this primarily by manipulating interest rates.

Low interest rates boost investment and increase asset prices. This has been a tool used for over 100 years to stimulate or slow the economy. For example, the double-digit interest rates back in the ‘70s and ‘80s were a drag on the economy. But conversely, when interest rates drop very low, it’s a boost to the economy.

Interest rates today are exceptionally low, about 1%. And that is extremely stimulative, primarily boosting investment and asset prices, as well as helping businesses. Most people overlook low interest rates in stimulus measures, but this is a major boost to the economy.

Government Guarantees

Next came Government guarantees, which are when the government backs an investment. This has happened in the past with the mortgage giants. The government backed the bonds issued by sponsored entities (GSEs) like Fannie Mae and Freddie Mac.

When investing in a bond that’s backed by the government, the price is much higher and thus the interest rate is much lower. This has the effect of basically lowering costs and increasing access to private capital, and doesn’t necessarily cost the government anything unless there’s a default. Only if that guarantee is actually used does it cost the government, but it massively benefits the economy and is hugely stimulative.

Right now the GSEs buy most of the US mortgages, and that keeps interest rates super low and it doesn’t cost anything unless they fail, which is rare.

Direct Debt or Equity Injections

The next stimulus measure is direct debt or equity injections, where the government actually takes a stake in a company. One example of this was in the 1980s with Chrysler and the direct equity injection. Chrysler was ready to declare bankruptcy, which would have resulted in losses of perhaps hundreds of thousands of jobs, but the government made a direct loan to Chrysler.

Another example was in the Great Financial Crisis when the government lent $182 billion to insurer AIG in exchange for 80% of the equity (the stock), becoming the biggest owner of AIG, a public company. This was the right move because AIG had become the key player in the financial plumbing of credit default swaps. They had made a huge mistake and had underwritten the credit of all these big lenders who were in trouble. And as the insurance provider, they were going to go under. It would have thrown the financial system in complete and utter chaos had they failed, so the government bought the equity to keep them afloat.

Another example was with the TARP program during the Great Financial Crisis. In the TARP program, the government directly purchased assets. The government is directly lending or buying equity, essentially taking a stake in a business. Generally with these investments there’s no cost until there’s actually a default.

In AIG’s case, a lot of people were upset about the $182 billion loan to AIG, a failing company. Well, when the government got out in 2012, they actually made a $23 billion profit. They were able to get the company through the crisis and then close the loan. So there’s generally no cost until default.

The latest version of direct injections is the PPP program, though the PPP program is different because it’s forgivable, so there is a cost.

During the Great Financial Crisis, the role of the central bank began to eclipse government spending. Central banks are taking a bigger role, due to a popular theory that’s gaining momentum, called Modern Monetary Theory, or MMT. The theory is basically that government deficits and monetization of debt and expenses can help the economy without cost. And the theory is proving out. There’s definitely a downside to deficits and monetization of debt, but it’s not as extreme as most people are fearing.

So to recap, starting in the 1980s and then continuing in the 2008 timeframe, we’re seeing direct injections, and we’re seeing a rise of the central bank and its role in stimulating the economy.

Direct Payments to Individuals

The final stimulus measure is direct payments to individuals. In Ben Bernanke’s Fed Chairman days, people were concerned about deflation. But he said there’s no way we should be worried about deflation happening in our economy because, if need be, we can fly helicopters and drop money on people and create inflation. And so it was jokingly called ‘helicopter money.’ And lo and behold, our latest COVID programs in 2020 created helicopter money, or direct payments to individuals. That money was not raised from tax dollars, but from the central bank. The central bank, in essence, prints money and gives it to people.

How Does Stimulus Impact Inflation?

It’s helpful to think about inflation as two different kinds, one is consumer price inflation, or the price of your milk and your bread and your rent. This is what most people think about when they think of inflation. The other kind of inflation is the price of assets, such as the price of your home, the price of the stock market, the price of gold.

A lot of people are concerned that stimulus measures are going to create inflation. Well, since 2008 it has not, as I showed in the first part of this series.

However, we are seeing the second type of inflation, asset price inflation. The stimulative measures have the primary effect not of increasing consumer price inflation, but increasing asset prices.

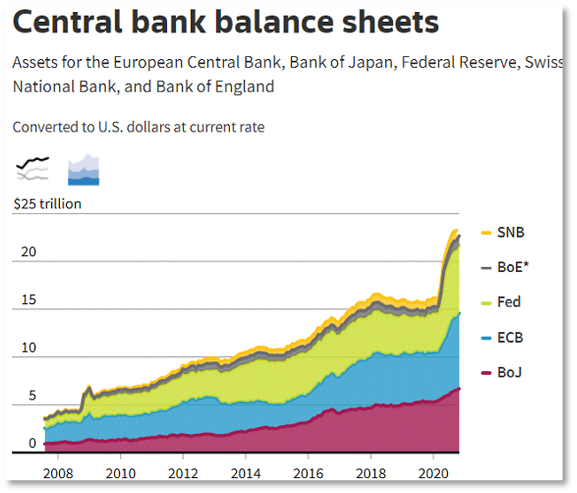

In this last category of stimulus measures, the second mechanism in my diagram, we saw $7 trillion in central bank direct purchases in 2020.

The central bank balance sheets outline what is owned by central banks. If the central bank makes a loan to a business, they print money and they buy equity. This will go on their balance sheet and increase its size.

The above chart shows the balance sheets for the largest central banks in the world, the Swiss National Bank, the Bank of England, the Federal Reserve, the European Central Bank and the Bank of Japan.

You can see about $3.5 trillion at the beginning of the Great Financial Crisis. Today their balance sheet is $23 trillion. This represents money they have “printed” to buy stuff. This has a hugely stimulative effect and inflationary effect, but primarily in terms of asset prices.

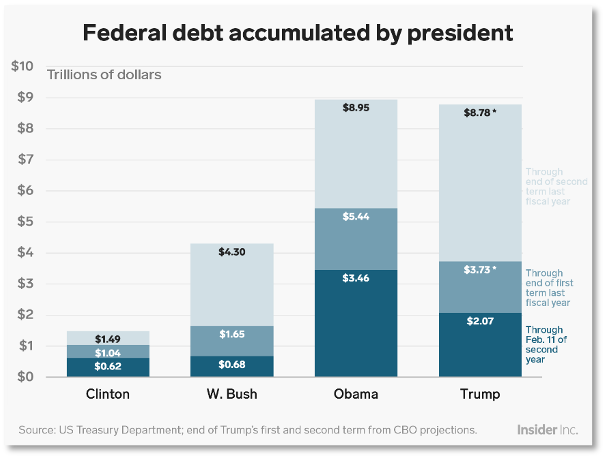

The other stimulative mechanism used is deficit spending. Deficit spending is when the government borrows money (by selling bonds) and spends it. The following chart shows recent deficit spending. During just the Obama and Trump years, we’ve seen $18 trillion in US deficit spending, an enormous amount. Additionally we’ve seen $6.4 trillion in US Federal Reserve purchases, and $19 trillion in global central bank purchases. Massive amounts of money are flowing into the economy, and this is the economic tide that has more effect than any other factor.

Our 2021 Economic Forecast Bottom Line

- We’re going to see a solid GDP growth in 2021. It will be in the higher range through 2021 as consumers exit COVID19 and begin to spend. People are flush with savings and are sick of staying in their homes. They’re going to travel, they’re going to go to restaurants, they’re going to go to bars. We’re going to see high GDP growth as soon as confidence returns.

- We’re going to see unemployment continue to drop, but not to the Trump era lows and we’ll talk about why in another part in this series

- The economic tide–this is the biggest point here–is government stimulus and excess liquidity will continue to roll through the economy. Its primary effect will be the lifting of asset prices. This is the time to be owning assets. There’s a lot of concern that the rich are getting richer and the poor are not benefiting. This is primarily the result of stimulative policies having the effect of increasing asset prices. So those people that own assets are the primary beneficiaries, and the people who own assets (stocks, homes, etc) are the wealthier. As these things go up, you’re seeing this wealth disparity continue to increase.

- Many small businesses failed and many job losses were permanent, but the PPP program saved the US from the worst of it. With the second stimulus and vaccine rollout we should see a strong recovery of small businesses and jobs. The risk of a second great depression has been averted by stimulus efforts and a fast vaccine response.

Recap & Next Article

Up to this point, we’ve covered what happened economically in 2020, and we believe the economy is headed in 2021 as we begin COVID19 recovery.

Next article in series: The Biden Tax Plan